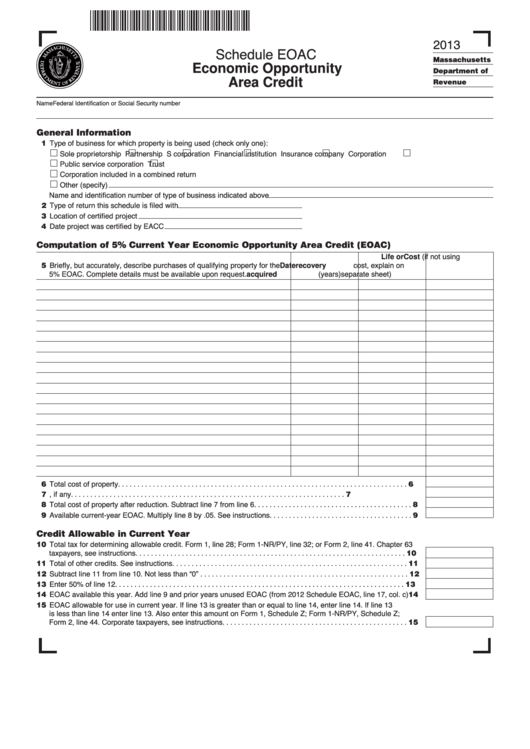

2013

Schedule EOAC

Massachusetts

Economic Opportunity

Department of

Area Credit

Revenue

Name

Federal Identification or Social Security number

11 Type of business for which property is being used (check only one):

General Information

Sole proprietorship

Partnership

S corporation

Financial institution

Insurance company

Corporation

Public service corporation

Trust

Corporation included in a combined return

Other (specify)

Name and identification number of type of business indicated above

12 Type of return this schedule is filed with

13 Location of certified project

14 Date project was certified by EACC

Computation of 5% Current Year Economic Opportunity Area Credit (EOAC)

Cost (if not using

15 Briefly, but accurately, describe purchases of qualifying property for the

cost, explain on

Life or

5% EOAC. Complete details must be available upon request.

(years)

separate sheet)

Date

recovery

acquired

16 Total cost of property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 U.S. basis reduction, if any. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Total cost of property after reduction. Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Available current-year EOAC. Multiply line 8 by .05. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Total tax for determining allowable credit. Form 1, line 28; Form 1-NR/PY, line 32; or Form 2, line 41. Chapter 63

Credit Allowable in Current Year

taxpayers, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total of other credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Subtract line 11 from line 10. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Enter 50% of line 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 EOAC available this year. Add line 9 and prior years unused EOAC (from 2012 Schedule EOAC, line 17, col. c) 14

15 EOAC allowable for use in current year. If line 13 is greater than or equal to line 14, enter line 14. If line 13

is less than line 14 enter line 13. Also enter this amount on Form 1, Schedule Z; Form 1-NR/PY, Schedule Z;

Form 2, line 44. Corporate taxpayers, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

1

1 2

2 3

3