Schedule Rz Of D-1040(R), D-1040(L) Or D-1040(Nr) - Income Tax - City Of Detroit

ADVERTISEMENT

*10612014*

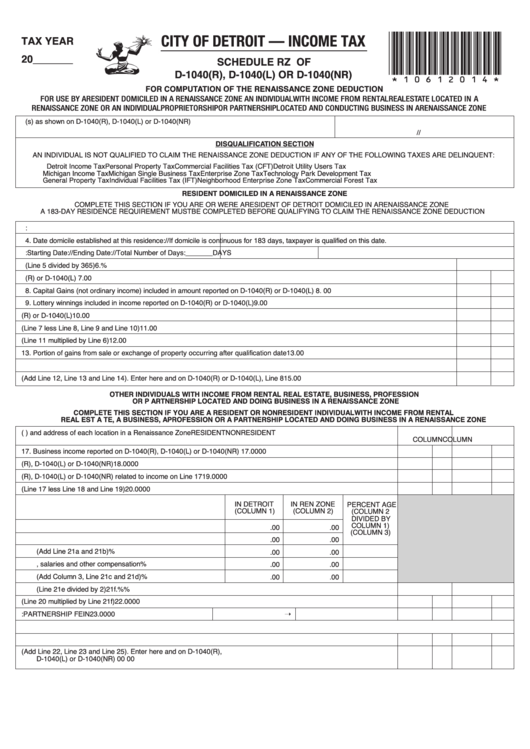

CITY OF DETROIT — INCOME TAX

TAX YEAR

20_______

SCHEDULE RZ OF

D-1040(R), D-1040(L) OR D-1040(NR)

FOR COMPUTATION OF THE RENAISSANCE ZONE DEDUCTION

FOR USE BY A RESIDENT DOMICILED IN A RENAISSANCE ZONE AN INDIVIDUAL WITH INCOME FROM RENTAL REAL ESTATE LOCATED IN A

RENAISSANCE ZONE OR AN INDIVIDUAL PROPRIETORSHIP OR PARTNERSHIP LOCATED AND CONDUCTING BUSINESS IN A RENAISSANCE ZONE

1. Name(s) as shown on D-1040(R), D-1040(L) or D-1040(NR)

2.

Social Security Number

/

/

DISQUALIFICA TION SECTION

AN INDIVIDUAL IS NOT QUALIFIED TO CLAIM THE RENAISSANCE ZONE DEDUCTION IF ANY OF THE FOLLOWING TAXES ARE DELINQUENT:

Detroit Income Tax

Personal Property Tax

Commercial Facilities Tax (CFT)

Detroit Utility Users Tax

Michigan Income Tax

Michigan Single Business Tax

Enterprise Zone Tax

Technology Park Development Tax

General Property Tax

Individual Facilities Tax (IFT)

Neighborhood Enterprise Zone Tax

Commercial Forest Tax

RESIDENT DOMICILED IN A RENAISSANCE ZONE

COMPLETE THIS SECTION IF YOU ARE OR WERE A RESIDENT OF DETROIT DOMICILED IN A RENAISSANCE ZONE

A 183-DAY RESIDENCE REQUIREMENT MUST BE COMPLETED BEFORE QUALIFYING TO CLAIM THE RENAISSANCE ZONE DEDUCTION

3. Address of domicile in Renaissance Zone:

4. Date domicile established at this residence:

/

/

If domicile is continuous for 183 days, taxpayer is qualified on this date.

5. Dates of domicile this year:

Starting Date:

/

/

Ending Date:

/

/

Total Number of Days:

_______DAYS

6. Percentage of year as a qualified resident of a Renaissance Zone (Line 5 divided by 365)

6.

%

7. Gross income from Line 3 of D-1040(R) or D-1040(L)

7.

00

8. Capital Gains (not ordinary income) included in amount reported on D-1040(R) or D-1040(L)

8.

00

9. Lottery winnings included in income reported on D-1040(R) or D-1040(L)

9.

00

10. Total deductions related to income included in Line 7 above D-1040(R) or D-1040(L)

10.

00

11. Base income for Renaissance Zone deduction (Line 7 less Line 8, Line 9 and Line 10)

11.

00

12. Total qualified ordinary income (Line 11 multiplied by Line 6)

12.

00

13. Portion of gains from sale or exchange of property occurring after qualification date

13.

00

14. Lottery winnings from an instate lottery game or an on-line game won after becoming a qualified taxpayer

14.

00

15. Renaissance Zone deduction allowed (Add Line 12, Line 13 and Line 14). Enter here and on D-1040(R) or D-1040(L), Line 8

15.

00

OTHER INDIVIDUALS WITH INCOME FROM RENTAL REAL ESTATE, BUSINESS, PROFESSION

OR P ARTNERSHIP LOCATED AND DOING BUSINESS IN A RENAISSANCE ZONE

COMPLETE THIS SECTION IF YOU ARE A RESIDENT OR NONRESIDENT INDIVIDUAL WITH INCOME FROM RENTAL

REAL EST A TE, A BUSINESS, A PROFESSION OR A PARTNERSHIP LOCATED AND DOING BUSINESS IN A RENAISSANCE ZONE

16. Business Name (D.B.A.) and address of each location in a Renaissance Zone

RESIDENT

NONRESIDENT

COLUMN

COLUMN

17. Business income reported on D-1040(R), D-1040(L) or D-1040(NR)

17.

00

00

18. Net operating loss deduction claimed on D-1040(R), D-1040(L) or D-1040(NR)

18.

00

00

19. Retirement plan deduction claimed on D-1040(R), D-1040(L) or D-1040(NR) related to income on Line 17

19.

00

00

20. Base for Renaissance Zone Deduction (Line 17 less Line 18 and Line 19)

20.

00

00

21. Renaissance Zone Apportionment Percentage

IN DETROIT

IN REN ZONE

PERCENT AGE

(COLUMN 1)

(COLUMN 2)

(COLUMN 2

DIVIDED BY

COLUMN 1)

21a. Average net book value of real and personal property

.00

.00

(COLUMN 3)

21b. Gross rents paid on real property multiplied by 8

.00

.00

21c. Total property (Add Line 21a and 21b)

%

.00

.00

21d. Total wages, salaries and other compensation

%

.00

.00

21e. Total percentages (Add Column 3, Line 21c and 21d)

%

.00

.00

21f. Renaissance zone deduction percentage (Line 21e divided by 2)

21f.

%

%

22. Renaissance Zone deduction for business (Line 20 multiplied by Line 21f)

22.

00

00

23. Renaissance Zone deduction from partnership return:

PARTNERSHIP FEIN

23.

00

00

24. Address of each parcel of rental real estate located within a Renaissance Zone

25. Income from rental real estate located within a Renaissance Zone

25.

00

00

26. Total Renaissance Zone Deduction (Add Line 22, Line 23 and Line 25). Enter here and on D-1040(R),

D-1040(L) or D-1040(NR)

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1