*VA500T112000*

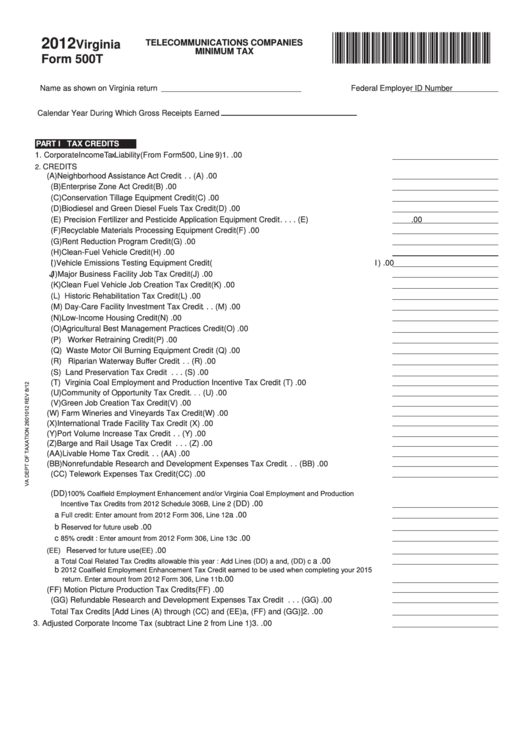

2012

TelecommunicaTions companies

Virginia

minimum Tax

Form 500T

Name as shown on Virginia return

Federal Employer ID Number

Calendar Year During Which Gross Receipts Earned

paRT i Tax cReDiTs

1. Corporate Income Tax Liability (From Form 500, Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

.00

CREDITS

2.

(A)

Neighborhood Assistance Act Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

.00

(B)

Enterprise Zone Act Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (B)

.00

(C)

Conservation Tillage Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (C)

.00

(D)

Biodiesel and Green Diesel Fuels Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (D)

.00

Precision Fertilizer and Pesticide Application Equipment Credit . . . . . . . . . . . . . . . . . . . . (E)

.00

(E)

(F)

Recyclable Materials Processing Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(F)

.00

(G)

Rent Reduction Program Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (G)

.00

(H)

Clean-Fuel Vehicle Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (H)

.00

( I )

Vehicle Emissions Testing Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .( I )

.00

(J)

Major Business Facility Job Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (J)

.00

(K)

Clean Fuel Vehicle Job Creation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (K)

.00

(L)

Historic Rehabilitation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(L)

.00

(M) Day-Care Facility Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (M)

.00

(N)

Low-Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (N)

.00

(O)

Agricultural Best Management Practices Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (O)

.00

(P)

Worker Retraining Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (P)

.00

(Q)

Waste Motor Oil Burning Equipment Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (Q)

.00

(R)

Riparian Waterway Buffer Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (R)

.00

(S)

Land Preservation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (S)

.00

(T)

Virginia Coal Employment and Production Incentive Tax Credit . . . . . . . . . . . . . . . . . . . .(T)

.00

(U)

Community of Opportunity Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (U)

.00

(V)

Green Job Creation Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (V)

.00

(W) Farm Wineries and Vineyards Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (W)

.00

(X)

International Trade Facility Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (X)

.00

(Y)

Port Volume Increase Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (Y)

.00

(Z)

Barge and Rail Usage Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(Z)

.00

(AA) Livable Home Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (AA)

.00

(BB) Nonrefundable Research and Development Expenses Tax Credit . . . . . . . . . . . . . . . . . (BB)

.00

(CC) Telework Expenses Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (CC)

.00

100% Coalfield Employment Enhancement and/or Virginia Coal Employment and Production

(DD)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . (DD)

.00

Incentive Tax Credits from 2012 Schedule 306B, Line 2

a

a

.00

Full credit: Enter amount from 2012 Form 306, Line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b R

b

.00

eserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

c

.00

85% credit : Enter amount from 2012 Form 306, Line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

R

.00

(EE)

eserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (EE)

a

a

.00

Total Coal Related Tax Credits allowable this year : Add Lines (DD) a and, (DD) c . . . . . . . . . . . . . . . .

2012 Coalfield Employment Enhancement Tax Credit earned to be used when completing your 2015

b

b

.00

return. Enter amount from 2012 Form 306, Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(FF) Motion Picture Production Tax Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (FF)

.00

(GG) Refundable Research and Development Expenses Tax Credit . . . . . . . . . . . . . . . . . . . (GG)

.00

Total Tax Credits [Add Lines (A) through (CC) and (EE)a, (FF) and (GG)] . . . . . . . . . . . . . . . . . 2.

.00

3. Adjusted Corporate Income Tax (subtract Line 2 from Line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

.00

1

1 2

2