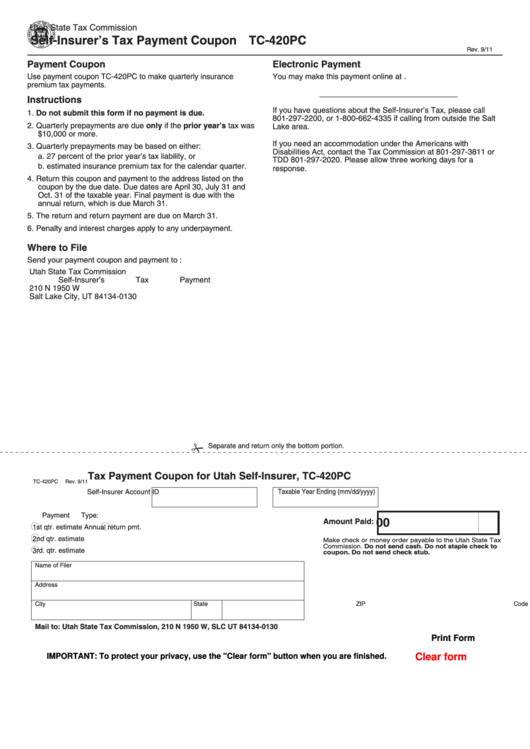

Utah State Tax Commission

Self-Insurer’s Tax Payment Coupon

TC-420PC

Rev. 9/11

Payment Coupon

Electronic Payment

Use payment coupon TC-420PC to make quarterly insurance

You may make this payment online at taxexpress.utah.gov.

premium tax payments.

___________________

Instructions

If you have questions about the Self-Insurer’s Tax, please call

1. Do not submit this form if no payment is due.

801-297-2200, or 1-800-662-4335 if calling from outside the Salt

2. Quarterly prepayments are due only if the prior year’s tax was

Lake area.

$10,000 or more.

If you need an accommodation under the Americans with

3. Quarterly prepayments may be based on either:

Disabilities Act, contact the Tax Commission at 801-297-3811 or

a. 27 percent of the prior year’s tax liability, or

TDD 801-297-2020. Please allow three working days for a

b. estimated insurance premium tax for the calendar quarter.

response.

4. Return this coupon and payment to the address listed on the

coupon by the due date. Due dates are April 30, July 31 and

Oct. 31 of the taxable year. Final payment is due with the

annual return, which is due March 31.

5. The return and return payment are due on March 31.

6. Penalty and interest charges apply to any underpayment.

Where to File

Send your payment coupon and payment to :

Utah State Tax Commission

Self-Insurer’s Tax Payment

210 N 1950 W

Salt Lake City, UT 84134-0130

Separate and return only the bottom portion.

Tax Payment Coupon for Utah Self-Insurer, TC-420PC

TC-420PC

Rev. 9/11

Self-Insurer Account ID

Taxable Year Ending (mm/dd/yyyy)

Payment Type:

00

Amount Paid:

1st qtr. estimate

Annual return pmt.

2nd qtr. estimate

Make check or money order payable to the Utah State Tax

Commission. Do not send cash. Do not staple check to

3rd. qtr. estimate

coupon. Do not send check stub.

Name of Filer

Address

City

State

ZIP Code

Mail to: Utah State Tax Commission, 210 N 1950 W, SLC UT 84134-0130

Print Form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1