California Form 3832 - Limited Liability Company Nonresident Members' Consent - 2013

ADVERTISEMENT

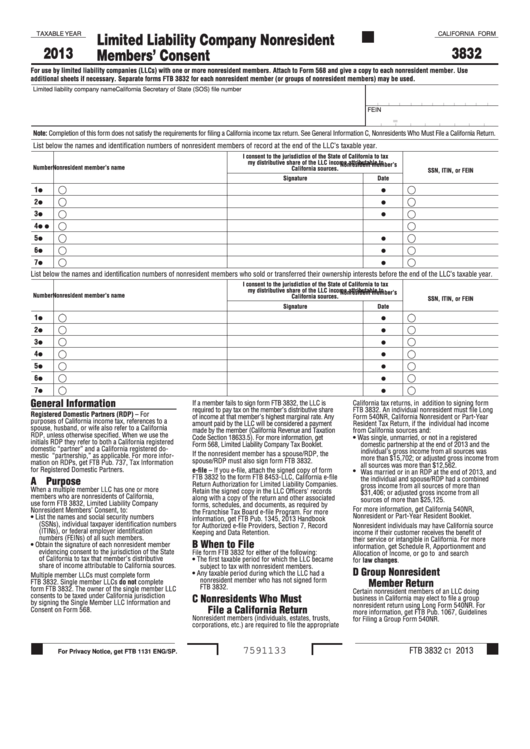

Limited Liability Company Nonresident

TAXABLE YEAR

CALIFORNIA FORM

2013

3832

Members’ Consent

For use by limited liability companies (LLCs) with one or more nonresident members. Attach to Form 568 and give a copy to each nonresident member. Use

additional sheets if necessary. Separate forms FTB 3832 for each nonresident member (or groups of nonresident members) may be used.

Limited liability company name

California Secretary of State (SOS) file number

FEIN

-

Note: Completion of this form does not satisfy the requirements for filing a California income tax return. See General Information C, Nonresidents Who Must File a California Return.

List below the names and identification numbers of nonresident members of record at the end of the LLC’s taxable year.

I consent to the jurisdiction of the State of California to tax

my distributive share of the LLC income attributable to

Nonresident member’s

Number

Nonresident member’s name

California sources.

SSN, ITIN, or FEIN

Signature

Date

1

2

3

4

5

6

7

List below the names and identification numbers of nonresident members who sold or transferred their ownership interests before the end of the LLC’s taxable year.

I consent to the jurisdiction of the State of California to tax

my distributive share of the LLC income attributable to

Nonresident member’s

Number

Nonresident member’s name

California sources.

SSN, ITIN, or FEIN

Signature

Date

1

2

3

4

5

6

7

General Information

If a member fails to sign form FTB 3832, the LLC is

California tax returns, in addition to signing form

required to pay tax on the member’s distributive share

FTB 3832. An individual nonresident must file Long

Registered Domestic Partners (RDP) – For

of income at that member’s highest marginal rate. Any

Form 540NR, California Nonresident or Part-Year

purposes of California income tax, references to a

amount paid by the LLC will be considered a payment

Resident Tax Return, if the individual had income

spouse, husband, or wife also refer to a California

made by the member (California Revenue and Taxation

from California sources and:

RDP, unless otherwise specified. When we use the

Code Section 18633.5). For more information, get

• Was single, unmarried, or not in a registered

initials RDP they refer to both a California registered

Form 568, Limited Liability Company Tax Booklet.

domestic partnership at the end of 2013 and the

domestic “partner” and a California registered do-

individual’s gross income from all sources was

If the nonresident member has a spouse/RDP, the

mestic “partnership,” as applicable. For more infor-

more than $15,702; or adjusted gross income from

spouse/RDP must also sign form FTB 3832.

mation on RDPs, get FTB Pub. 737, Tax Information

all sources was more than $12,562.

for Registered Domestic Partners.

e-file – If you e-file, attach the signed copy of form

• Was married or in an RDP at the end of 2013, and

FTB 3832 to the form FTB 8453-LLC, California e-file

A Purpose

the individual and spouse/RDP had a combined

Return Authorization for Limited Liability Companies.

gross income from all sources of more than

When a multiple member LLC has one or more

Retain the signed copy in the LLC Officers’ records

$31,406; or adjusted gross income from all

members who are nonresidents of California,

along with a copy of the return and other associated

sources of more than $25,125.

use form FTB 3832, Limited Liability Company

forms, schedules, and documents, as required by

For more information, get California 540NR,

Nonresident Members’ Consent, to:

the Franchise Tax Board e-file Program. For more

Nonresident or Part-Year Resident Booklet.

• List the names and social security numbers

information, get FTB Pub. 1345, 2013 Handbook

(SSNs), individual taxpayer identification numbers

for Authorized e-file Providers, Section 7, Record

Nonresident individuals may have California source

(ITINs), or federal employer identification

Keeping and Data Retention.

income if their customer receives the benefit of

numbers (FEINs) of all such members.

their service or intangible in California. For more

B When to File

• Obtain the signature of each nonresident member

information, get Schedule R, Apportionment and

evidencing consent to the jurisdiction of the State

File form FTB 3832 for either of the following:

Allocation of Income, or go to ftb.ca.gov and search

of California to tax that member’s distributive

• The first taxable period for which the LLC became

for law changes.

share of income attributable to California sources.

subject to tax with nonresident members.

D Group Nonresident

• Any taxable period during which the LLC had a

Multiple member LLCs must complete form

nonresident member who has not signed form

Member Return

FTB 3832. Single member LLCs do not complete

FTB 3832.

form FTB 3832. The owner of the single member LLC

Certain nonresident members of an LLC doing

consents to be taxed under California jurisdiction

C Nonresidents Who Must

business in California may elect to file a group

by signing the Single Member LLC Information and

nonresident return using Long Form 540NR. For

File a California Return

Consent on Form 568.

more information, get FTB Pub. 1067, Guidelines

Nonresident members (individuals, estates, trusts,

for Filing a Group Form 540NR.

corporations, etc.) are required to file the appropriate

FTB 3832

2013

7591133

C1

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1