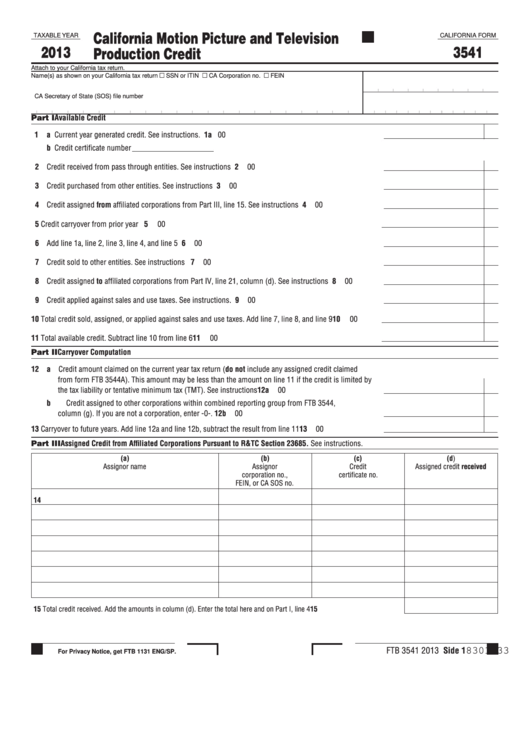

California Motion Picture and Television

TAXABLE YEAR

CALIFORNIA FORM

2013

3541

Production Credit

Attach to your California tax return.

SSN or ITIN CA Corporation no. FEIN

Name(s) as shown on your California tax return

CA Secretary of State (SOS) file number

Part I Available Credit

1

a Current year generated credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

00

b Credit certificate number

2 Credit received from pass through entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Credit purchased from other entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Credit assigned from affiliated corporations from Part III, line 15. See instructions . . . . . . . . . . . . . . . . . . . . 4

00

5 Credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Add line 1a, line 2, line 3, line 4, and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 Credit sold to other entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8 Credit assigned to affiliated corporations from Part IV, line 21, column (d). See instructions . . . . . . . . . . . . 8

00

9 Credit applied against sales and use taxes. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 Total credit sold, assigned, or applied against sales and use taxes. Add line 7, line 8, and line 9 . . . . . . . . . .10

00

11 Total available credit. Subtract line 10 from line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11

00

Part II Carryover Computation

12 a Credit amount claimed on the current year tax return (do not include any assigned credit claimed

from form FTB 3544A). This amount may be less than the amount on line 11 if the credit is limited by

the tax liability or tentative minimum tax (TMT). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12a

00

b Credit assigned to other corporations within combined reporting group from FTB 3544,

column (g). If you are not a corporation, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12b

00

13 Carryover to future years. Add line 12a and line 12b, subtract the result from line 11 . . . . . . . . . . . . . . . . . .13

00

Part III Assigned Credit from Affiliated Corporations Pursuant to R&TC Section 23685. See instructions.

(a)

(b)

(c)

(d)

Assignor name

Assignor

Credit

Assigned credit received

corporation no.,

certificate no.

FEIN, or CA SOS no.

14

15

Total credit received. Add the amounts in column (d). Enter the total here and on Part I, line 4 . . . . . . . . . . . . . . . . . . 15

FTB 3541 2013 Side 1

8301133

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4 5

5