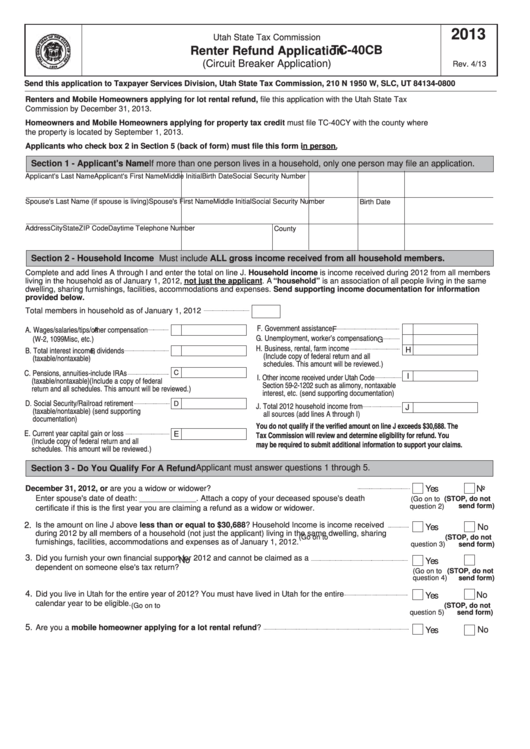

2013

Utah State Tax Commission

Renter Refund Application

TC-40CB

(Circuit Breaker Application)

Rev. 4/13

Send this application to Taxpayer Services Division, Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0800

Renters and Mobile Homeowners applying for lot rental refund, file this application with the Utah State Tax

Commission by December 31, 2013.

Homeowners and Mobile Homeowners applying for property tax credit must file TC-40CY with the county where

the property is located by September 1, 2013.

Applicants who check box 2 in Section 5 (back of form) must file this form in person.

Section 1 - Applicant's Name If more than one person lives in a household, only one person may file an application.

Applicant's Last Name

Applicant's First Name

Middle Initial

Birth Date

Social Security Number

Spouse's Last Name (if spouse is living)

Spouse's First Name

Middle Initial

Social Security Number

Birth Date

Address

City

State

ZIP Code

Daytime Telephone Number

County

Section 2 - Household Income

Must include ALL gross income received from all household members.

Complete and add lines A through I and enter the total on line J. Household income is income received during 2012 from all members

living in the household as of January 1, 2012, not just the applicant. A “household” is an association of all people living in the same

dwelling, sharing furnishings, facilities, accommodations and expenses. Send supporting income documentation for information

provided below.

Total members in household as of January 1, 2012

F. Government assistance

A. Wages/salaries/tips/other compensation

F

A

G. Unemployment, worker’s compensation

(W-2, 1099Misc, etc.)

G

H. Business, rental, farm income

B. Total interest income, dividends

H

B

(Include copy of federal return and all

(taxable/nontaxable)

schedules. This amount will be reviewed.)

C. Pensions, annuities-include IRAs

C

I. Other income received under Utah Code

I

(taxable/nontaxable)(Include a copy of federal

Section 59-2-1202 such as alimony, nontaxable

return and all schedules. This amount will be reviewed.)

interest, etc. (send supporting documentation)

D. Social Security/Railroad retirement

D

J. Total 2012 household income from

J

(taxable/nontaxable) (send supporting

all sources (add lines A through I)

documentation)

You do not qualify if the verified amount on line J exceeds $30,688. The

E. Current year capital gain or loss

Tax Commission will review and determine eligibility for refund. You

E

(Include copy of federal return and all

may be required to submit additional information to support your claims.

schedules. This amount will be reviewed.)

Section 3 - Do You Qualify For A Refund Applicant must answer questions 1 through 5.

1. Were you age 66 or older on or before December 31, 2012, or are you a widow or widower?

Yes

No

Enter spouse's date of death: _____________. Attach a copy of your deceased spouse's death

(Go on to

(STOP, do not

send form)

question 2)

certificate if this is the first year you are claiming a refund as a widow or widower.

2.

Is the amount on line J above less than or equal to $30,688? Household Income is income received

Yes

No

during 2012 by all members of a household (not just the applicant) living in the same dwelling, sharing

(Go on to

(STOP, do not

furnishings, facilities, accommodations and expenses as of January 1, 2012.

question 3)

send form)

3.

Did you furnish your own financial support for 2012 and cannot be claimed as a

No

Yes

dependent on someone else's tax return?

(Go on to

(STOP, do not

question 4)

send form)

4.

Did you live in Utah for the entire year of 2012? You must have lived in Utah for the entire

No

Yes

calendar year to be eligible.

(Go on to

(STOP, do not

question 5)

send form)

5.

Are you a mobile homeowner applying for a lot rental refund?

No

Yes

1

1 2

2