Eta Form 9065 - Work Opportunity Tax Credit Program

ADVERTISEMENT

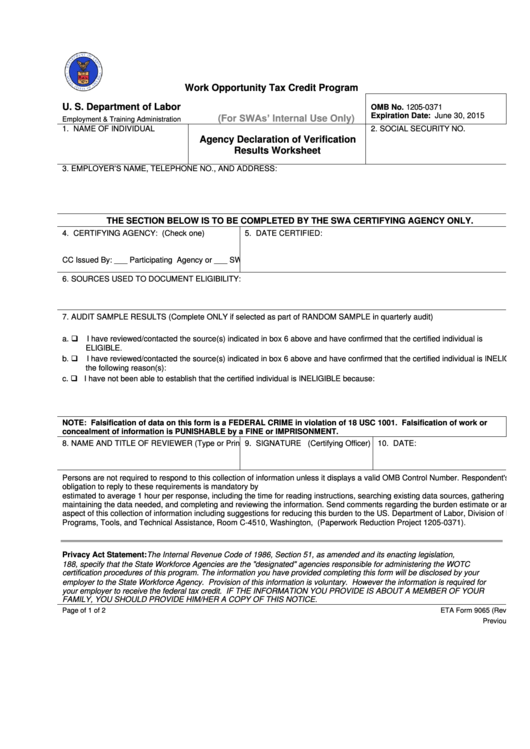

Work Opportunity Tax Credit Program

U. S. Department of Labor

OMB No. 1205-0371

(For SWAs’ Internal Use Only)

Expiration Date: June 30, 2015

Employment & Training Administration

1. NAME OF INDIVIDUAL

2. SOCIAL SECURITY NO.

Agency Declaration of Verification

Results Worksheet

3. EMPLOYER’S NAME, TELEPHONE NO., AND ADDRESS:

THE SECTION BELOW IS TO BE COMPLETED BY THE SWA CERTIFYING AGENCY ONLY.

4. CERTIFYING AGENCY: (Check one)

5. DATE CERTIFIED:

CC Issued By: ___ Participating Agency or ___ SWA

6. SOURCES USED TO DOCUMENT ELIGIBILITY:

7. AUDIT SAMPLE RESULTS (Complete ONLY if selected as part of RANDOM SAMPLE in quarterly audit)

a. I have reviewed/contacted the source(s) indicated in box 6 above and have confirmed that the certified individual is

ELIGIBLE.

b. I have reviewed/contacted the source(s) indicated in box 6 above and have confirmed that the certified individual is INELIGIBLE for

the following reason(s):

c. I have not been able to establish that the certified individual is INELIGIBLE because:

NOTE: Falsification of data on this form is a FEDERAL CRIME in violation of 18 USC 1001. Falsification of work or

concealment of information is PUNISHABLE by a FINE or IMPRISONMENT.

8. NAME AND TITLE OF REVIEWER (Type or Print):

9. SIGNATURE (Certifying Officer)

10. DATE:

Persons are not required to respond to this collection of information unless it displays a valid OMB Control Number. Respondent's

obligation to reply to these requirements is mandatory by P.L. 104-188. Public reporting burden for this collection of information is

estimated to average 1 hour per response, including the time for reading instructions, searching existing data sources, gathering and

maintaining the data needed, and completing and reviewing the information. Send comments regarding the burden estimate or any other

aspect of this collection of information including suggestions for reducing this burden to the US. Department of Labor, Division of National

Programs, Tools, and Technical Assistance, Room C-4510, Washington, D.C. 20210 (Paperwork Reduction Project 1205-0371).

Privacy Act Statement: The Internal Revenue Code of 1986, Section 51, as amended and its enacting legislation, P.L. 104-

188, specify that the State Workforce Agencies are the "designated" agencies responsible for administering the WOTC

certification procedures of this program. The information you have provided completing this form will be disclosed by your

employer to the State Workforce Agency. Provision of this information is voluntary. However the information is required for

your employer to receive the federal tax credit. IF THE INFORMATION YOU PROVIDE IS ABOUT A MEMBER OF YOUR

FAMILY, YOU SHOULD PROVIDE HIM/HER A COPY OF THIS NOTICE.

Page of 1 of 2

ETA Form 9065 (Rev. June 2012)

Previous versions usable

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1