Form 04-407 - Qualified Dealer License Application/renewal

ADVERTISEMENT

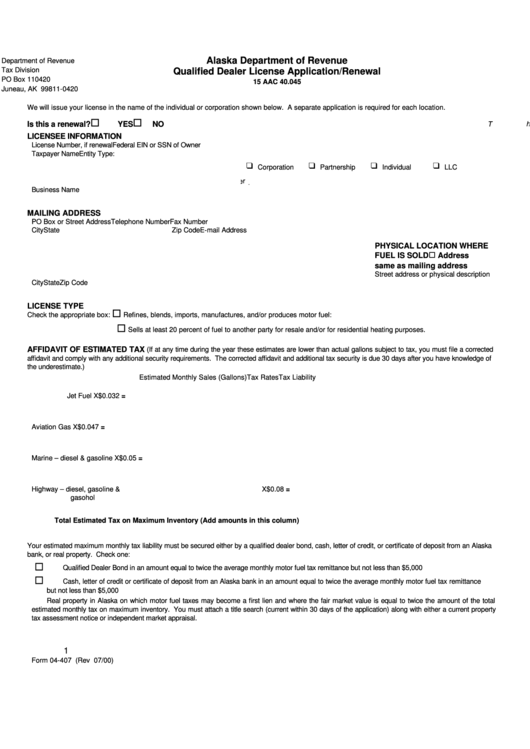

Alaska Department of Revenue

Department of Revenue

Tax Division

Qualified Dealer License Application/Renewal

PO Box 110420

15 AAC 40.045

Juneau, AK 99811-0420

We will issue your license in the name of the individual or corporation shown below. A separate application is required for each location.

¨

¨

Is this a renewal?

YES

NO

Th

LICENSEE INFORMATION

License Number, if renewal

Federal EIN or SSN of Owner

Taxpayer Name

Entity Type:

Corporation

Partnership

Individual

LLC

er

Business Name

MAILING ADDRESS

PO Box or Street Address

Telephone Number

Fax Number

City

State

Zip CodeE-mail Address

PHYSICAL LOCATION WHERE

FUEL IS SOLD ¨ Address

same as mailing address

Street address or physical description

City

State

Zip Code

LICENSE TYPE

¨

Check the appropriate box:

Refines, blends, imports, manufactures, and/or produces motor fuel:

¨

Sells at least 20 percent of fuel to another party for resale and/or for residential heating purposes.

AFFIDAVIT OF ESTIMATED TAX

(If at any time during the year these estimates are lower than actual gallons subject to tax, you must file a corrected

affidavit and comply with any additional security requirements. The corrected affidavit and additional tax security is due 30 days after you have knowledge of

the underestimate.)

Estimated Monthly Sales (Gallons)

Tax Rates

Tax Liability

Jet Fuel

X

$0.032

=

=

Aviation Gas

X

$0.047

Marine – diesel & gasoline

X

$0.05

=

Highway – diesel, gasoline &

X

$0.08

=

gasohol

Total Estimated Tax on Maximum Inventory (Add amounts in this column)

Your estimated maximum monthly tax liability must be secured either by a qualified dealer bond, cash, letter of credit, or certificate of deposit from an Alaska

bank, or real property. Check one:

¨

Qualified Dealer Bond in an amount equal to twice the average monthly motor fuel tax remittance but not less than $5,000

¨

Cash, letter of credit or certificate of deposit from an Alaska bank in an amount equal to twice the average monthly motor fuel tax remittance

but not less than $5,000

Real property in Alaska on which motor fuel taxes may become a first lien and where the fair market value is equal to twice the amount of the total

estimated monthly tax on maximum inventory. You must attach a title search (current within 30 days of the application) along with either a current property

tax assessment notice or independent market appraisal.

1

Form 04-407 (Rev 07/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4