Form Pt-420 - Utility And Railroad Companies Property Tax Return

ADVERTISEMENT

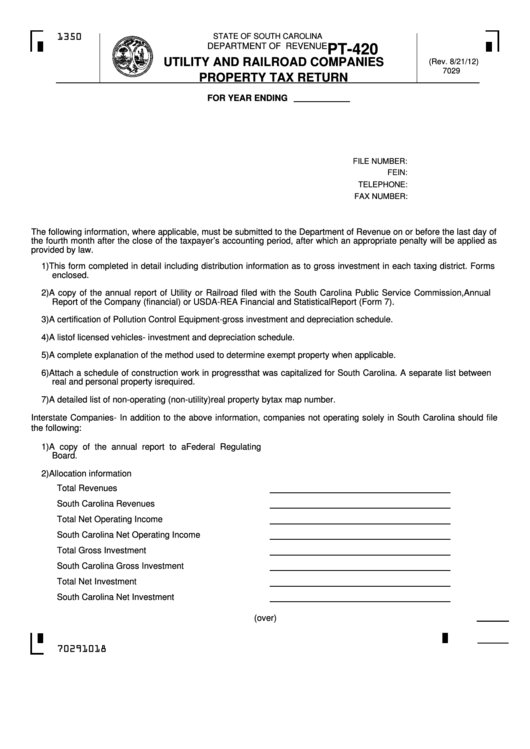

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

PT-420

UTILITY AND RAILROAD COMPANIES

(Rev. 8/21/12)

7029

PROPERTY TAX RETURN

FOR YEAR ENDING

FILE NUMBER:

FEIN:

TELEPHONE:

FAX NUMBER:

The following information, where applicable, must be submitted to the Department of Revenue on or before the last day of

the fourth month after the close of the taxpayer’s accounting period, after which an appropriate penalty will be applied as

provided by law.

1) This form completed in detail including distribution information as to gross investment in each taxing district. Forms

enclosed.

2) A copy of the annual report of Utility or Railroad filed with the South Carolina Public Service Commission, Annual

Report of the Company (financial) or USDA-REA Financial and Statistical Report (Form 7).

3) A certification of Pollution Control Equipment- gross investment and depreciation schedule.

4) A list of licensed vehicles- investment and depreciation schedule.

5) A complete explanation of the method used to determine exempt property when applicable.

6) Attach a schedule of construction work in progress that was capitalized for South Carolina. A separate list between

real and personal property is required.

7) A detailed list of non-operating (non-utility) real property by tax map number.

Interstate Companies- In addition to the above information, companies not operating solely in South Carolina should file

the following:

1) A copy of the annual report to a Federal Regulating

Board.

2) Allocation information

Total Revenues

South Carolina Revenues

Total Net Operating Income

South Carolina Net Operating Income

Total Gross Investment

South Carolina Gross Investment

Total Net Investment

South Carolina Net Investment

____

(over)

70291018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2