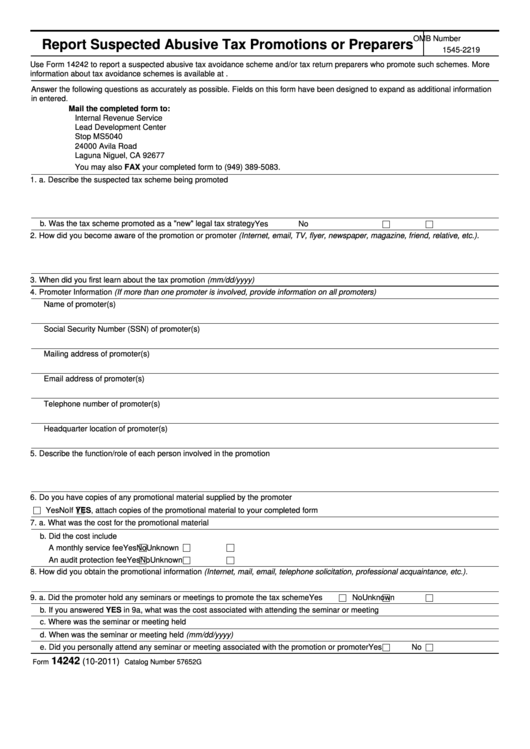

OMB Number

Report Suspected Abusive Tax Promotions or Preparers

1545-2219

Use Form 14242 to report a suspected abusive tax avoidance scheme and/or tax return preparers who promote such schemes. More

information about tax avoidance schemes is available at

Answer the following questions as accurately as possible. Fields on this form have been designed to expand as additional information

in entered.

Mail the completed form to:

Internal Revenue Service

Lead Development Center

Stop MS5040

24000 Avila Road

Laguna Niguel, CA 92677

You may also FAX your completed form to (949) 389-5083.

1. a. Describe the suspected tax scheme being promoted

b. Was the tax scheme promoted as a "new" legal tax strategy

Yes

No

2. How did you become aware of the promotion or promoter (Internet, email, TV, flyer, newspaper, magazine, friend, relative, etc.).

3. When did you first learn about the tax promotion (mm/dd/yyyy)

4. Promoter Information (If more than one promoter is involved, provide information on all promoters)

Name of promoter(s)

Social Security Number (SSN) of promoter(s)

Mailing address of promoter(s)

Email address of promoter(s)

Telephone number of promoter(s)

Headquarter location of promoter(s)

5. Describe the function/role of each person involved in the promotion

6. Do you have copies of any promotional material supplied by the promoter

Yes

No

If YES, attach copies of the promotional material to your completed form

7. a. What was the cost for the promotional material

b. Did the cost include

A monthly service fee

Yes

No

Unknown

An audit protection fee

Yes

No

Unknown

8. How did you obtain the promotional information (Internet, mail, email, telephone solicitation, professional acquaintance, etc.).

9. a. Did the promoter hold any seminars or meetings to promote the tax scheme

Yes

No

Unknown

b. If you answered YES in 9a, what was the cost associated with attending the seminar or meeting

c. Where was the seminar or meeting held

d. When was the seminar or meeting held (mm/dd/yyyy)

e. Did you personally attend any seminar or meeting associated with the promotion or promoter

Yes

No

14242

(10-2011)

Department of the Treasury - Internal Revenue Service

Form

Catalog Number 57652G

1

1 2

2 3

3