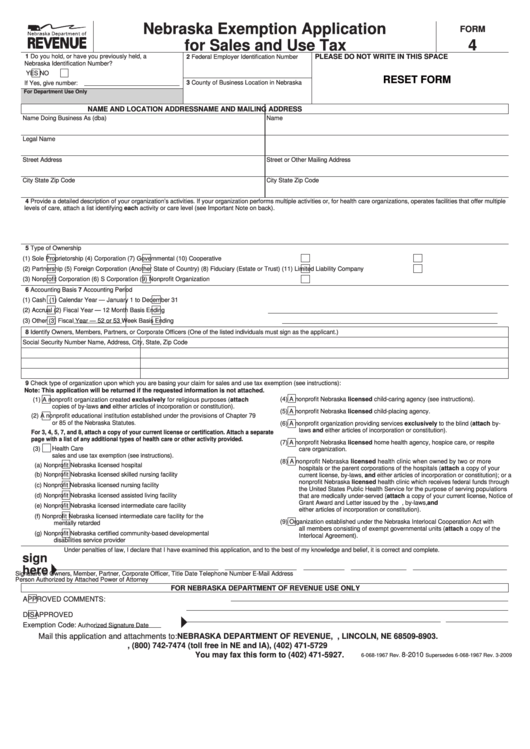

Nebraska Exemption Application

FORM

4

for Sales and Use Tax

1 Do you hold, or have you previously held, a

2 Federal Employer Identification Number

PLEASE DO NOT WRITE IN ThIS SPACE

Nebraska Identification Number?

YES

NO

RESET FORM

3 County of Business Location in Nebraska

If Yes, give number:

For Department Use Only

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Name Doing Business As (dba)

Name

Legal Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

4 Provide a detailed description of your organization’s activities. If your organization performs multiple activities or, for health care organizations, operates facilities that offer multiple

levels of care, attach a list identifying each activity or care level (see Important Note on back).

5 Type of Ownership

(1)

Sole Proprietorship

(4)

Corporation

(7)

Governmental

(10)

Cooperative

(2)

Partnership

(5)

Foreign Corporation (Another State of Country)

(8)

Fiduciary (Estate or Trust)

(11)

Limited Liability Company

(3)

Nonprofit Corporation

(6)

S Corporation

(9)

Nonprofit Organization

6 Accounting Basis

7 Accounting Period

(1)

Cash

(1)

Calendar Year — January 1 to December 31

(2)

Accrual

(2)

Fiscal Year — 12 Month Basis Ending

(3)

Other

(3)

Fiscal Year — 52 or 53 Week Basis Ending

8 Identify Owners, Members, Partners, or Corporate Officers (One of the listed individuals must sign as the applicant.)

Social Security Number

Name, Address, City, State, Zip Code

9 Check type of organization upon which you are basing your claim for sales and use tax exemption (see instructions):

Note: This application will be returned if the requested information is not attached.

(4)

A nonprofit Nebraska licensed child-caring agency (see instructions).

(1)

A nonprofit organization created exclusively for religious purposes (attach

copies of by-laws and either articles of incorporation or constitution).

(5)

A nonprofit Nebraska licensed child-placing agency.

(2)

A nonprofit educational institution established under the provisions of Chapter 79

or 85 of the Nebraska Statutes.

(6)

A nonprofit organization providing services exclusively to the blind (attach by-

laws and either articles of incorporation or constitution).

For 3, 4, 5, 7, and 8, attach a copy of your current license or certification. Attach a separate

page with a list of any additional types of health care or other activity provided.

(7)

A nonprofit Nebraska licensed home health agency, hospice care, or respite

(3)

Health Care Facility. Check type of facility upon which you are basing your claim for

care organization.

sales and use tax exemption (see instructions).

(8)

A nonprofit Nebraska licensed health clinic when owned by two or more

(a)

Nonprofit Nebraska licensed hospital

hospitals or the parent corporations of the hospitals (attach a copy of your

(b)

Nonprofit Nebraska licensed skilled nursing facility

current license, by-laws, and either articles of incorporation or constitution); or a

nonprofit Nebraska licensed health clinic which receives federal funds through

(c)

Nonprofit Nebraska licensed nursing facility

the United States Public Health Service for the purpose of serving populations

(d)

Nonprofit Nebraska licensed assisted living facility

that are medically under-served (attach a copy of your current license, Notice of

Grant Award and Letter issued by the U.S. Public Health Service, by-laws, and

(e)

Nonprofit Nebraska licensed intermediate care facility

either articles of incorporation or constitution).

(f)

Nonprofit Nebraska licensed intermediate care facility for the

(9)

Organization established under the Nebraska Interlocal Cooperation Act with

mentally retarded

all members consisting of exempt governmental units (attach a copy of the

(g)

Nonprofit Nebraska certified community-based developmental

Interlocal Agreement).

disabilities service provider

Under penalties of law, I declare that I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Owners, Member, Partner, Corporate Officer,

Title

Date

Telephone Number

E-Mail Address

Person Authorized by Attached Power of Attorney

FOR NEBRASKA DEPARTMENT OF REVENUE USE ONLY

APPROVED

COMMENTS:

DISAPPROVED

Exemption Code:

Authorized Signature

Date

Mail this application and attachments to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 98903, LINCOLN, NE 68509-8903.

, (800) 742-7474 (toll free in NE and IA), (402) 471-5729

You may fax this form to (402) 471-5927.

8-2010

6-068-1967 Rev.

Supersedes 6-068-1967 Rev. 3-2009

1

1 2

2 3

3