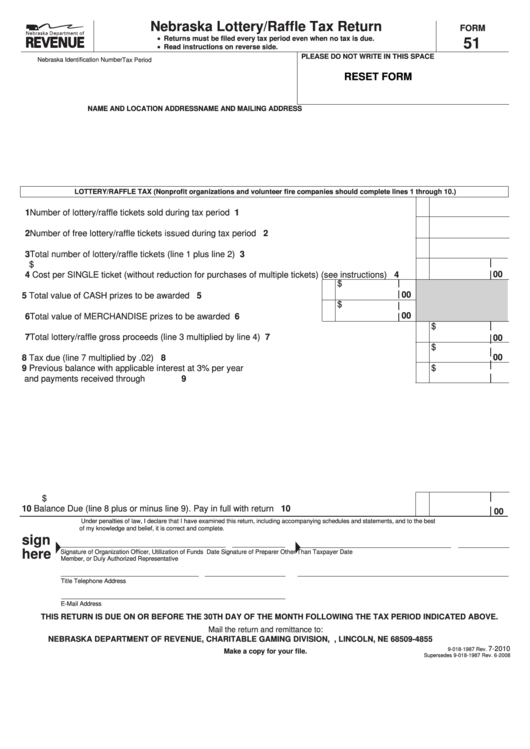

Nebraska Lottery/Raffle Tax Return

FORM

• Returns must be filed every tax period even when no tax is due.

51

• Read instructions on reverse side.

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska Identification Number

Tax Period

RESET FORM

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

LOTTERY/RAFFLE TAX (Nonprofit organizations and volunteer fire companies should complete lines 1 through 10.)

1 Number of lottery/raffle tickets sold during tax period ........................................................................

1

2 Number of free lottery/raffle tickets issued during tax period .............................................................

2

3 Total number of lottery/raffle tickets (line 1 plus line 2) ......................................................................

3

$

00

4 Cost per SINGLE ticket (without reduction for purchases of multiple tickets) (see instructions) ........

4

$

00

5 Total value of CASH prizes to be awarded ...................................................

5

$

00

6 Total value of MERCHANDISE prizes to be awarded ..................................

6

$

7 Total lottery/raffle gross proceeds (line 3 multiplied by line 4) ............................................................

7

00

$

00

8 Tax due (line 7 multiplied by .02) ........................................................................................................

8

9 Previous balance with applicable interest at 3% per year

$

and payments received through

9

$

10 Balance Due (line 8 plus or minus line 9). Pay in full with return ........................................................

10

00

Under penalties of law, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief, it is correct and complete.

sign

here

Signature of Organization Officer, Utilization of Funds

Date

Signature of Preparer Other Than Taxpayer

Date

Member, or Duly Authorized Representative

Title

Telephone

Address

E-Mail Address

THIS RETURN IS DUE ON OR BEFORE THE 30TH DAY OF THE MONTH FOLLOWING THE TAX PERIOD INDICATED ABOVE.

Mail the return and remittance to:

NEBRASKA DEPARTMENT OF REVENUE, CHARITABLE GAMING DIVISION, P.O. BOX 94855, LINCOLN, NE 68509-4855

7-2010

9-018-1987 Rev.

Make a copy for your file.

Supersedes 9-018-1987 Rev. 6-2008

1

1 2

2