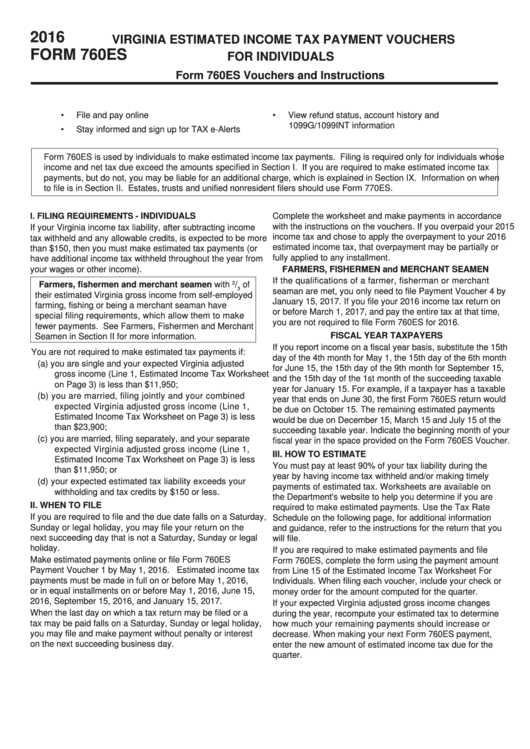

2016

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS

FORM 760ES

FOR INDIVIDUALS

Form 760ES Vouchers and Instructions

•

•

File and pay online

View refund status, account history and

1099G/1099INT information

•

Stay informed and sign up for TAX e-Alerts

Form 760ES is used by individuals to make estimated income tax payments. Filing is required only for individuals whose

income and net tax due exceed the amounts specified in Section I. If you are required to make estimated income tax

payments, but do not, you may be liable for an additional charge, which is explained in Section IX. Information on when

to file is in Section II. Estates, trusts and unified nonresident filers should use Form 770ES.

I. FILING REQUIREMENTS -

INDIVIDUALS

Complete the worksheet and make payments in accordance

with the instructions on the vouchers. If you overpaid your 2015

If your Virginia income tax liability, after subtracting income

income tax and chose to apply the overpayment to your 2016

tax withheld and any allowable credits, is expected to be more

estimated income tax, that overpayment may be partially or

than $150, then you must make estimated tax payments (or

fully applied to any installment.

have additional income tax withheld throughout the year from

your wages or other income).

FARMERS, FISHERMEN and MERCHANT SEAMEN

If the qualifications of a farmer, fisherman or merchant

2

Farmers, fishermen and merchant seamen with

/

of

3

seaman are met, you only need to file Payment Voucher 4 by

their estimated Virginia gross income from self-employed

January 15, 2017. If you file your 2016 income tax return on

farming, fishing or being a merchant seaman have

or before March 1, 2017, and pay the entire tax at that time,

special filing requirements, which allow them to make

you are not required to file Form 760ES for 2016.

fewer payments. See Farmers, Fishermen and Merchant

FISCAL YEAR TAXPAYERS

Seamen in Section II for more information.

If you report income on a fiscal year basis, substitute the 15th

You are not required to make estimated tax payments if:

day of the 4th month for May 1, the 15th day of the 6th month

(a) you are single and your expected Virginia adjusted

for June 15, the 15th day of the 9th month for September 15,

gross income (Line 1, Estimated Income Tax Worksheet

and the 15th day of the 1st month of the succeeding taxable

on Page 3) is less than $11,950;

year for January 15. For example, if a taxpayer has a taxable

(b) you are married, filing jointly and your combined

year that ends on June 30, the first Form 760ES return would

expected Virginia adjusted gross income (Line 1,

be due on October 15. The remaining estimated payments

Estimated Income Tax Worksheet on Page 3) is less

would be due on December 15, March 15 and July 15 of the

than $23,900;

succeeding taxable year. Indicate the beginning month of your

(c) you are married, filing separately, and your separate

fiscal year in the space provided on the Form 760ES Voucher.

expected Virginia adjusted gross income (Line 1,

III. HOW TO ESTIMATE

Estimated Income Tax Worksheet on Page 3) is less

You must pay at least 90% of your tax liability during the

than $11,950; or

year by having income tax withheld and/or making timely

(d) your expected estimated tax liability exceeds your

payments of estimated tax. Worksheets are available on

withholding and tax credits by $150 or less.

the Department's website to help you determine if you are

II. WHEN TO FILE

required to make estimated payments. Use the Tax Rate

If you are required to file and the due date falls on a Saturday,

Schedule on the following page, for additional information

Sunday or legal holiday, you may file your return on the

and guidance, refer to the instructions for the return that you

next succeeding day that is not a Saturday, Sunday or legal

will file.

holiday.

If you are required to make estimated payments and file

Make estimated payments online or file Form 760ES

Form 760ES, complete the form using the payment amount

Payment Voucher 1 by May 1, 2016. Estimated income tax

from Line 15 of the Estimated Income Tax Worksheet For

payments must be made in full on or before May 1, 2016,

Individuals. When filing each voucher, include your check or

or in equal installments on or before May 1, 2016, June 15,

money order for the amount computed for the quarter.

2016, September 15, 2016, and January 15, 2017.

If your expected Virginia adjusted gross income changes

When the last day on which a tax return may be filed or a

during the year, recompute your estimated tax to determine

tax may be paid falls on a Saturday, Sunday or legal holiday,

how much your remaining payments should increase or

you may file and make payment without penalty or interest

decrease. When making your next Form 760ES payment,

on the next succeeding business day.

enter the new amount of estimated income tax due for the

quarter.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8