Maine Biofuel Production And Use Tax Credit Worksheet - 2015

ADVERTISEMENT

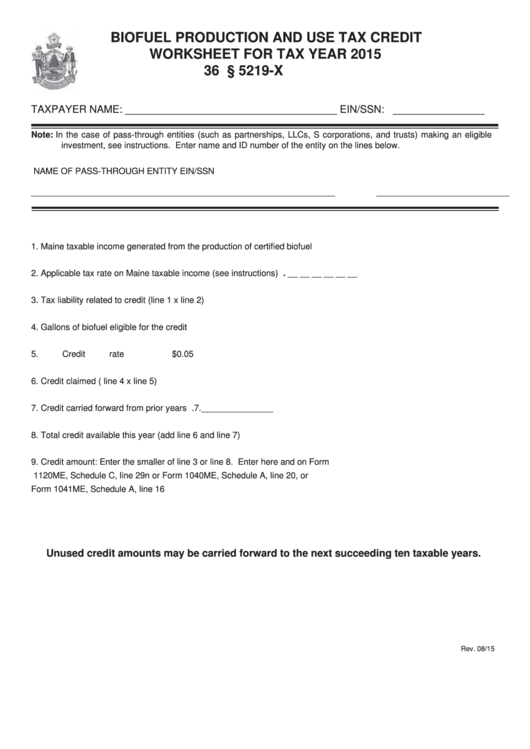

BIOFUEL PRODUCTION AND USE TAX CREDIT

WORKSHEET FOR TAX YEAR 2015

36 M.R.S. § 5219-X

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: In the case of pass-through entities (such as partnerships, LLCs, S corporations, and trusts) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Maine taxable income generated from the production of certifi ed biofuel ................................1. _______________

2.

Applicable tax rate on Maine taxable income (see instructions) ...............................................2. . __ __ __ __ __ __

3.

Tax liability related to credit (line 1 x line 2) ..............................................................................3. _______________

4.

Gallons of biofuel eligible for the credit .....................................................................................4. _______________

5.

Credit rate .................................................................................................................................5.

$0.05

6.

Credit claimed ( line 4 x line 5) .................................................................................................6. _______________

7.

Credit carried forward from prior years .....................................................................................7. _______________

8.

Total credit available this year (add line 6 and line 7) ...............................................................8. _______________

9.

Credit amount: Enter the smaller of line 3 or line 8. Enter here and on Form

1120ME, Schedule C, line 29n or Form 1040ME, Schedule A, line 20, or

Form 1041ME, Schedule A, line 16 ..........................................................................................9. _______________

Unused credit amounts may be carried forward to the next succeeding ten taxable years.

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2