Form 4889 - Request For Accelerated Payment For The Brownfield Redevelopment Credit And The Historic Preservation Credit - 2012

ADVERTISEMENT

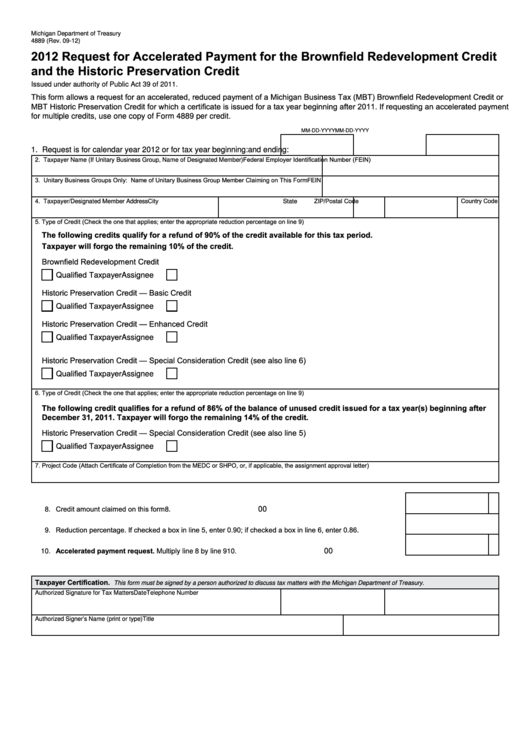

Michigan Department of Treasury

4889 (Rev. 09-12)

2012 Request for Accelerated Payment for the Brownfield Redevelopment Credit

and the Historic Preservation Credit

Issued under authority of Public Act 39 of 2011.

This form allows a request for an accelerated, reduced payment of a Michigan Business Tax (MBT) Brownfield Redevelopment Credit or

MBT Historic Preservation Credit for which a certificate is issued for a tax year beginning after 2011. If requesting an accelerated payment

for multiple credits, use one copy of Form 4889 per credit.

MM-DD-YYYY

MM-DD-YYYY

1. Request is for calendar year 2012 or for tax year beginning:

and ending:

Federal Employer Identification Number (FEIN)

2. Taxpayer Name (If Unitary Business Group, Name of Designated Member)

3. Unitary Business Groups Only: Name of Unitary Business Group Member Claiming on This Form

FEIN

City

ZIP/Postal Code

Country Code

4. Taxpayer/Designated Member Address

State

5. Type of Credit (Check the one that applies; enter the appropriate reduction percentage on line 9)

The following credits qualify for a refund of 90% of the credit available for this tax period.

Taxpayer will forgo the remaining 10% of the credit.

Brownfield Redevelopment Credit

Qualified Taxpayer

Assignee

Historic Preservation Credit — Basic Credit

Qualified Taxpayer

Assignee

Historic Preservation Credit — Enhanced Credit

Qualified Taxpayer

Assignee

Historic Preservation Credit — Special Consideration Credit (see also line 6)

Qualified Taxpayer

Assignee

6. Type of Credit (Check the one that applies; enter the appropriate reduction percentage on line 9)

The following credit qualifies for a refund of 86% of the balance of unused credit issued for a tax year(s) beginning after

December 31, 2011. Taxpayer will forgo the remaining 14% of the credit.

Historic Preservation Credit — Special Consideration Credit (see also line 5)

Qualified Taxpayer

Assignee

7. Project Code (Attach Certificate of Completion from the MEDC or SHPO, or, if applicable, the assignment approval letter)

8. Credit amount claimed on this form ..................................................................................................................

00

8.

9. Reduction percentage. If checked a box in line 5, enter 0.90; if checked a box in line 6, enter 0.86. ..............

9.

10. Accelerated payment request. Multiply line 8 by line 9 .................................................................................

00

10.

Taxpayer Certification.

This form must be signed by a person authorized to discuss tax matters with the Michigan Department of Treasury.

Authorized Signature for Tax Matters

Date

Telephone Number

Authorized Signer’s Name (print or type)

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4