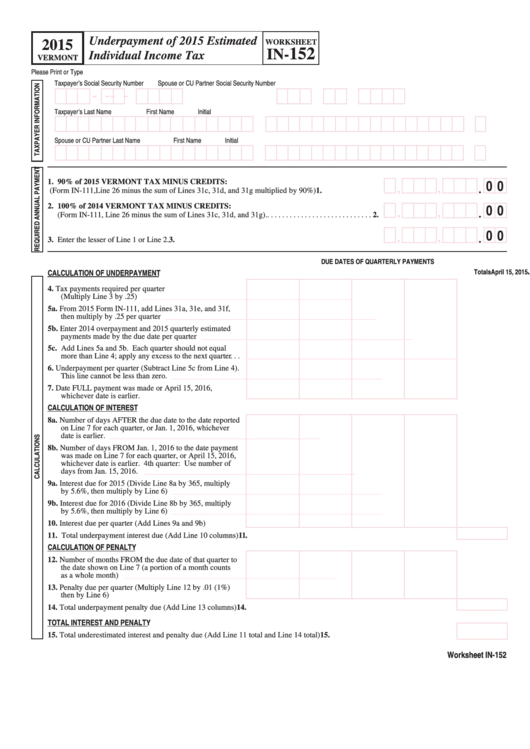

Worksheet In-152 - Vermont Underpayment Of Estimated Individual Income Tax - 2015

ADVERTISEMENT

Underpayment of 2015 Estimated

2015

WORKSHEET

152

IN-

Individual Income Tax

VERMONT

Please Print or Type

Taxpayer’s Social Security Number

Spouse or CU Partner Social Security Number

-

-

-

-

Taxpayer’s Last Name

First Name

Initial

Spouse or CU Partner Last Name

First Name

Initial

0 0

1. 90% of 2015 VERMONT TAX MINUS CREDITS:

,

,

.

(Form IN-111, Line 26 minus the sum of Lines 31c, 31d, and 31g multiplied by 90%) . . . . . . . . . . . . . 1.

0 0

2. 100% of 2014 VERMONT TAX MINUS CREDITS:

,

,

.

(Form IN-111, Line 26 minus the sum of Lines 31c, 31d, and 31g).. . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

0 0

,

,

.

3. Enter the lesser of Line 1 or Line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

DUE DATES OF QUARTERLY PAYMENTS

April 15, 2015

June 15, 2015

Sept. 15, 2015

Jan. 15, 2016

Totals

CALCULATION OF UNDERPAYMENT

4. Tax payments required per quarter

(Multiply Line 3 by .25) . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

5a. From 2015 Form IN-111, add Lines 31a, 31e, and 31f,

then multiply by .25 per quarter . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

5b. Enter 2014 overpayment and 2015 quarterly estimated

payments made by the due date per quarter . . . . . . . . . . . .

______________________________________________________

5c. Add Lines 5a and 5b. Each quarter should not equal

more than Line 4; apply any excess to the next quarter . . .

______________________________________________________

6. Underpayment per quarter (Subtract Line 5c from Line 4).

This line cannot be less than zero. . . . . . . . . . . . . . . . . . . .

______________________________________________________

7. Date FULL payment was made or April 15, 2016,

whichever date is earlier. . . . . . . . . . . . . . . . . . . . . . . . . . .

CALCULATION OF INTEREST

8a. Number of days AFTER the due date to the date reported

on Line 7 for each quarter, or Jan. 1, 2016, whichever

date is earlier. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

8b. Number of days FROM Jan. 1, 2016 to the date payment

was made on Line 7 for each quarter, or April 15, 2016,

whichever date is earlier. 4th quarter: Use number of

days from Jan. 15, 2016. . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

9a. Interest due for 2015 (Divide Line 8a by 365, multiply

by 5.6%, then multiply by Line 6) . . . . . . . . . . . . . . . . . . .

______________________________________________________

9b. Interest due for 2016 (Divide Line 8b by 365, multiply

by 5.6%, then multiply by Line 6) . . . . . . . . . . . . . . . . . . .

______________________________________________________

10. Interest due per quarter (Add Lines 9a and 9b) . . . . . . . . .

11. Total underpayment interest due (Add Line 10 columns) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11.

CALCULATION OF PENALTY

12. Number of months FROM the due date of that quarter to

the date shown on Line 7 (a portion of a month counts

as a whole month) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

13. Penalty due per quarter (Multiply Line 12 by .01 (1%)

then by Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Total underpayment penalty due (Add Line 13 columns) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14.

TOTAL INTEREST AND PENALTY

15. Total underestimated interest and penalty due (Add Line 11 total and Line 14 total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15.

Worksheet IN-152

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1