Instructions For Form Ftb 3834 - Interest Computation Under The Look-Back Method For Completed Long-Term Contracts - 2013

ADVERTISEMENT

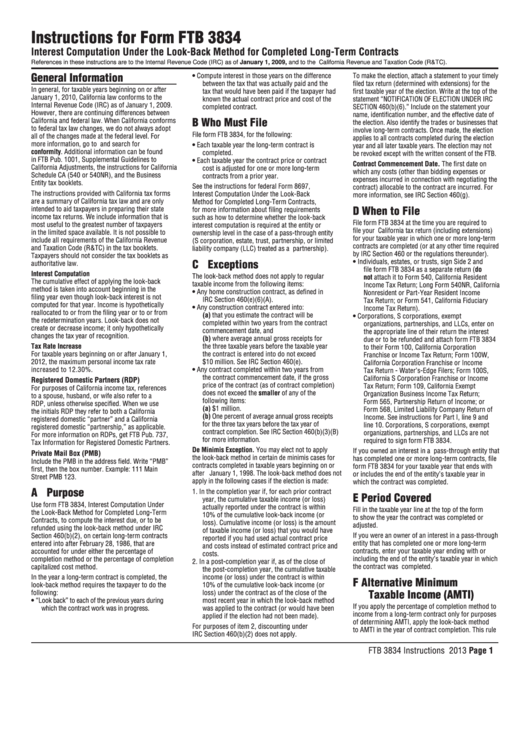

Instructions for Form FTB 3834

Interest Computation Under the Look-Back Method for Completed Long-Term Contracts

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

•

Compute interest in those years on the difference

To make the election, attach a statement to your timely

between the tax that was actually paid and the

filed tax return (determined with extensions) for the

In general, for taxable years beginning on or after

tax that would have been paid if the taxpayer had

first taxable year of the election. Write at the top of the

January 1, 2010, California law conforms to the

known the actual contract price and cost of the

statement “NOTIFICATION OF ELECTION UNDER IRC

Internal Revenue Code (IRC) as of January 1, 2009.

completed contract.

SECTION 460(b)(6).” Include on the statement your

However, there are continuing differences between

name, identification number, and the effective date of

B Who Must File

California and federal law. When California conforms

the election. Also identify the trades or businesses that

to federal tax law changes, we do not always adopt

involve long-term contracts. Once made, the election

File form FTB 3834, for the following:

all of the changes made at the federal level. For

applies to all contracts completed during the election

more information, go to ftb.ca.gov and search for

•

Each taxable year the long-term contract is

year and all later taxable years. The election may not

conformity. Additional information can be found

completed.

be revoked except with the written consent of the FTB.

in FTB Pub. 1001, Supplemental Guidelines to

•

Each taxable year the contract price or contract

Contract Commencement Date. The first date on

California Adjustments, the instructions for California

cost is adjusted for one or more long-term

which any costs (other than bidding expenses or

Schedule CA (540 or 540NR), and the Business

contracts from a prior year.

expenses incurred in connection with negotiating the

Entity tax booklets.

See the instructions for federal Form 8697,

contract) allocable to the contract are incurred. For

The instructions provided with California tax forms

Interest Computation Under the Look-Back

more information, see IRC Section 460(g).

are a summary of California tax law and are only

Method for Completed Long-Term Contracts,

D When to File

intended to aid taxpayers in preparing their state

for more information about filing requirements

income tax returns. We include information that is

such as how to determine whether the look-back

File form FTB 3834 at the time you are required to

most useful to the greatest number of taxpayers

interest computation is required at the entity or

file your California tax return (including extensions)

in the limited space available. It is not possible to

ownership level in the case of a pass-through entity

for your taxable year in which one or more long-term

include all requirements of the California Revenue

(S corporation, estate, trust, partnership, or limited

contracts are completed (or at any other time required

and Taxation Code (R&TC) in the tax booklets.

liability company (LLC) treated as a partnership).

by IRC Section 460 or the regulations thereunder).

Taxpayers should not consider the tax booklets as

C Exceptions

•

Individuals, estates, or trusts, sign Side 2 and

authoritative law.

file form FTB 3834 as a separate return (do

Interest Computation

The look-back method does not apply to regular

not attach it to Form 540, California Resident

The cumulative effect of applying the look-back

taxable income from the following items:

Income Tax Return; Long Form 540NR, California

method is taken into account beginning in the

•

Any home construction contract, as defined in

Nonresident or Part-Year Resident Income

filing year even though look-back interest is not

IRC Section 460(e)(6)(A).

