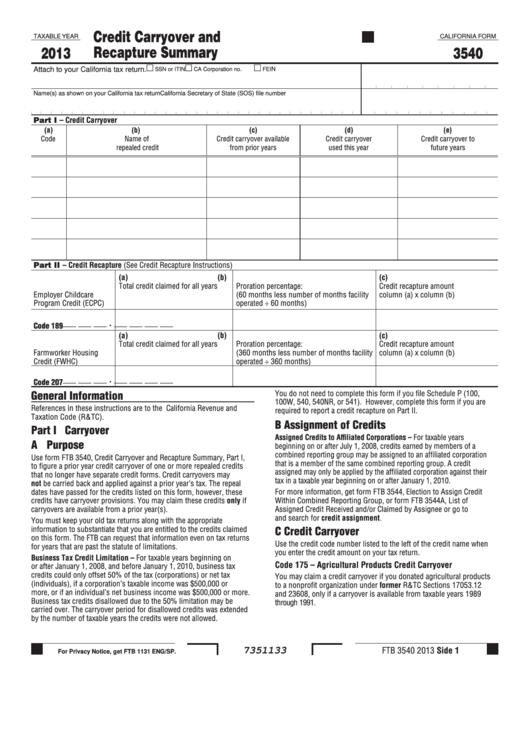

Credit Carryover and

TAXABLE YEAR

CALIFORNIA FORM

Recapture Summary

2013

3540

Attach to your California tax return.

N

SSN or ITIN

CA Corporation no.

FEI

Name(s) as shown on your California tax return

California Secretary of State (SOS) file number

Part I – Credit Carryover

(a)

(b)

(c)

(d)

(e)

Code

Name of

Credit carryover available

Credit carryover

Credit carryover to

used this year

future years

repealed credit

from prior years

Part II – Credit Recapture (See Credit Recapture Instructions)

(a)

(b)

(c)

Total credit claimed for all years

Proration percentage:

Credit recapture amount

Employer Childcare

(60 months less number of months facility

column (a) x column (b)

Program Credit (ECPC)

operated ÷ 60 months)

___ ___ ___ . ___ ___ ___ ___

Code 189

(a)

(b)

(c)

Total credit claimed for all years

Proration percentage:

Credit recapture amount

Farmworker Housing

(360 months less number of months facility

column (a) x column (b)

Credit (FWHC)

operated ÷ 360 months)

___ ___ ___ . ___ ___ ___ ___

Code 207

You do not need to complete this form if you file Schedule P (100,

General Information

100W, 540, 540NR, or 541). However, complete this form if you are

References in these instructions are to the California Revenue and

required to report a credit recapture on Part II.

Taxation Code (R&TC).

B Assignment of Credits

Part I Carryover

Assigned Credits to Affiliated Corporations – For taxable years

A Purpose

beginning on or after July 1, 2008, credits earned by members of a

combined reporting group may be assigned to an affiliated corporation

Use form FTB 3540, Credit Carryover and Recapture Summary, Part I,

that is a member of the same combined reporting group. A credit

to figure a prior year credit carryover of one or more repealed credits

assigned may only be applied by the affiliated corporation against their

that no longer have separate credit forms. Credit carryovers may

tax in a taxable year beginning on or after January 1, 2010.

not be carried back and applied against a prior year’s tax. The repeal

dates have passed for the credits listed on this form, however, these

For more information, get form FTB 3544, Election to Assign Credit

Within Combined Reporting Group, or form FTB 3544A, List of

credits have carryover provisions. You may claim these credits only if

carryovers are available from a prior year(s).

Assigned Credit Received and/or Claimed by Assignee or go to

ftb.ca.gov and search for credit assignment.

You must keep your old tax returns along with the appropriate

C Credit Carryover

information to substantiate that you are entitled to the credits claimed

on this form. The FTB can request that information even on tax returns

Use the credit code number listed to the left of the credit name when

for years that are past the statute of limitations.

you enter the credit amount on your tax return.

Business Tax Credit Limitation – For taxable years beginning on

Code 175 – Agricultural Products Credit Carryover

or after January 1, 2008, and before January 1, 2010, business tax

credits could only offset 50% of the tax (corporations) or net tax

You may claim a credit carryover if you donated agricultural products

(individuals), if a corporation’s taxable income was $500,000 or

to a nonprofit organization under former R&TC Sections 17053.12

more, or if an individual’s net business income was $500,000 or more.

and 23608, only if a carryover is available from taxable years 1989

Business tax credits disallowed due to the 50% limitation may be

through 1991.

carried over. The carryover period for disallowed credits was extended

by the number of taxable years the credits were not allowed.

FTB 3540 2013 Side 1

7351133

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4