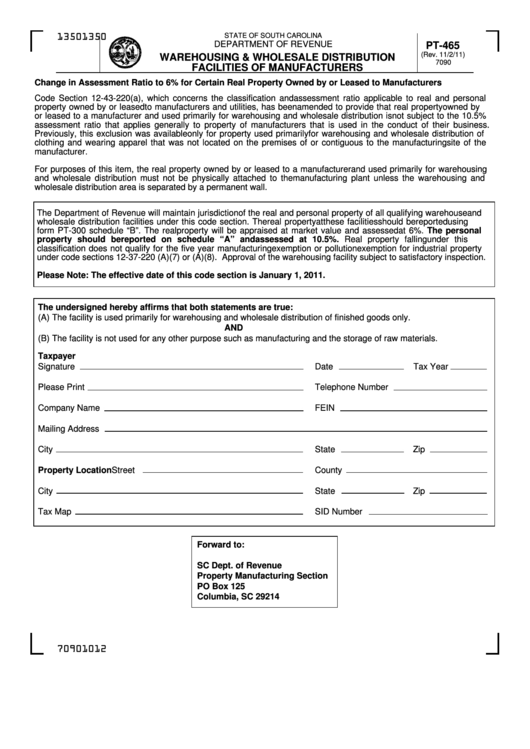

Form Pt-465 - Warehousing & Wholesale Distribution Facilities Of Manufacturers

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

PT-465

(Rev. 11/2/11)

WAREHOUSING & WHOLESALE DISTRIBUTION

7090

FACILITIES OF MANUFACTURERS

Change in Assessment Ratio to 6% for Certain Real Property Owned by or Leased to Manufacturers

Code Section 12-43-220(a), which concerns the classification and assessment ratio applicable to real and personal

property owned by or leased to manufacturers and utilities, has been amended to provide that real property owned by

or leased to a manufacturer and used primarily for warehousing and wholesale distribution is not subject to the 10.5%

assessment ratio that applies generally to property of manufacturers that is used in the conduct of their business.

Previously, this exclusion was available only for property used primarily for warehousing and wholesale distribution of

clothing and wearing apparel that was not located on the premises of or contiguous to the manufacturing site of the

manufacturer.

For purposes of this item, the real property owned by or leased to a manufacturer and used primarily for warehousing

and wholesale distribution must not be physically attached to the manufacturing plant unless the warehousing and

wholesale distribution area is separated by a permanent wall.

The Department of Revenue will maintain jurisdiction of the real and personal property of all qualifying warehouse and

wholesale distribution facilities under this code section. The real property at these facilities should be reported using

form PT-300 schedule “B”. The real property will be appraised at market value and assessed at 6%. The personal

property should be reported on schedule “A” and assessed at 10.5%. Real property falling under this

classification does not qualify for the five year manufacturing exemption or pollution exemption for industrial property

under code sections 12-37-220 (A)(7) or (A)(8). Approval of the warehousing facility subject to satisfactory inspection.

Please Note: The effective date of this code section is January 1, 2011.

The undersigned hereby affirms that both statements are true:

(A) The facility is used primarily for warehousing and wholesale distribution of finished goods only.

AND

(B) The facility is not used for any other purpose such as manufacturing and the storage of raw materials.

Taxpayer

Signature

Date

Tax Year

Please Print

Telephone Number

Company Name

FEIN

Mailing Address

City

State

Zip

Property Location Street

County

City

State

Zip

Tax Map

SID Number

Forward to:

SC Dept. of Revenue

Property Manufacturing Section

PO Box 125

Columbia, SC 29214

70901012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1