Clear

Print

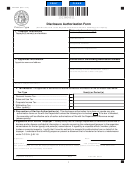

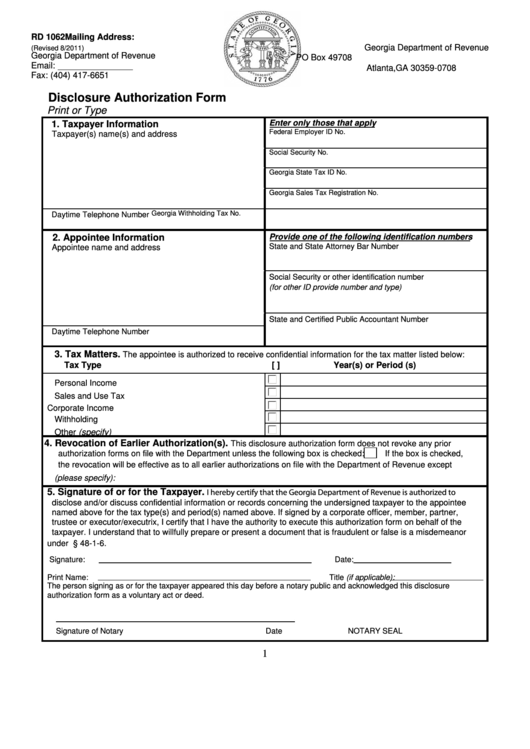

RD 1062

Mailing Address:

Georgia Department of Revenue

(Revised 8/2011)

Georgia Department of Revenue

PO Box 49708

Email: taxadv@dor.ga.gov

Atlanta,GA 30359-0708

Fax: (404) 417-6651

Disclosure Authorization Form

Print or Type

Enter only those that apply

1. Taxpayer Information

Federal Employer ID No.

Taxpayer(s) name(s) and address

Social Security No.

Georgia State Tax ID No.

Georgia Sales Tax Registration No.

Georgia Withholding Tax No.

Daytime Telephone Number

Provide one of the following identification numbers

2. Appointee Information

State and State Attorney Bar Number

Appointee name and address

Social Security or other identification number

(for other ID provide number and type)

State and Certified Public Accountant Number

Daytime Telephone Number

3. Tax Matters.

The appointee is authorized to receive confidential information for the tax matter listed below:

Tax Type

[ ]

Year(s) or Period (s)

Personal Income Tax.......................................................

Sales and Use Tax ..........................................................

Corporate Income Tax.....................................................

Withholding Tax...............................................................

Other (specify)

4. Revocation of Earlier Authorization(s).

This disclosure authorization form does not revoke any prior

authorization forms on file with the Department unless the following box is checked:

If the box is checked,

the revocation will be effective as to all earlier authorizations on file with the Department of Revenue except

(please specify):

I hereby certify that the Georgia Department of Revenue is authorized to

5. Signature of or for the Taxpayer.

disclose and/or discuss confidential information or records concerning the undersigned taxpayer to the appointee

named above for the tax type(s) and period(s) named above. If signed by a corporate officer, member, partner,

trustee or executor/executrix, I certify that I have the authority to execute this authorization form on behalf of the

taxpayer. I understand that to willfully prepare or present a document that is fraudulent or false is a misdemeanor

under O.C.G.A. § 48-1-6.

Signature:

Date:

Print Name:

Title (if applicable):

The person signing as or for the taxpayer appeared this day before a notary public and acknowledged this disclosure

authorization form as a voluntary act or deed.

Signature of Notary

Date

NOTARY SEAL

1

1

1 2

2