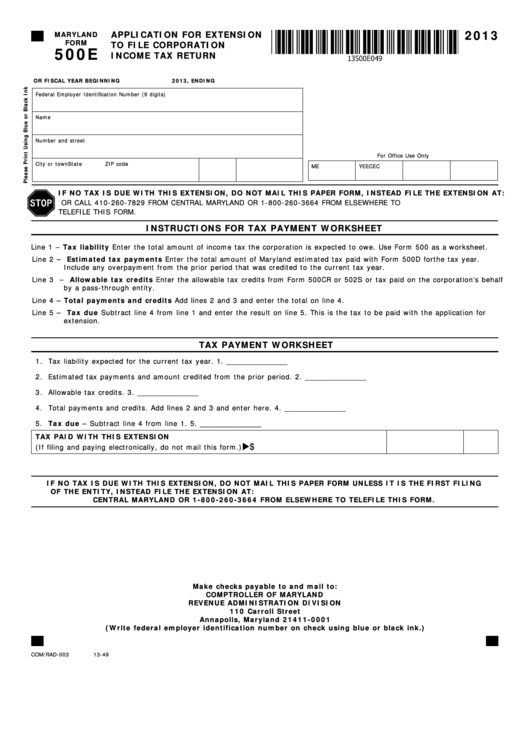

2013

APPLICATION FOR EXTENSION

MARYLAND

FORM

TO FILE CORPORATION

500E

INCOME TAX RETURN

OR FISCAL YEAR BEGINNING

2013, ENDING

Federal Employer Identification Number (9 digits)

Name

Number and street

For Office Use Only

City or town

State

ZIP code

ME

YE

EC

EC

IF NO TAX IS DUE WITH THIS EXTENSION, DO NOT MAIL THIS PAPER FORM, INSTEAD FILE THE EXTENSION AT:

OR CALL 410-260-7829 FROM CENTRAL MARYLAND OR 1-800-260-3664 FROM ELSEWHERE TO

TELEFILE THIS FORM.

INSTRUCTIONS FOR TAX PAYMENT WORKSHEET

Line 1 – Tax liability Enter the total amount of income tax the corporation is expected to owe. Use Form 500 as a worksheet.

Line 2 – Estimated tax payments Enter the total amount of Maryland estimated tax paid with Form 500D for the tax year.

Include any overpayment from the prior period that was credited to the current tax year.

Line 3 – Allowable tax credits Enter the allowable tax credits from Form 500CR or 502S or tax paid on the corporation’s behalf

by a pass-through entity.

Line 4 – Total payments and credits Add lines 2 and 3 and enter the total on line 4.

Line 5 – Tax due Subtract line 4 from line 1 and enter the result on line 5. This is the tax to be paid with the application for

extension.

TAX PAYMENT WORKSHEET

1. Tax liability expected for the current tax year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. ______________

2. Estimated tax payments and amount credited from the prior period.. . . . . . . . 2. ______________

3. Allowable tax credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ______________

4. Total payments and credits. Add lines 2 and 3 and enter here.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ______________

5. Tax due – Subtract line 4 from line 1.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ______________

TAX PAID WITH THIS EXTENSION

$

(If filing and paying electronically, do not mail this form.) . . . . . . . . . . . . . . . . . . . . . . . . . .

IF NO TAX IS DUE WITH THIS EXTENSION, DO NOT MAIL THIS PAPER FORM UNLESS IT IS THE FIRST FILING

OF THE ENTITY, INSTEAD FILE THE EXTENSION AT: OR CALL 410-260-7829 FROM

CENTRAL MARYLAND OR 1-800-260-3664 FROM ELSEWHERE TO TELEFILE THIS FORM.

Make checks payable to and mail to:

COMPTROLLER OF MARYLAND

REVENUE ADMINISTRATION DIVISION

110 Carroll Street

Annapolis, Maryland 21411-0001

(Write federal employer identification number on check using blue or black ink.)

COM/RAD-003

13-49

1

1 2

2