Reset Form

Print Form

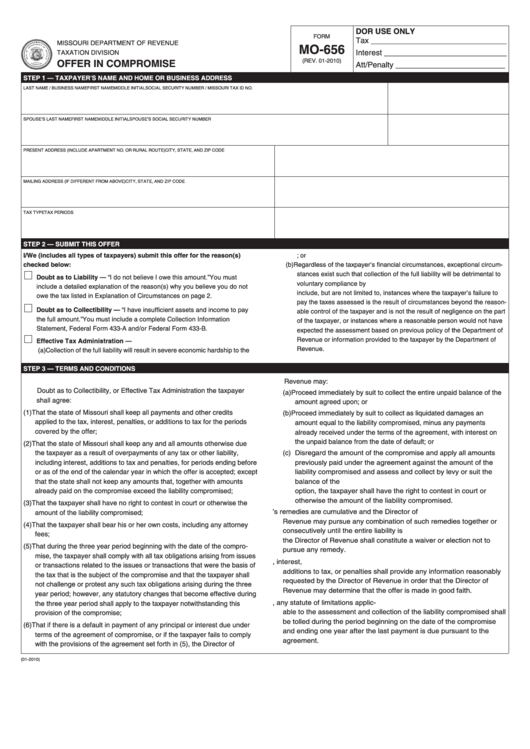

DOR USE ONLY

FORM

Tax _______________________________

MISSOURI DEPARTMENT OF REVENUE

MO-656

TAXATION DIVISION

Interest ____________________________

(REV. 01-2010)

OFFER IN COMPROMISE

Att/Penalty _________________________

STEP 1 — TAXPAYER'S NAME AND HOME OR BUSINESS ADDRESS

LAST NAME / BUSINESS NAME

FIRST NAME

MIDDLE INITIAL

SOCIAL SECURITY NUMBER / MISSOURI TAX ID NO.

SPOUSE’S LAST NAME

FIRST NAME

MIDDLE INITIAL

SPOUSE’S SOCIAL SECURITY NUMBER

PRESENT ADDRESS (INCLUDE APARTMENT NO. OR RURAL ROUTE)

CITY, STATE, AND ZIP CODE

MAILING ADDRESS (IF DIFFERENT FROM ABOVE)

CITY, STATE, AND ZIP CODE

TAX TYPE

TAX PERIODS

STEP 2 — SUBMIT THIS OFFER

I/We (includes all types of taxpayers) submit this offer for the reason(s)

taxpayer. You must include Federal Form 433A and/or Federal Form 433B; or

checked below:

(b) Regardless of the taxpayer’s financial circumstances, exceptional circum-

stances exist such that collection of the full liability will be detrimental to

Doubt as to Liability — “I do not believe I owe this amount.” You must

voluntary compliance by taxpayers. Such exceptional circumstances

include a detailed explanation of the reason(s) why you believe you do not

include, but are not limited to, instances where the taxpayer’s failure to

owe the tax listed in Explanation of Circumstances on page 2.

pay the taxes assessed is the result of circumstances beyond the reason-

Doubt as to Collectibility — “I have insufficient assets and income to pay

able control of the taxpayer and is not the result of negligence on the part

the full amount.” You must include a complete Collection Information

of the taxpayer, or instances where a reasonable person would not have

Statement, Federal Form 433-A and/or Federal Form 433-B.

expected the assessment based on previous policy of the Department of

Revenue or information provided to the taxpayer by the Department of

Effective Tax Administration —

Revenue.

(a) Collection of the full liability will result in severe economic hardship to the

STEP 3 — TERMS AND CONDITIONS

A. As part of the consideration for any compromise of taxes that is based on

Revenue may:

Doubt as to Collectibility, or Effective Tax Administration the taxpayer

(a) Proceed immediately by suit to collect the entire unpaid balance of the

shall agree:

amount agreed upon; or

(1) That the state of Missouri shall keep all payments and other credits

(b) Proceed immediately by suit to collect as liquidated damages an

applied to the tax, interest, penalties, or additions to tax for the periods

amount equal to the liability compromised, minus any payments

covered by the offer;

already received under the terms of the agreement, with interest on

the unpaid balance from the date of default; or

(2) That the state of Missouri shall keep any and all amounts otherwise due

the taxpayer as a result of overpayments of any tax or other liability,

(c) Disregard the amount of the compromise and apply all amounts

including interest, additions to tax and penalties, for periods ending before

previously paid under the agreement against the amount of the

or as of the end of the calendar year in which the offer is accepted; except

liability compromised and assess and collect by levy or suit the

that the state shall not keep any amounts that, together with amounts

balance of the liability. If the Director of Revenue chooses this

already paid on the compromise exceed the liability compromised;

option, the taxpayer shall have the right to contest in court or

otherwise the amount of the liability compromised.

(3) That the taxpayer shall have no right to contest in court or otherwise the

B. The Director of Revenue’s remedies are cumulative and the Director of

amount of the liability compromised;

Revenue may pursue any combination of such remedies together or

(4) That the taxpayer shall bear his or her own costs, including any attorney

consecutively until the entire liability is paid. No action or inaction by

fees;

the Director of Revenue shall constitute a waiver or election not to

(5) That during the three year period beginning with the date of the compro-

pursue any remedy.

mise, the taxpayer shall comply with all tax obligations arising from issues

C. The taxpayer requesting to compromise payment of taxes, interest,

or transactions related to the issues or transactions that were the basis of

additions to tax, or penalties shall provide any information reasonably

the tax that is the subject of the compromise and that the taxpayer shall

requested by the Director of Revenue in order that the Director of

not challenge or protest any such tax obligations arising during the three

Revenue may determine that the offer is made in good faith.

year period; however, any statutory changes that become effective during

D. If compromise of taxes is agreed upon, any statute of limitations applic-

the three year period shall apply to the taxpayer notwithstanding this

able to the assessment and collection of the liability compromised shall

provision of the compromise;

be tolled during the period beginning on the date of the compromise

(6) That if there is a default in payment of any principal or interest due under

and ending one year after the last payment is due pursuant to the

terms of the agreement of compromise, or if the taxpayer fails to comply

agreement.

with the provisions of the agreement set forth in (5), the Director of

(01-2010)

1

1 2

2