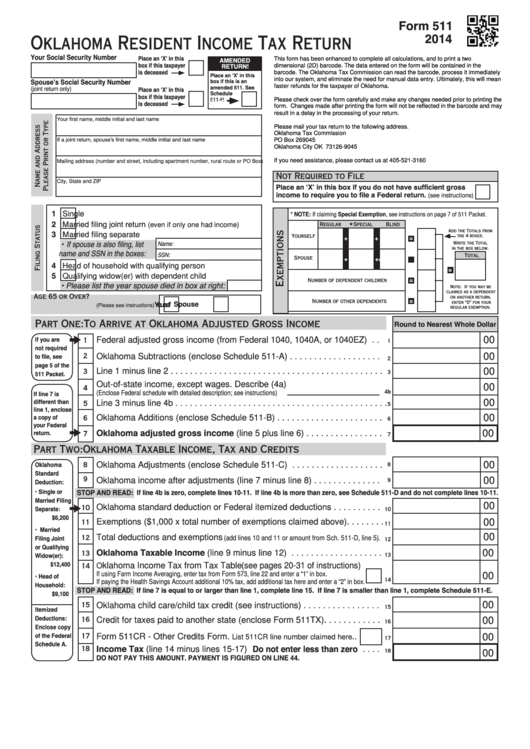

Form 511

PRINT FORM

RESET FORM

2014

Oklahoma Resident Income Tax Return

Place an ‘X’ in this

Your Social Security Number

This form has been enhanced to complete all calculations, and to print a two

AMENDED

box if this taxpayer

dimensional (2D) barcode. The data entered on the form will be contained in the

RETURN!

barcode. The Oklahoma Tax Commission can read the barcode, process it immediately

is deceased

Place an ‘X’ in this

Spouse’s Social Security Number

into our system, and eliminate the need for manual data entry. Ultimately, this will mean

box if this is an

amended 511. See

faster refunds for the taxpayer of Oklahoma.

Place an ‘X’ in this

(joint return only)

Schedule

box if this taxpayer

511-H.

Please check over the form carefully and make any changes needed prior to printing the

511-H

is deceased

form. Changes made after printing the form will not be reflected in the barcode and may

result in a delay in the processing of your return.

Your first name, middle initial and last name

Please mail your tax return to the following address.

Oklahoma Tax Commission

If a joint return, spouse’s first name, middle initial and last name

PO Box 269045

Oklahoma City OK 73126-9045

If you need assistance, please contact us at 405-521-3160

Mailing address (number and street, including apartment number, rural route or PO Box)

Not Required to File

City, State and ZIP

Place an ‘X’ in this box if you do not have sufficient gross

income to require you to file a Federal return.

(see instructions)

* NOTE: If claiming Special Exemption, see instructions on page 7 of 511 Packet.

1

Single

2

Married filing joint return

Regular

Special

Blind

(even if only one had income)

*

Add the Totals from

Married filing separate

3

Yourself

the 4 boxes.

+

+

=

• If spouse is also filing, list

Name:

Write the Total

in the box below.

name and SSN in the boxes:

SSN:

Total

Spouse

+

+

=

4

Head of household with qualifying person

=

5

Qualifying widow(er) with dependent child

Number of dependent children

=

• Please list the year spouse died in box at right:

Note: If you may be

claimed as a dependent

on another return,

Number of other dependents

=

Yourself

Age 65 or Over?

enter “0” for your

Spouse

(Please see instructions)

regular exemption.

Part One: To Arrive at Oklahoma Adjusted Gross Income

Round to Nearest Whole Dollar

If you are

00

1

Federal adjusted gross income (from Federal 1040, 1040A, or 1040EZ) . .

1

not required

2

to file, see

SCH-A

00

Oklahoma Subtractions (enclose Schedule 511-A) . . . . . . . . . . . . . . . . . . .

2

page 5 of the

3

00

Line 1 minus line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

511 Packet.

Out-of-state income, except wages. Describe (4a)

00

4

4b

If line 7 is

(Enclose Federal schedule with detailed description; see instructions)

different than

00

5

Line 3 minus line 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

line 1, enclose

a copy of

6

00

Oklahoma Additions (enclose Schedule 511-B) . . . . . . . . . . . . . . . . . . . . . .

SCH-B

6

your Federal

return.

00

7

Oklahoma adjusted gross income (line 5 plus line 6) . . . . . . . . . . . . . . . .

7

Part Two: Oklahoma Taxable Income, Tax and Credits

8

00

8

Oklahoma Adjustments (enclose Schedule 511-C) . . . . . . . . . . . . . . . . . . .

SCH-C

Oklahoma

Standard

9

9

00

Oklahoma income after adjustments (line 7 minus line 8) . . . . . . . . . . . . . .

Deduction:

• Single or

STOP AND READ: If line 4b is zero, complete lines 10-11. If line 4b is more than zero, see Schedule 511-D and do not complete lines 10-11.

Married Filing

00

10

Oklahoma standard deduction or Federal itemized deductions . . . . . . . . . .

10

Separate:

$6,200

11

Exemptions ($1,000 x total number of exemptions claimed above). . . . . . . .

00

11

• Married

00

Filing Joint

12

Total deductions and exemptions

SCH-D

(add lines 10 and 11 or amount from Sch. 511-D, line 5) .

12

or Qualifying

Oklahoma Taxable Income (line 9 minus line 12) . . . . . . . . . . . . . . . . . . .

00

13

13

Widow(er):

$12,400

14

klahoma Income Tax from Tax Table (see pages 20-31 of instructions)

O

If using Farm Income Averaging, enter tax from Form 573, line 22 and enter a “1” in box.

• Head of

00

14

If paying the Health Savings Account additional 10% tax, add additional tax here and enter a “2” in box.

Household:

STOP AND READ: If line 7 is equal to or larger than line 1, complete line 15. If line 7 is smaller than line 1, complete Schedule 511-E.

$9,100

15

00

SCH-E

Oklahoma child care/child tax credit (see instructions) . . . . . . . . . . . . . . . .

15

Itemized

16

Deductions:

Credit for taxes paid to another state (enclose Form 511TX). . . . . . . . . . . .

00

16

Enclose copy

of the Federal

17

Form 511CR - Other Credits Form.

..

SCH-CR

00

List 511CR line number claimed here

17

Schedule A.

Income Tax (line 14 minus lines 15-17) Do not enter less than zero . . . .

18

18

00

DO NOT PAY THIS AMOUNT. PAYMENT IS FIGURED ON LINE 44.

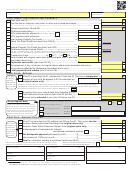

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10