Tax Return; or Form 541, California Fiduciary

computed for that year. Income is hypothetically

•

Any construction contract entered into:

Income Tax Return).

reallocated to or from the filing year or to or from

(a) that you estimate the contract will be

•

Corporations, S corporations, exempt

the redetermination years. Look-back does not

completed within two years from the contract

organizations, partnerships, and LLCs, enter on

create or decrease income; it only hypothetically

commencement date, and

the appropriate line of their return the interest

changes the tax year of recognition.

(b) where average annual gross receipts for

due or to be refunded and attach form FTB 3834

Tax Rate Increase

the three taxable years before the taxable year

to their Form 100, California Corporation

For taxable years beginning on or after January 1,

the contract is entered into do not exceed

Franchise or Income Tax Return; Form 100W,

2012, the maximum personal income tax rate

$10 million. See IRC Section 460(e).

California Corporation Franchise or Income

increased to 12.30%.

•

Any contract completed within two years from

Tax Return - Water’s-Edge Filers; Form 100S,

the contract commencement date, if the gross

California S Corporation Franchise or Income

Registered Domestic Partners (RDP)

price of the contract (as of contract completion)

Tax Return; Form 109, California Exempt

For purposes of California income tax, references

does not exceed the smaller of any of the

Organization Business Income Tax Return;

to a spouse, husband, or wife also refer to a

following items:

Form 565, Partnership Return of Income; or

RDP, unless otherwise specified. When we use

(a) $1 million.

Form 568, Limited Liability Company Return of

the initials RDP they refer to both a California

(b) One percent of average annual gross receipts

Income. See instructions for Part I, line 9 and

registered domestic “partner” and a California

for the three tax years before the tax year of

line 10. Corporations, S corporations, exempt

registered domestic “partnership,” as applicable.

contract completion. See IRC Section 460(b)(3)(B)

organizations, partnerships, and LLCs are not

For more information on RDPs, get FTB Pub. 737,

for more information.

required to sign form FTB 3834.

Tax Information for Registered Domestic Partners.

De Minimis Exception. You may elect not to apply

If you owned an interest in a pass-through entity that

Private Mail Box (PMB)

the look-back method in certain de minimis cases for

has completed one or more long-term contracts, file

Include the PMB in the address field. Write “PMB”

contracts completed in taxable years beginning on or

form FTB 3834 for your taxable year that ends with

first, then the box number. Example: 111 Main

after January 1, 1998. The look-back method does not

or includes the end of the entity’s taxable year in

Street PMB 123.

apply in the following cases if the election is made:

which the contract was completed.

A Purpose

1. In the completion year if, for each prior contract

E Period Covered

year, the cumulative taxable income (or loss)

Use form FTB 3834, Interest Computation Under

actually reported under the contract is within

Fill in the taxable year line at the top of the form

the Look-Back Method for Completed Long-Term

10% of the cumulative look-back income (or

to show the year the contract was completed or

Contracts, to compute the interest due, or to be

loss). Cumulative income (or loss) is the amount

adjusted.

refunded using the look-back method under IRC

of taxable income (or loss) that you would have

Section 460(b)(2), on certain long-term contracts

If you were an owner of an interest in a pass-through

reported if you had used actual contract price

entered into after February 28, 1986, that are

entity that has completed one or more long-term

and costs instead of estimated contract price and

accounted for under either the percentage of

contracts, enter your taxable year ending with or

costs.

completion method or the percentage of completion

including the end of the entity’s taxable year in which

2. In a post-completion year if, as of the close of

capitalized cost method.

the contract was completed.

the post-completion year, the cumulative taxable

In the year a long-term contract is completed, the

income (or loss) under the contract is within

F Alternative Minimum

look-back method requires the taxpayer to do the

10% of the cumulative look-back income (or

Taxable Income (AMTI)

following:

loss) under the contract as of the close of the

•

“Look back” to each of the previous years during

most recent year in which the look-back method

If you apply the percentage of completion method to

which the contract work was in progress.

was applied to the contract (or would have been

income from a long-term contract only for purposes

applied if the election had not been made).

of determining AMTI, apply the look-back method

For purposes of item 2, discounting under

to AMTI in the year of contract completion. This rule

IRC Section 460(b)(2) does not apply.

FTB 3834 Instructions 2013 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3