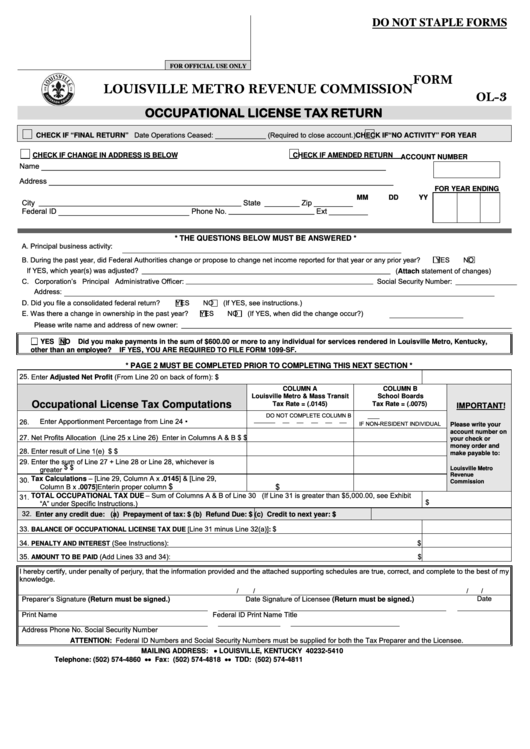

DO NOT STAPLE FORMS

FOR OFFICIAL USE ONLY

FORM

LOUISVILLE METRO REVENUE COMMISSION

3

OL-

OCCUPATIONAL LICENSE TAX RETURN

CHECK IF “FINAL RETURN” Date Operations Ceased: _____________ (Required to close account.)

CHECK IF “NO ACTIVITY” FOR YEAR

CHECK IF CHANGE IN ADDRESS IS BELOW

CHECK IF AMENDED RETURN

ACCOUNT NUMBER

Name

_______________________________________________________________________________

_______________________________________________________________________________

Address

FOR YEAR ENDING

MM

DD

YY

City

____________________________________________________

State

Zip

_________

__________

Federal ID

______________________________

Phone No.

Ext

__________

______________________

* THE QUESTIONS BELOW MUST BE ANSWERED *

A. Principal business activity:

B. During the past year, did Federal Authorities change or propose to change net income reported for that year or any prior year?

YES

NO

If YES, which year(s) was adjusted?

(Attach statement of changes)

_________________________________________________________________________

C. Corporation’s Principal Administrative Officer:

Social Security Number:

_______________________________________________________

__________________

Address:

D. Did you file a consolidated federal return?

YES

NO

(If YES, see instructions.)

E. Was there a change in ownership in the past year?

YES

NO

(If YES, when did the change occur?)

Please write name and address of new owner:

_________________________________________________________________________________________________

YES

NO

Did you make payments in the sum of $600.00 or more to any individual for services rendered in Louisville Metro, Kentucky,

other than an employee?

IF YES, YOU ARE REQUIRED TO FILE FORM 1099-SF.

* PAGE 2 MUST BE COMPLETED PRIOR TO COMPLETING THIS NEXT SECTION *

25.

$

Enter Adjusted Net Profit (From Line 20 on back of form):

COLUMN A

COLUMN B

Louisville Metro & Mass Transit

School Boards

Occupational License Tax Computations

Tax Rate = (.0145)

Tax Rate = (.0075)

IMPORTANT!

DO NOT COMPLETE COLUMN B

.

Enter Apportionment Percentage from Line 24

26.

IF NON-RESIDENT INDIVIDUAL

Please write your

account number on

27.

Net Profits Allocation (Line 25 x Line 26) Enter in Columns A & B

$

$

your check or

money order and

28.

Enter result of Line 1(e)

$

$

make payable to:

29.

Enter the sum of Line 27 + Line 28 or Line 28, whichever is

$

$

greater

Louisville Metro

Revenue

Tax Calculations – [Line 29, Column A x .0145] & [Line 29,

30.

Commission

$

$

Column B x .0075] Enter in proper column

TOTAL OCCUPATIONAL TAX DUE – Sum of Columns A & B of Line 30 (If Line 31 is greater than $5,000.00, see Exhibit

31.

$

“A” under Specific Instructions.)

32. Enter any credit due:

(a) Prepayment of tax: $

(b) Refund Due: $

(c) Credit to next year: $

33.

Line 31 minus Line 32(a)]

$

BALANCE OF OCCUPATIONAL LICENSE TAX DUE [

:

34.

(See Instructions):

$

PENALTY AND INTEREST

35.

(Add Lines 33 and 34):

$

AMOUNT TO BE PAID

I hereby certify, under penalty of perjury, that the information provided and the attached supporting schedules are true, correct, and complete to the best of my

knowledge.

/

/

/

/

Date

Date

Preparer’s Signature (Return must be signed.)

Signature of Licensee (Return must be signed.)

Print Name

Federal ID

Print Name

Title

Address

Phone No.

Social Security Number

ATTENTION: Federal ID Numbers and Social Security Numbers must be supplied for both the Tax Preparer and the Licensee.

MAILING ADDRESS: P.O. BOX 35410 LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 Fax: (502) 574-4818 TDD: (502) 574-4811

1

1 2

2