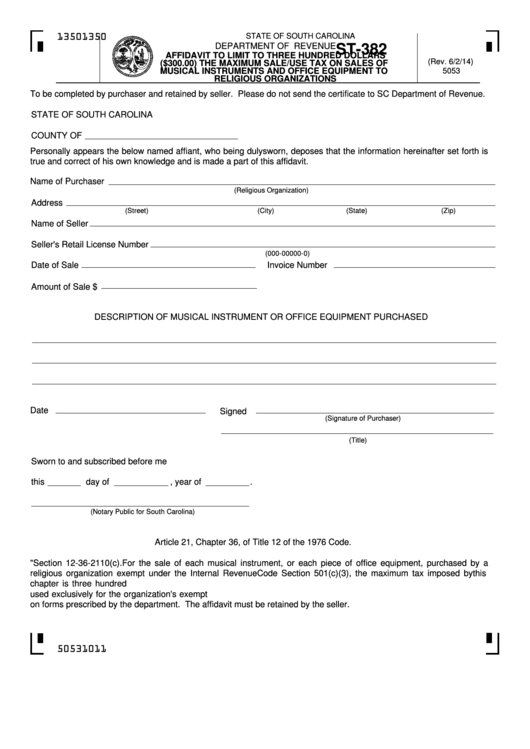

Form St-382 - Affidavit To Limit To Three Hundred Dollars The Maximum Sale/use Tax On Sales Of Musical Instruments And Office Equipment To Religious Organizations

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

ST-382

AFFIDAVIT TO LIMIT TO THREE HUNDRED DOLLARS

(Rev. 6/2/14)

($300.00) THE MAXIMUM SALE/USE TAX ON SALES OF

MUSICAL INSTRUMENTS AND OFFICE EQUIPMENT TO

5053

RELIGIOUS ORGANIZATIONS

To be completed by purchaser and retained by seller. Please do not send the certificate to SC Department of Revenue.

STATE OF SOUTH CAROLINA

COUNTY OF

Personally appears the below named affiant, who being duly sworn, deposes that the information hereinafter set forth is

true and correct of his own knowledge and is made a part of this affidavit.

Name of Purchaser

(Religious Organization)

Address

(Street)

(City)

(State)

(Zip)

Name of Seller

Seller's Retail License Number

(000-00000-0)

Date of Sale

Invoice Number

Amount of Sale $

DESCRIPTION OF MUSICAL INSTRUMENT OR OFFICE EQUIPMENT PURCHASED

Date

Signed

(Signature of Purchaser)

(Title)

Sworn to and subscribed before me

this

day of

, year of

.

(Notary Public for South Carolina)

Article 21, Chapter 36, of Title 12 of the 1976 Code.

"Section 12-36-2110(c). For the sale of each musical instrument, or each piece of office equipment, purchased by a

religious organization exempt under the Internal Revenue Code Section 501(c)(3), the maximum tax imposed by this

chapter is three hundred dollars. The musical instrument or office equipment must be located on church property and

used exclusively for the organization's exempt purpose. The religious organization must furnish to the seller an affidavit

on forms prescribed by the department. The affidavit must be retained by the seller.

50531011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1