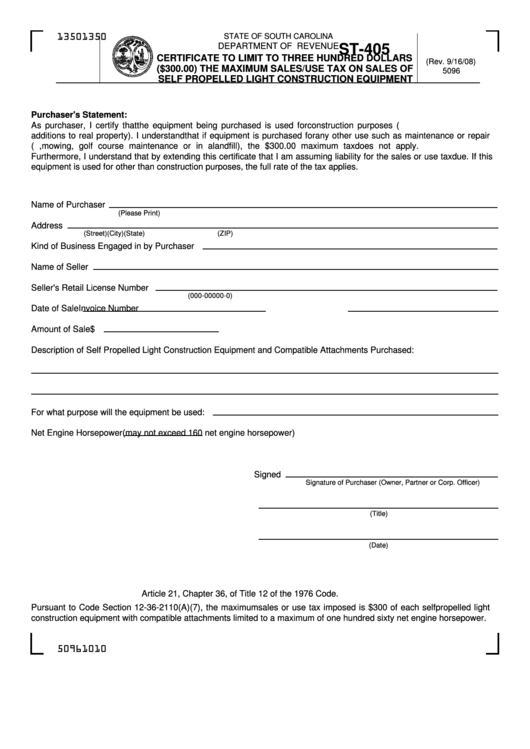

Form St-405 - Certificate To Limit To Three Hundred Dollars The Maximum Sales/use Tax On Sales Of Self Propelled Light Construction Equipment

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

ST-405

CERTIFICATE TO LIMIT TO THREE HUNDRED DOLLARS

(Rev. 9/16/08)

($300.00) THE MAXIMUM SALES/USE TAX ON SALES OF

5096

SELF PROPELLED LIGHT CONSTRUCTION EQUIPMENT

Purchaser's Statement:

As purchaser, I certify that the equipment being purchased is used for construction purposes (i.e. building or making

additions to real property). I understand that if equipment is purchased for any other use such as maintenance or repair

(i.e. road repair, mowing, golf course maintenance or in a landfill), the $300.00 maximum tax does not apply.

Furthermore, I understand that by extending this certificate that I am assuming liability for the sales or use tax due. If this

equipment is used for other than construction purposes, the full rate of the tax applies.

Name of Purchaser

(Please Print)

Address

(Street)

(City)

(State)

(ZIP)

Kind of Business Engaged in by Purchaser

Name of Seller

Seller's Retail License Number

(000-00000-0)

Date of Sale

Invoice Number

Amount of Sale $

Description of Self Propelled Light Construction Equipment and Compatible Attachments Purchased:

For what purpose will the equipment be used:

Net Engine Horsepower

(may not exceed 160 net engine horsepower)

Signed

Signature of Purchaser (Owner, Partner or Corp. Officer)

(Title)

(Date)

Article 21, Chapter 36, of Title 12 of the 1976 Code.

Pursuant to Code Section 12-36-2110(A)(7), the maximum sales or use tax imposed is $300 of each self propelled light

construction equipment with compatible attachments limited to a maximum of one hundred sixty net engine horsepower.

50961010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1