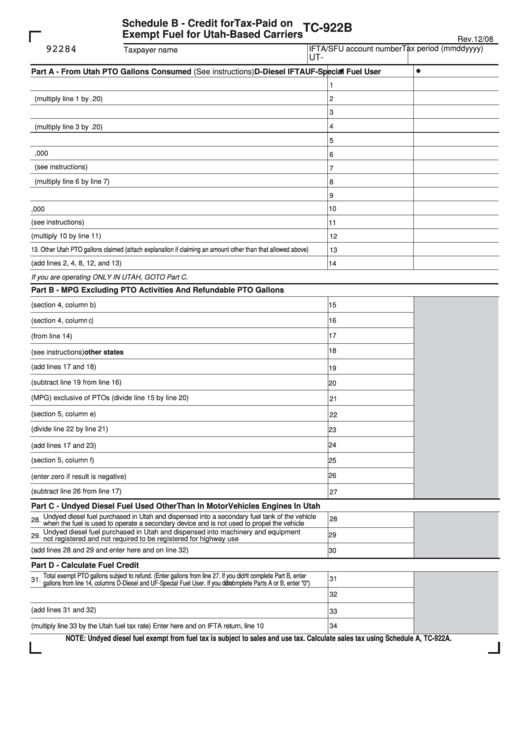

Schedule B - Credit for Tax-Paid on

TC-922B

Exempt Fuel for Utah-Based Carriers

Rev.12/08

92284

Tax period (mmddyyyy)

IFTA/SFU account number

Taxpayer name

UT-

Part A - From Utah PTO Gallons Consumed (See instructions)

D-Diesel IFTA

UF-Special Fuel User

1. Enter gallons dispensed into cement trucks in Utah

1

2

2. Cement truck exempt gallons in Utah (multiply line 1 by .20)

3

3. Enter gallons dispensed into trash compaction vehicles in Utah

4

4. Trash compaction vehicle exempt gallons (multiply line 3 by .20)

5. Enter the number of pounds of dry product loaded or off loaded in Utah

5

6. Divide line 5 by 6,000

6

7. Enter exemption allowance (see instructions)

7

8. Dry product loaded/off loaded PTO exempt gallons (multiply line 6 by line 7)

8

9. Enter the number of gallons of liquid product loaded or off loaded in Utah

9

10. Divide line 9 by 1,000

10

11. Enter exemption allowance (see instructions)

11

12. Enter liquid product loaded/off loaded PTO exempt gallons (multiply 10 by line 11)

12

13. Other Utah PTO gallons claimed (attach explanation if claiming an amount other than that allowed above)

13

14. Total Utah PTO gallons (add lines 2, 4, 8, 12, and 13)

14

If you are operating ONLY IN UTAH, GO TO Part C.

Part B - MPG Excluding PTO Activities And Refundable PTO Gallons

15. Enter total miles reported on the IFTA return (section 4, column b)

15

16. Enter total dispensed fuel into supply tank reported on the IFTA return (section 4, column c)

16

17. Utah PTO gallons consumed (from line 14)

17

18

18. PTO gallons consumed from operations in

other states

(see instructions)

19. Total PTO gallons consumed (add lines 17 and 18)

19

20. Non-PTO gallons consumed (subtract line 19 from line 16)

20

21. Miles Per Gallon (MPG) exclusive of PTO s (divide line 15 by line 20)

21

22. Taxable Utah miles per the IFTA tax return (section 5, column e)

22

23. Taxable Utah fuel (divide line 22 by line 21)

23

24

24. Total Utah fuel (add lines 17 and 23)

25. Utah taxable gallons reported on the IFTA tax return (section 5, column f)

25

26

26. Subtract line 25 from line 24 (enter zero if result is negative)

27. Refundable PTO gallons consumed (subtract line 26 from line 17)

27

Part C - Undyed Diesel Fuel Used Other Than In Motor Vehicles Engines In Utah

Undyed diesel fuel purchased in Utah and dispensed into a secondary fuel tank of the vehicle

28

28.

when the fuel is used to operate a secondary device and is not used to propel the vehicle

Undyed diesel fuel purchased in Utah and dispensed into machinery and equipment

29

29.

not registered and not required to be registered for highway use

30. Refundable non-highway gallons (add lines 28 and 29 and enter here and on line 32)

30

Part D - Calculate Fuel Credit

Total exempt PTO gallons subject to refund. (Enter gallons from line 27. If you didn t complete Part B, enter

'

31

31.

gallons from line 14, columns D-Diesel and UF-Special Fuel User. If you di

dn'

t complete Parts A or B, enter "0")

32

32. Enter qualifying exempt gallons from line 30

33. Total refundable exempt gallons (add lines 31 and 32)

33

34. Total refund (multiply line 33 by the Utah fuel tax rate) Enter here and on IFTA return, line 10

34

NOTE: Undyed diesel fuel exempt from fuel tax is subject to sales and use tax. Calculate sales tax using Schedule A, TC-922A.

1

1 2

2