:

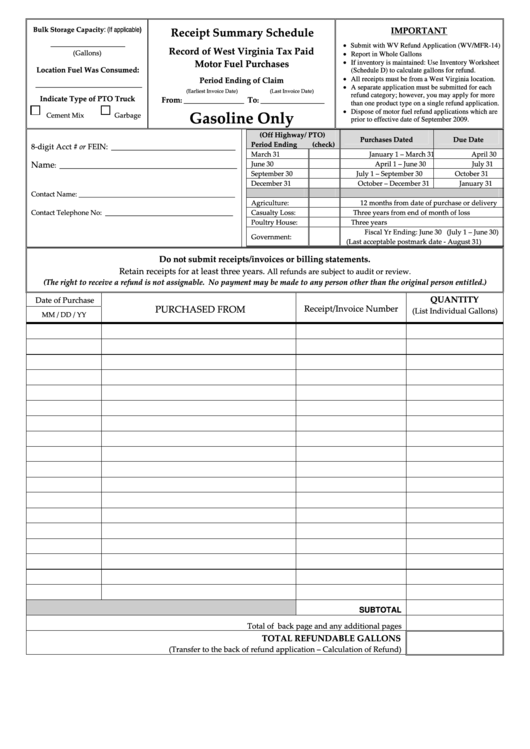

(If applicable)

Bulk Storage Capacity

IMPORTANT

Receipt Summary Schedule

_____________________

• Submit with WV Refund Application (WV/MFR-14)

Record of West Virginia Tax Paid

• Report in Whole Gallons

(Gallons)

• If inventory is maintained: Use Inventory Worksheet

Motor Fuel Purchases

:

Location Fuel Was Consumed

(Schedule D) to calculate gallons for refund.

• All receipts must be from a West Virginia location.

Period Ending of Claim

______________________________

• A separate application must be submitted for each

(Earliest Invoice Date) (Last Invoice Date)

refund category; however, you may apply for more

Indicate Type of PTO Truck

From

To

: _________________

: __________________

than one product type on a single refund application.

• Dispose of motor fuel refund applications which are

Gasoline Only

Cement Mix Garbage

prior to effective date of September 2009.

(Off Highway/ PTO)

Purchases Dated

Due Date

Period Ending (check)

8‐digit Acct # or FEIN:

___________________________________

March 31

January 1 – March 31

April 30

June 30

April 1 – June 30

July 31

Name

: __________________________________________________

September 30

July 1 – September 30

October 31

December 31

October – December 31

January 31

Contact Name: ____________________________________________

Agriculture:

12 months from date of purchase or delivery

Contact Telephone No: ____________________________________

Casualty Loss:

Three years from end of month of loss

Poultry House:

Three years

Fiscal Yr Ending: June 30 (July 1 – June 30)

Government:

(Last acceptable postmark date ‐ August 31)

Do not submit receipts/invoices or billing statements.

Retain receipts for at least three years.

All refunds are subject to audit or review.

(The right to receive a refund is not assignable. No payment may be made to any person other than the original person entitled.)

QUANTITY

Date of Purchase

Receipt/Invoice Number

PURCHASED FROM

(List Individual Gallons)

MM / DD / YY

SUBTOTAL

Total of back page and any additional pages

TOTAL REFUNDABLE GALLONS

(Transfer to the back of refund application – Calculation of Refund)

1

1 2

2