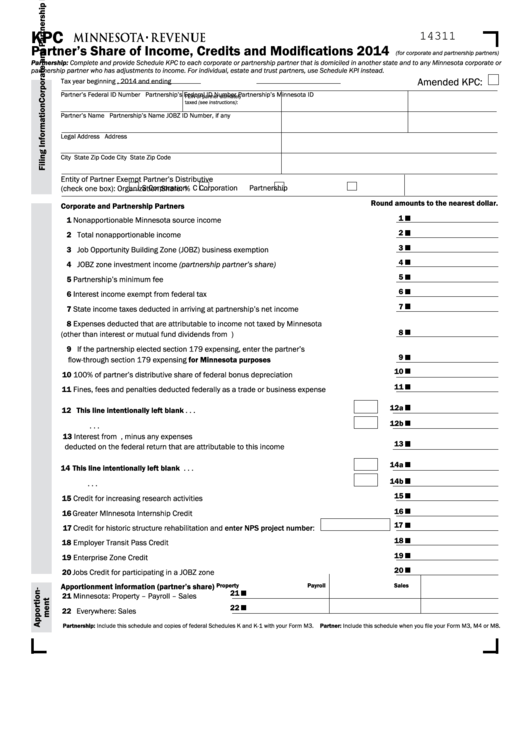

KPC

14311

Partner’s Share of Income, Credits and Modifications 2014

(for corporate and partnership partners)

Partnership: Complete and provide Schedule KPC to each corporate or partnership partner that is domiciled in another state and to any Minnesota corporate or

partnership partner who has adjustments to income . For individual, estate and trust partners, use Schedule KPI instead .

Amended KPC:

Tax year beginning

, 2014 and ending

Partner’s Federal ID Number

Partnership’s Federal ID Number

Partnership’s Minnesota ID

FEIN of partner ultimately

taxed (see instructions):

Partner’s Name

Partnership’s Name

JOBZ ID Number, if any

Legal Address

Address

City

State

Zip Code

City

State

Zip Code

Entity of Partner

Exempt

Partner’s Distributive

S Corporation

C Corporation

Partnership

(check one box):

Organization

Share:

%

Round amounts to the nearest dollar.

Corporate and Partnership Partners

1

1 Nonapportionable Minnesota source income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Total nonapportionable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Job Opportunity Building Zone (JOBZ) business exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 JOBZ zone investment income (partnership partner’s share) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Partnership’s minimum fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Interest income exempt from federal tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 State income taxes deducted in arriving at partnership’s net income . . . . . . . . . . . . . . . . . . . . . .

8 Expenses deducted that are attributable to income not taxed by Minnesota

8

(other than interest or mutual fund dividends from U .S . bonds) . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 If the partnership elected section 179 expensing, enter the partner’s

9

flow-through section 179 expensing for Minnesota purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 100% of partner’s distributive share of federal bonus depreciation . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Fines, fees and penalties deducted federally as a trade or business expense . . . . . . . . . . . . . . . .

12a

12 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . .

12b

. . .

13 Interest from U .S . government bond obligations, minus any expenses

13

deducted on the federal return that are attributable to this income . . . . . . . . . . . . . . . . . . . . . . . .

14a

14 This line intentionally left blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . .

14b

. . .

15

15 Credit for increasing research activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16 Greater MInnesota Internship Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17 Credit for historic structure rehabilitation and enter NPS project number:

18

18 Employer Transit Pass Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19 Enterprise Zone Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

20 Jobs Credit for participating in a JOBZ zone . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Apportionment information (partner’s share)

Property

Payroll

Sales

21

21 Minnesota: Property – Payroll – Sales . . . . . . .

22

22 Everywhere: Sales . . . . . . . . . . . . . . . . . . . . . . .

Partnership: Include this schedule and copies of federal Schedules K and K-1 with your Form M3. Partner: Include this schedule when you file your Form M3, M4 or M8.

1

1 2

2 3

3