Form Ftb 4073 - Mandatory E-Pay Pay-By-Phone Authorization Agreement For Individuals

ADVERTISEMENT

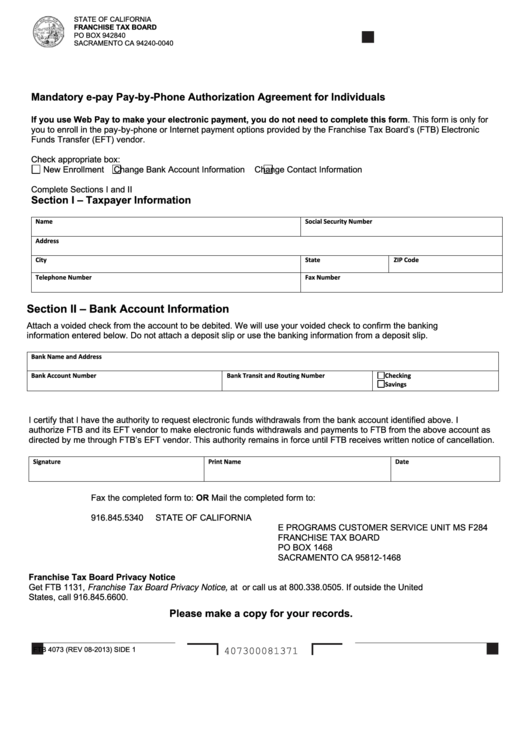

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0040

Mandatory e-pay Pay-by-Phone Authorization Agreement for Individuals

If you use Web Pay to make your electronic payment, you do not need to complete this form. This form is only for

you to enroll in the pay-by-phone or Internet payment options provided by the Franchise Tax Board’s (FTB) Electronic

Funds Transfer (EFT) vendor.

Check appropriate box:

New Enrollment

Change Bank Account Information

Change Contact Information

Complete Sections I and II

Section I – Taxpayer Information

Name

Social Security Number

Address

City

State

ZIP Code

Telephone Number

Fax Number

Section II – Bank Account Information

Attach a voided check from the account to be debited. We will use your voided check to confirm the banking

information entered below. Do not attach a deposit slip or use the banking information from a deposit slip.

Bank Name and Address

Bank Account Number

Bank Transit and Routing Number

Checking

Savings

I certify that I have the authority to request electronic funds withdrawals from the bank account identified above. I

authorize FTB and its EFT vendor to make electronic funds withdrawals and payments to FTB from the above account as

directed by me through FTB’s EFT vendor. This authority remains in force until FTB receives written notice of cancellation.

Signature

Print Name

Date

Fax the completed form to:

OR

Mail the completed form to:

916.845.5340

STATE OF CALIFORNIA

E PROGRAMS CUSTOMER SERVICE UNIT MS F284

FRANCHISE TAX BOARD

PO BOX 1468

SACRAMENTO CA 95812-1468

Franchise Tax Board Privacy Notice

Get FTB 1131, Franchise Tax Board Privacy Notice, at ftb.ca.gov or call us at 800.338.0505. If outside the United

States, call 916.845.6600.

Please make a copy for your records.

FTB 4073 (REV 08-2013) SIDE 1

407300081371

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2