Form Ct-43 - Claim For Special Additional Mortgage Recording Tax Credit - 2014

ADVERTISEMENT

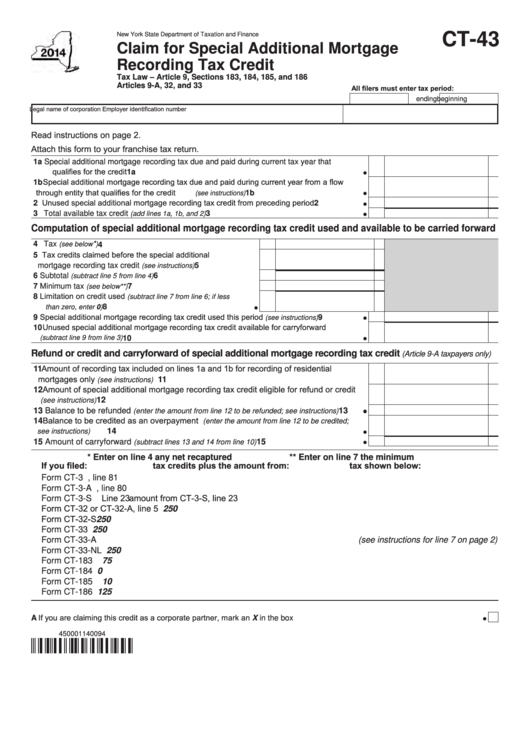

CT-43

New York State Department of Taxation and Finance

Claim for Special Additional Mortgage

Recording Tax Credit

Tax Law – Article 9, Sections 183, 184, 185, and 186

Articles 9-A, 32, and 33

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

Read instructions on page 2.

Attach this form to your franchise tax return.

1a Special additional mortgage recording tax due and paid during current tax year that

qualifies for the credit...........................................................................................................

1a

1b Special additional mortgage recording tax due and paid during current year from a flow

through entity that qualifies for the credit

.....................................................

1b

(see instructions)

2 Unused special additional mortgage recording tax credit from preceding period ...................

2

3 Total available tax credit

......................................................................

3

(add lines 1a, 1b, and 2)

Computation of special additional mortgage recording tax credit used and available to be carried forward

4 Tax

*

(see below

)

........................................................................

4

5 Tax credits claimed before the special additional

mortgage recording tax credit

.....................

5

(see instructions)

6 Subtotal

............................................

6

(subtract line 5 from line 4)

7 Minimum tax

........................................................

7

(see below**)

8 Limitation on credit used

(subtract line 7 from line 6; if less

.................................................................

8

than zero, enter 0)

9 Special additional mortgage recording tax credit used this period

.................

9

(see instructions)

10 Unused special additional mortgage recording tax credit available for carryforward

.......................................................................................................

(subtract line 9 from line 3)

10

Refund or credit and carryforward of special additional mortgage recording tax credit

(Article 9-A taxpayers only)

11 Amount of recording tax included on lines 1a and 1b for recording of residential

mortgages only

11

(see instructions)

..........................................................................................

12 Amount of special additional mortgage recording tax credit eligible for refund or credit

............................................................................................................... 12

(see instructions)

13 Balance to be refunded

........

13

(enter the amount from line 12 to be refunded; see instructions)

14 Balance to be credited as an overpayment

(enter the amount from line 12 to be credited;

..............................................................................................................

14

see instructions)

15 Amount of carryforward

............................................

15

(subtract lines 13 and 14 from line 10)

* Enter on line 4 any net recaptured

** Enter on line 7 the minimum

If you filed:

tax credits plus the amount from:

tax shown below:

Form CT-3 ........................... Line 78 ..................................................................... amount from CT-3, line 81

Form CT-3-A ........................ Line 77 ..................................................................... amount from CT-3-A, line 80

Form CT-3-S ........................ Line 23 ..................................................................... amount from CT-3-S, line 23

Form CT-32 or CT-32-A ....... Schedule A, line 5 ..................................................................... 250

Form CT-32-S ...................... Line 10 ...................................................................................... 250

Form CT-33 ......................... Line 11 ...................................................................................... 250

Form CT-33-A ...................... Line 15 ..................................................................... (see instructions for line 7 on page 2)

Form CT-33-NL .................... Line 5 .......................................................................................

250

Form CT-183 ....................... Line 4 ........................................................................................

75

Form CT-184 ....................... Line 3 or line 4 ..........................................................................

0

Form CT-185 ....................... Line 6 ........................................................................................

10

Form CT-186 ....................... Line 5 ........................................................................................ 125

A If you are claiming this credit as a corporate partner, mark an X in the box ......................................................................................

450001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2