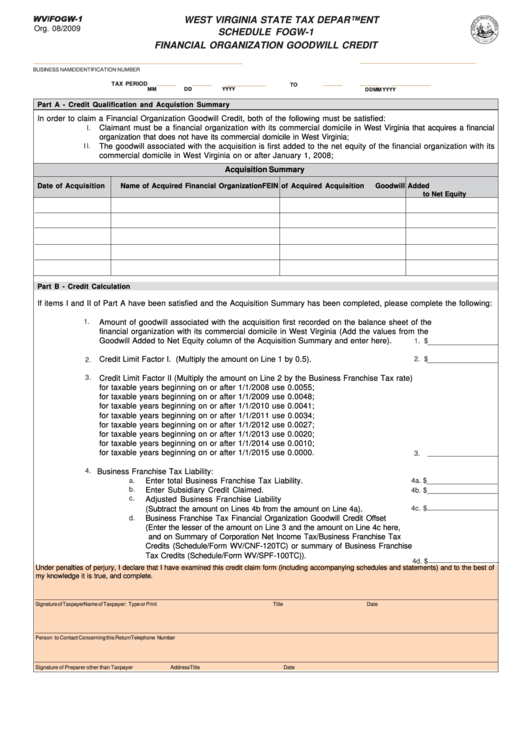

WV/FOGW-1

WEST VIRGINIA STATE TAX DEPARTMENT

Org. 08/2009

SCHEDULE FOGW-1

FINANCIAL ORGANIZATION GOODWILL CREDIT

BUSINESS NAME

IDENTIFICATION NUMBER

TAX PERIOD

TO

MM

DD

YYYY

MM

DD

YYYY

Part A - Credit Qualification and Acquistion Summary

In order to claim a Financial Organization Goodwill Credit, both of the following must be satisfied:

Claimant must be a financial organization with its commercial domicile in West Virginia that acquires a financial

I.

organization that does not have its commercial domicile in West Virginia;

I I.

The goodwill associated with the acquisition is first added to the net equity of the financial organization with its

commercial domicile in West Virginia on or after January 1, 2008;

Acquisition Summary

Date of Acquisition

Name of Acquired Financial Organization

FEIN of Acquired Acquisition

Goodwill Added

to Net Equity

Part B - Credit Calculation

If items I and II of Part A have been satisfied and the Acquisition Summary has been completed, please complete the following:

1.

Amount of goodwill associated with the acquisition first recorded on the balance sheet of the

financial organization with its commercial domicile in West Virginia (Add the values from the

Goodwill Added to Net Equity column of the Acquisition Summary and enter here).

1. $

Credit Limit Factor I. (Multiply the amount on Line 1 by 0.5).

2. $

2.

3.

Credit Limit Factor II (Multiply the amount on Line 2 by the Business Franchise Tax rate)

for taxable years beginning on or after 1/1/2008 use 0.0055;

for taxable years beginning on or after 1/1/2009 use 0.0048;

for taxable years beginning on or after 1/1/2010 use 0.0041;

for taxable years beginning on or after 1/1/2011 use 0.0034;

for taxable years beginning on or after 1/1/2012 use 0.0027;

for taxable years beginning on or after 1/1/2013 use 0.0020;

for taxable years beginning on or after 1/1/2014 use 0.0010;

for taxable years beginning on or after 1/1/2015 use 0.0000.

3.

4.

Business Franchise Tax Liability:

a.

Enter total Business Franchise Tax Liability.

4a. $

b.

Enter Subsidiary Credit Claimed.

4b. $

c.

Adjusted Business Franchise Liability

(Subtract the amount on Lines 4b from the amount on Line 4a).

4c. $

Business Franchise Tax Financial Organization Goodwill Credit Offset

d.

(Enter the lesser of the amount on Line 3 and the amount on Line 4c here,

and on Summary of Corporation Net Income Tax/Business Franchise Tax

Credits (Schedule/Form WV/CNF-120TC) or summary of Business Franchise

Tax Credits (Schedule/Form WV/SPF-100TC)).

4d. $

Under penalties of perjury, I declare that I have examined this credit claim form (including accompanying schedules and statements) and to the best of

my knowledge it is true, and complete.

Signature of Taxpayer

Name of Taxpayer: Type or Print

Title

Date

Person to Contact Concerning this Return

Telephone Number

Signature of Preparer other than Taxpayer

Address

Title

Date

1

1