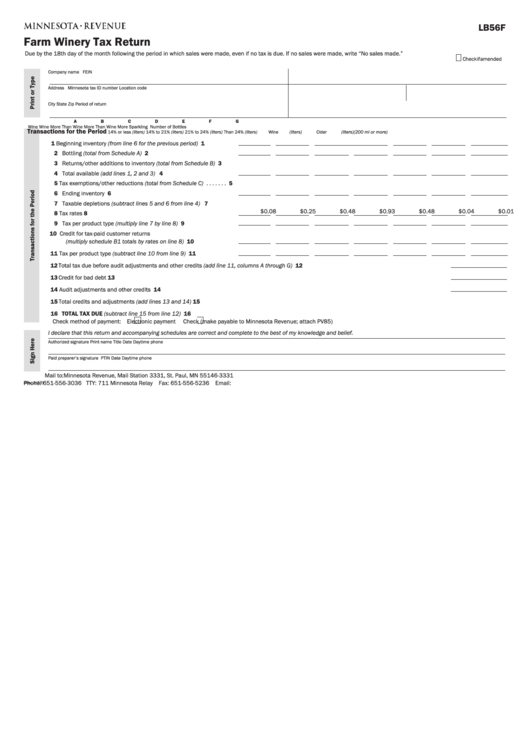

LB56F

Farm Winery Tax Return

Due by the 18th day of the month following the period in which sales were made, even if no tax is due. If no sales were made, write “No sales made.”

Check if amended

Company name

FEIN

Address

Minnesota tax ID number

Location code

City

State

Zip

Period of return

A

B

C

D

E

F

G

Wine

Wine More Than

Wine More Than

Wine More

Sparkling

Number of Bottles

Transactions for the Period

14% or less (liters) 14% to 21% (liters) 21% to 24% (liters) Than 24% (liters)

Wine (liters)

Cider (liters)

(200 ml or more)

1 Beginning inventory (from line 6 for the previous period) . . . . . . . . 1

2 Bottling (total from Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Returns/other additions to inventory (total from Schedule B) . . . . 3

4 Total available (add lines 1, 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Tax exemptions/other reductions (total from Schedule C) . . . . . . . 5

6 Ending inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Taxable depletions (subtract lines 5 and 6 from line 4) . . . . . . . . . 7

$0.08

$0.25

$0.48

$0.93

$0.48

$0.04

$0.01

8 Tax rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Tax per product type (multiply line 7 by line 8) . . . . . . . . . . . . . . . . 9

10 Credit for tax-paid customer returns

(multiply schedule B1 totals by rates on line 8) . . . . . . . . . . . . . . . 10

11 Tax per product type (subtract line 10 from line 9) . . . . . . . . . . . . 11

12 Total tax due before audit adjustments and other credits (add line 11, columns A through G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Credit for bad debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Audit adjustments and other credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Total credits and adjustments (add lines 13 and 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 TOTAL TAX DUE (subtract line 15 from line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Check method of payment:

Electronic payment

Check (make payable to Minnesota Revenue; attach PV85)

I declare that this return and accompanying schedules are correct and complete to the best of my knowledge and belief.

Authorized signature

Print name

Title

Date

Daytime phone

Paid preparer’s signature

PTIN

Date

Daytime phone

Mail to: Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331

Phone: 651-556-3036 TTY: 711 Minnesota Relay Fax: 651-556-5236 Email: alc.taxes@state.mn.us

(Rev. 2/12)

1

1 2

2 3

3 4

4 5

5