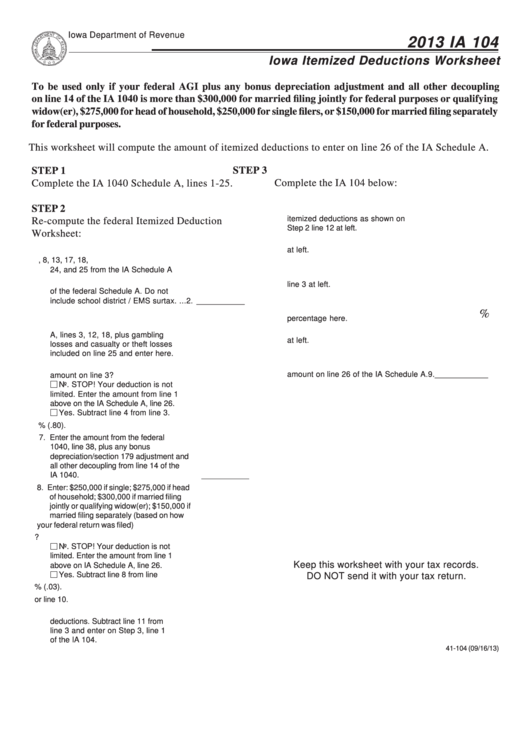

Iowa Department of Revenue

2013 IA 104

Iowa Itemized Deductions Worksheet

To be used only if your federal AGI plus any bonus depreciation adjustment and all other decoupling

on line 14 of the IA 1040 is more than $300,000 for married filing jointly for federal purposes or qualifying

widow(er), $275,000 for head of household, $250,000 for single filers, or $150,000 for married filing separately

for federal purposes.

This worksheet will compute the amount of itemized deductions to enter on line 26 of the IA Schedule A.

STEP 3

STEP 1

Complete the IA 1040 Schedule A, lines 1-25.

Complete the IA 104 below:

STEP 2

1. Enter the revised allowable federal

itemized deductions as shown on

Re-compute the federal Itemized Deduction

Step 2 line 12 at left. ................................ 1. ____________

Worksheet:

2. Enter the amount from Step 2 line 4

at left. ...................................................... 2. ____________

1. Enter the sum of lines 3, 8, 13, 17, 18,

3. Subtract line 2 from line 1. ...................... 3. ____________

24, and 25 from the IA Schedule A ..... 1. ___________

4. Enter the amount from Step 2

2. Enter any Iowa income tax from line 5

line 3 at left. ............................................ 4. ____________

of the federal Schedule A. Do not

5. Subtract line 2 from line 4. ...................... 5. ____________

include school district / EMS surtax. ... 2. ___________

6. Divide line 3 by line 5 and enter the

%

3. Add amounts from lines 1 and 2 .......... 3. ___________

percentage here. .................................... 6. ____________

4. Add the amounts on Iowa Schedule

7. Enter the amount from Step 2 line 2

A, lines 3, 12, 18, plus gambling

at left. ...................................................... 7. ____________

losses and casualty or theft losses

8. Multiply line 7 by the percent on line 6. .. 8. ____________

included on line 25 and enter here. ..... 4. ___________

9. Subtract line 8 from line 1. Enter this

5. Is the amount on line 4 less than the

amount on line 26 of the IA Schedule A. 9. ____________

amount on line 3?

No. STOP! Your deduction is not

limited. Enter the amount from line 1

above on the IA Schedule A, line 26.

Yes. Subtract line 4 from line 3. ...... 5. ___________

6. Multiply line 5 by 80% (.80). .................. 6. ___________

7. Enter the amount from the federal

1040, line 38, plus any bonus

depreciation/section 179 adjustment and

all other decoupling from line 14 of the

IA 1040. ................................................... 7.

8. Enter: $250,000 if single; $275,000 if head

of household; $300,000 if married filing

jointly or qualifying widow(er); $150,000 if

married filing separately (based on how

your federal return was filed).................... 8. ___________

9. Is the amount on line 8 less than line 7?

No. STOP! Your deduction is not

limited. Enter the amount from line 1

Keep this worksheet with your tax records.

above on IA Schedule A, line 26.

Yes. Subtract line 8 from line 7. ........ 9. ___________

DO NOT send it with your tax return.

10. Multiply line 9 by 3% (.03). .................... 10. ___________

11. Enter the smaller of line 6 or line 10. ..... 11. ___________

12. Total adjusted federal itemized

deductions. Subtract line 11 from

line 3 and enter on Step 3, line 1

of the IA 104. ........................................ 12. ___________

41-104 (09/16/13)

1

1