Form Bpt-In Instructions - Alabama Business Privilege Tax Initial Privilege Tax Return - 2011

ADVERTISEMENT

FORM

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

BPT-IN

2011

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Alabama Business Privilege Tax

INSTRUCTIONS

Initial Privilege Tax Return

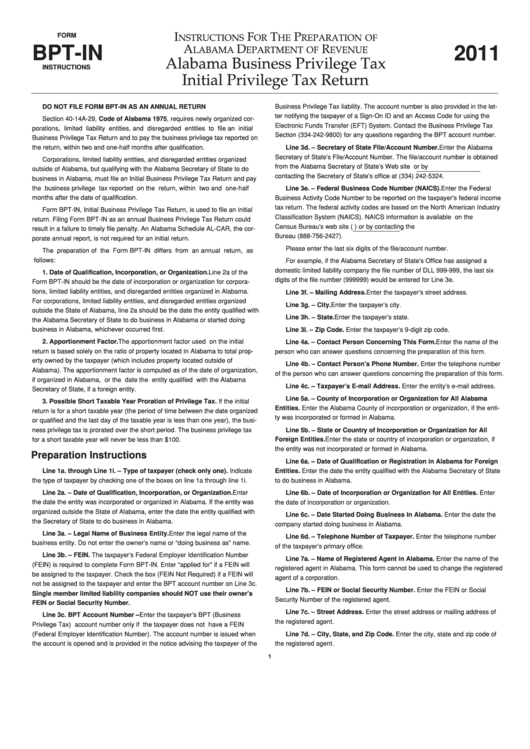

DO NOT FILE FORM BPT-IN AS AN ANNUAL RETURN

Business Privilege Tax liability. The account number is also provided in the let-

ter notifying the taxpayer of a Sign-On ID and an Access Code for using the

Section 40-14A-29, Code of Alabama 1975, requires newly organized cor-

Electronic Funds Transfer (EFT) System. Contact the Business Privilege Tax

porations, limited liability entities, and disregarded entities to file an initial

Section (334-242-9800) for any questions regarding the BPT account number.

Business Privilege Tax Return and to pay the business privilege tax reported on

the return, within two and one-half months after qualification.

Line 3d. – Secretary of State File/Account Number. Enter the Alabama

Secretary of State’s File/Account Number. The file/account number is obtained

Corporations, limited liability entities, and disregarded entities organized

from the Alabama Secretary of State’s Web site or by

outside of Alabama, but qualifying with the Alabama Secretary of State to do

contacting the Secretary of State’s office at (334) 242-5324.

business in Alabama, must file an Initial Business Privilege Tax Return and pay

the business privilege tax reported on the return, within two and one-half

Line 3e. – Federal Business Code Number (NAICS). Enter the Federal

months after the date of qualification.

Business Activity Code Number to be reported on the taxpayer’s federal income

tax return. The federal activity codes are based on the North American Industry

Form BPT-IN, Initial Business Privilege Tax Return, is used to file an initial

Classification System (NAICS). NAICS information is available on the U.S.

return. Filing Form BPT-IN as an annual Business Privilege Tax Return could

Census Bureau’s web site ( ) or by contacting the U.S. Census

result in a failure to timely file penalty. An Alabama Schedule AL-CAR, the cor-

Bureau (888-756-2427).

porate annual report, is not required for an initial return.

Please enter the last six digits of the file/account number.

The preparation of the Form BPT-IN differs from an annual return, as

follows:

For example, if the Alabama Secretary of State’s Office has assigned a

domestic limited liability company the file number of DLL 999-999, the last six

1. Date of Qualification, Incorporation, or Organization. Line 2a of the

digits of the file number (999999) would be entered for Line 3e.

Form BPT-IN should be the date of incorporation or organization for corpora-

tions, limited liability entities, and disregarded entities organized in Alabama.

Line 3f. – Mailing Address. Enter the taxpayer’s street address.

