Reconciliation Of Income Tax Withheld Form Bw-3 - 2014

ADVERTISEMENT

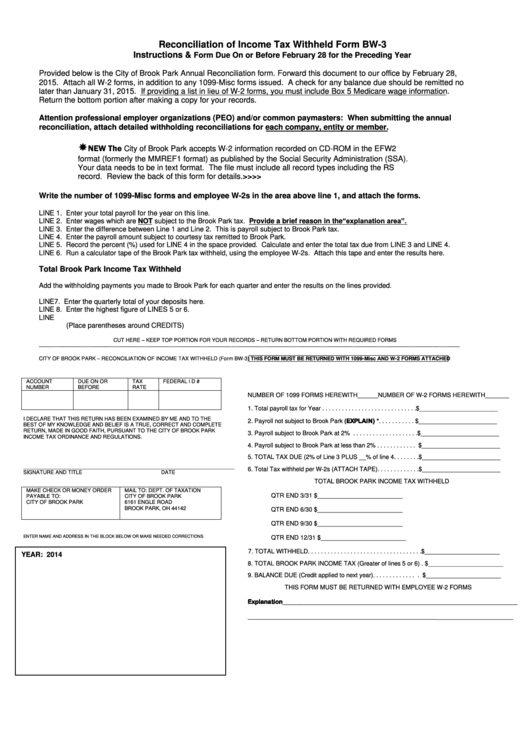

Reconciliation of Income Tax Withheld Form BW-3

Instructions &

Form Due On or Before February 28 for the Preceding Year

Provided below is the City of Brook Park Annual Reconciliation form. Forward this document to our office by February 28,

2015. Attach all W-2 forms, in addition to any 1099-Misc forms issued. A check for any balance due should be remitted no

later than January 31, 2015. If providing a list in lieu of W-2 forms, you must include Box 5 Medicare wage information.

Return the bottom portion after making a copy for your records.

Attention professional employer organizations (PEO) and/or common paymasters: When submitting the annual

reconciliation, attach detailed withholding reconciliations for each company, entity or member.

NEW The

City of Brook Park accepts W-2 information recorded on CD-ROM in the EFW2

format (formerly the MMREF1 format) as published by the Social Security Administration (SSA).

Your data needs to be in text format. The file must include all record types including the RS

record. Review the back of this form for details.>>>>

Write the number of 1099-Misc forms and employee W-2s in the area above line 1, and attach the forms.

LINE 1. Enter your total payroll for the year on this line.

LINE 2. Enter wages which are NOT subject to the Brook Park tax. Provide a brief reason in the “explanation area”.

LINE 3. Enter the difference between Line 1 and Line 2. This is payroll subject to Brook Park tax.

LINE 4. Enter the payroll amount subject to courtesy tax remitted to Brook Park.

LINE 5. Record the percent (%) used for LINE 4 in the space provided. Calculate and enter the total tax due from LINE 3 and LINE 4.

LINE 6. Run a calculator tape of the Brook Park tax withheld, using the employee W-2s. Attach this tape and enter the results here.

Total Brook Park Income Tax Withheld

Add the withholding payments you made to Brook Park for each quarter and enter the results on the lines provided.

LINE 7. Enter the quarterly total of your deposits here.

LINE 8. Enter the highest figure of LINES 5 or 6.

LINE 9. Subtract LINE 7 from LINE 8 and enter any BALANCE DUE or CREDIT to be applied to the next year here.

(Place parentheses around CREDITS)

CUT HERE – KEEP TOP PORTION FOR YOUR RECORDS – RETURN BOTTOM PORTION WITH REQUIRED FORMS

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

CITY OF BROOK PARK – RECONCILIATION OF INCOME TAX WITHHELD (Form BW-3) THIS FORM MUST BE RETURNED WITH 1099-Misc AND W-2 FORMS ATTACHED

ACCOUNT

DUE ON OR

TAX

FEDERAL I D #

NUMBER

BEFORE

RATE

NUMBER OF 1099 FORMS HEREWITH______NUMBER OF W-2 FORMS HEREWITH_______

1.

Total payroll tax for Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$_______________________

I DECLARE THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE

2.

Payroll not subject to Brook Park (EXPLAIN) * . . . . . . . . . . . $_______________________

BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE

RETURN, MADE IN GOOD FAITH, PURSUANT TO THE CITY OF BROOK PARK

3.

Payroll subject to Brook Park at 2% . . . . . . . . . . . . . . . . . . . .$_______________________

INCOME TAX ORDINANCE AND REGULATIONS.

4.

Payroll subject to Brook Park at less than 2% . . . . . . . . . . . . $_______________________

5.

TOTAL TAX DUE (2% of Line 3 PLUS __% of line 4. . . . . . . .$_______________________

________________________________________________________________________

6.

Total Tax withheld per W-2s (ATTACH TAPE). . . . . . . . . . . . .$_______________________

SIGNATURE AND TITLE

DATE

TOTAL BROOK PARK INCOME TAX WITHHELD

MAKE CHECK OR MONEY ORDER

MAIL TO: DEPT. OF TAXATION

QTR END 3/31

$_________________________

PAYABLE TO:

CITY OF BROOK PARK

CITY OF BROOK PARK

6161 ENGLE ROAD

BROOK PARK, OH 44142

QTR END 6/30

$_________________________

QTR END 9/30

$_________________________

ENTER NAME AND ADDRESS IN THE BLOCK BELOW OR MAKE NEEDED CORRECTIONS

QTR END 12/31

$_________________________

7.

TOTAL WITHHELD. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$______________________

YEAR: 2014

8.

TOTAL BROOK PARK INCOME TAX (Greater of lines 5 or 6) . $______________________

9.

BALANCE DUE (Credit applied to next year). . . . . . . . . . . . . . $______________________

THIS FORM MUST BE RETURNED WITH EMPLOYEE W-2 FORMS

Explanation_____________________________________________________________________

____________________

_______________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1