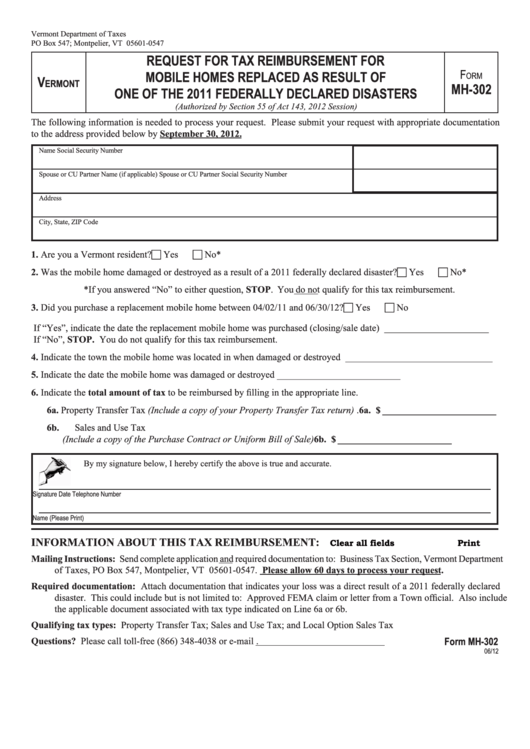

Vermont Department of Taxes

Miscellaneous Tax Division

PO Box 547; Montpelier, VT 05601-0547

Phone: (802) 828-2551

REQUEST FOR TAX REIMBURSEMENT FOR

F

MOBILE HOMES REPLACED AS RESULT OF

orm

V

ermont

MH-302

ONE OF THE 2011 FEDERALLY DECLARED DISASTERS

(Authorized by Section 55 of Act 143, 2012 Session)

The following information is needed to process your request. Please submit your request with appropriate documentation

to the address provided below by September 30, 2012.

Name

Social Security Number

Spouse or CU Partner Name (if applicable)

Spouse or CU Partner Social Security Number

Address

City, State, ZIP Code

1. Are you a Vermont resident? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c Yes

c No*

2. Was the mobile home damaged or destroyed as a result of a 2011 federally declared disaster? . . . . . . c Yes

c No*

*If you answered “No” to either question, STOP. You do not qualify for this tax reimbursement.

3. Did you purchase a replacement mobile home between 04/02/11 and 06/30/12? . . . . . . . . . . . . . . . . . c Yes

No*

c

If “Yes”, indicate the date the replacement mobile home was purchased (closing/sale date) ______________________

If “No”, STOP. You do not qualify for this tax reimbursement.

4. Indicate the town the mobile home was located in when damaged or destroyed _______________________________

5. Indicate the date the mobile home was damaged or destroyed __________________________

6. Indicate the total amount of tax to be reimbursed by filling in the appropriate line.

6a. Property Transfer Tax (Include a copy of your Property Transfer Tax return) . 6a. $ ________________________

6b. Sales and Use Tax

(Include a copy of the Purchase Contract or Uniform Bill of Sale) . . . . . . . . . 6b. $ ________________________

By my signature below, I hereby certify the above is true and accurate.

Signature

Date

Telephone Number

Name (Please Print)

INFORMATION ABOUT THIS TAX REIMBURSEMENT:

Clear all fields

Print

Mailing Instructions: Send complete application and required documentation to: Business Tax Section, Vermont Department

of Taxes, PO Box 547, Montpelier, VT 05601-0547. Please allow 60 days to process your request.

Required documentation: Attach documentation that indicates your loss was a direct result of a 2011 federally declared

disaster. This could include but is not limited to: Approved FEMA claim or letter from a Town official. Also include

the applicable document associated with tax type indicated on Line 6a or 6b.

Qualifying tax types: Property Transfer Tax; Sales and Use Tax; and Local Option Sales Tax

Form MH-302

Questions? Please call toll-free (866) 348-4038 or e-mail tax.MobileHomeHelp@state.vt.us.

06/12

1

1 2

2