For corporations, limited liability entities, and disregarded entities organized

Line 3g. – City. Enter the taxpayer’s city.

outside the State of Alabama, line 2a should be the date the entity qualified with

Line 3h. – State. Enter the taxpayer’s state.

the Alabama Secretary of State to do business in Alabama or started doing

business in Alabama, whichever occurred first.

Line 3i. – Zip Code. Enter the taxpayer’s 9-digit zip code.

2. Apportionment Factor. The apportionment factor used on the initial

Line 4a. – Contact Person Concerning This Form. Enter the name of the

return is based solely on the ratio of property located in Alabama to total prop-

person who can answer questions concerning the preparation of this form.

erty owned by the taxpayer (which includes property located outside of

Line 4b. – Contact Person’s Phone Number. Enter the telephone number

Alabama). The apportionment factor is computed as of the date of organization,

of the person who can answer questions concerning the preparation of this form.

if organized in Alabama, or the date the entity qualified with the Alabama

Line 4c. – Taxpayer’s E-mail Address. Enter the entity’s e-mail address.

Secretary of State, if a foreign entity.

Line 5a. – County of Incorporation or Organization for All Alabama

3. Possible Short Taxable Year Proration of Privilege Tax. If the initial

Entities. Enter the Alabama County of incorporation or organization, if the enti-

return is for a short taxable year (the period of time between the date organized

ty was incorporated or formed in Alabama.

or qualified and the last day of the taxable year is less than one year), the busi-

Line 5b. – State or Country of Incorporation or Organization for All

ness privilege tax is prorated over the short period. The business privilege tax

Foreign Entities. Enter the state or country of incorporation or organization, if

for a short taxable year will never be less than $100.

the entity was not incorporated or formed in Alabama.

Preparation Instructions

Line 6a. – Date of Qualification or Registration in Alabama for Foreign

Line 1a. through Line 1i. – Type of taxpayer (check only one). Indicate

Entities. Enter the date the entity qualified with the Alabama Secretary of State

the type of taxpayer by checking one of the boxes on line 1a through line 1i.

to do business in Alabama.

Line 2a. – Date of Qualification, Incorporation, or Organization. Enter

Line 6b. – Date of Incorporation or Organization for All Entities. Enter

the date the entity was incorporated or organized in Alabama. If the entity was

the date of incorporation or organization.

organized outside the State of Alabama, enter the date the entity qualified with

Line 6c. – Date Started Doing Business in Alabama. Enter the date the

the Secretary of State to do business in Alabama.

company started doing business in Alabama.

Line 3a. – Legal Name of Business Entity. Enter the legal name of the

Line 6d. – Telephone Number of Taxpayer. Enter the telephone number

business entity. Do not enter the owner’s name or “doing business as” name.

of the taxpayer’s primary office.

Line 3b. – FEIN. The taxpayer’s Federal Employer Identification Number

Line 7a. – Name of Registered Agent in Alabama. Enter the name of the

(FEIN) is required to complete Form BPT-IN. Enter “applied for” if a FEIN will

registered agent in Alabama. This form cannot be used to change the registered

be assigned to the taxpayer. Check the box (FEIN Not Required) if a FEIN will

agent of a corporation.

not be assigned to the taxpayer and enter the BPT account number on Line 3c.

Line 7b. – FEIN or Social Security Number. Enter the FEIN or Social

Single member limited liability companies should NOT use their owner’s

Security Number of the registered agent.

FEIN or Social Security Number.

Line 7c. – Street Address. Enter the street address or mailing address of

Line 3c. BPT Account Number – Enter the taxpayer’s BPT (Business

the registered agent.

Privilege Tax) account number only if the taxpayer does not have a FEIN

(Federal Employer Identification Number). The account number is issued when

Line 7d. – City, State, and Zip Code. Enter the city, state and zip code of

the account is opened and is provided in the notice advising the taxpayer of the

the registered agent.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4