Form St-236 - Casual Or Use Excise Tax Return

ADVERTISEMENT

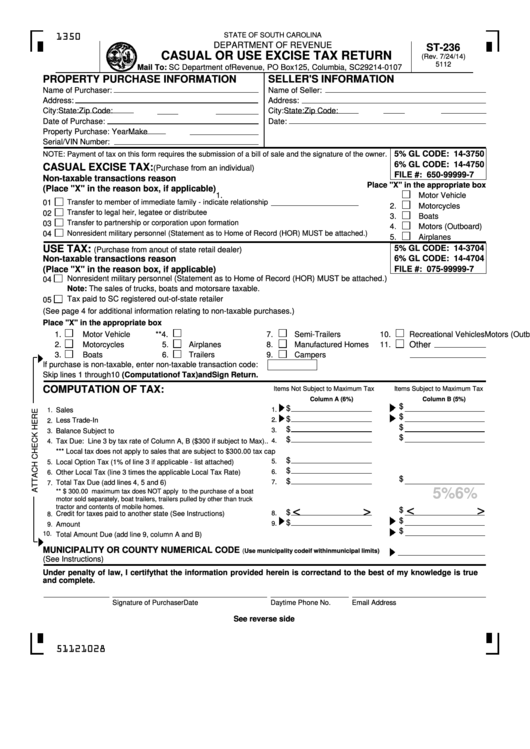

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

ST-236

CASUAL OR USE EXCISE TAX RETURN

(Rev. 7/24/14)

5112

Mail To: SC Department of Revenue, PO Box 125, Columbia, SC 29214-0107

SELLER'S INFORMATION

PROPERTY PURCHASE INFORMATION

Name of Purchaser:

Name of Seller:

Address:

Address:

City:

State:

Zip Code:

City:

State:

Zip Code:

Date of Purchase:

Date:

Property Purchase: Year

Make

Serial/VIN Number:

5% GL CODE: 14-3750

NOTE: Payment of tax on this form requires the submission of a bill of sale and the signature of the owner.

6% GL CODE: 14-4750

CASUAL EXCISE TAX:

(Purchase from an individual)

FILE #: 650-99999-7

Non-taxable transactions reason

Place "X" in the appropriate box

(Place "X" in the reason box, if applicable)

1.

Motor Vehicle

Transfer to member of immediate family - indicate relationship

01

2.

Motorcycles

Transfer to legal heir, legatee or distributee

02

3.

Boats

Transfer to partnership or corporation upon formation

03

4.

Motors (Outboard)

Nonresident military personnel (Statement as to Home of Record (HOR) MUST be attached.)

04

5.

Airplanes

USE TAX:

5% GL CODE: 14-3704

(Purchase from an out of state retail dealer)

Non-taxable transactions reason

6% GL CODE: 14-4704

(Place "X" in the reason box, if applicable)

FILE #: 075-99999-7

Nonresident military personnel (Statement as to Home of Record (HOR) MUST be attached.)

04

Note: The sales of trucks, boats and motors are taxable.

Tax paid to SC registered out-of-state retailer

05

(See page 4 for additional information relating to non-taxable purchases.)

Place "X" in the appropriate box

1.

Motor Vehicle

**4.

Motors (Outboard)

7.

Semi-Trailers

10.

Recreational Vehicles

2.

Motorcycles

5.

Airplanes

8.

Manufactured Homes

11.

Other

3.

Boats

6.

Trailers

9.

Campers

If purchase is non-taxable, enter non-taxable transaction code:

Skip lines 1 through 10 (Computation of Tax) and Sign Return.

COMPUTATION OF TAX:

Items Not Subject to Maximum Tax

Items Subject to Maximum Tax

Column A (6%)

Column B (5%)

$

$

Sales Price..........................................................................................

1.

1.

$

$

2.

Less Trade-In Allowance.....................................................................

2.

$

$

3.

3.

Balance Subject to Tax.......................................................................

$

$

Tax Due: Line 3 by tax rate of Column A, B ($300 if subject to Max)..

4.

4.

*** Local tax does not apply to sales that are subject to $300.00 tax cap

$

5.

5.

Local Option Tax (1% of line 3 if applicable - list attached)..................

$

Other Local Tax (line 3 times the applicable Local Tax Rate)..............

6.

6.

$

$

7.

Total Tax Due (add lines 4, 5 and 6)....................................................

7.

6%

5%

** $ 300.00 maximum tax does NOT apply to the purchase of a boat

motor sold separately, boat trailers, trailers pulled by other than truck

tractor and contents of mobile homes.

<

>

<

>

$

$

Credit for taxes paid to another state (See Instructions)......................

8.

8.

$

$

9.

Amount Due.........................................................................................

9.

$

10.

Total Amount Due (add line 9, column A and B).........................................................................................

MUNICIPALITY OR COUNTY NUMERICAL CODE

(Use municipality code if within municipal limits)

(See Instructions)

Under penalty of law, I certify that the information provided herein is correct and to the best of my knowledge is true

and complete.

Date

Signature of Purchaser

Daytime Phone No.

Email Address

See reverse side

51121028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6