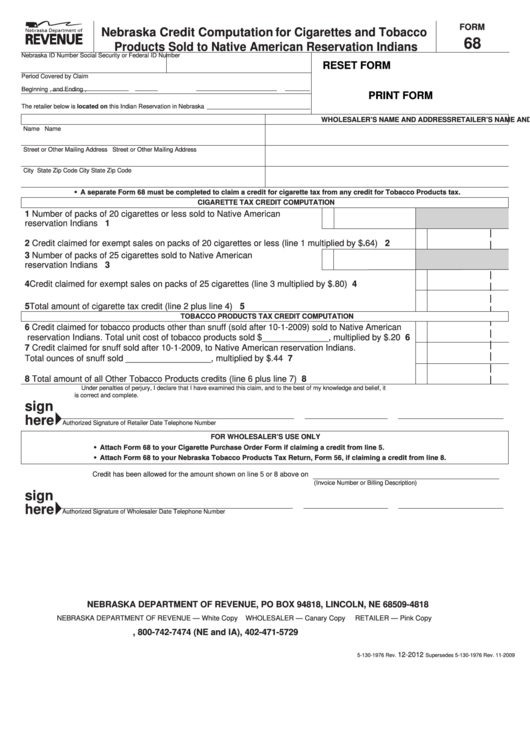

FORM

Nebraska Credit Computation for Cigarettes and Tobacco

68

Products Sold to Native American Reservation Indians

Nebraska ID Number

Social Security or Federal ID Number

RESET FORM

Period Covered by Claim

Beginning

,

and Ending

,

PRINT FORM

The retailer below is located on this Indian Reservation in Nebraska

RETAILER’S NAME AND ADDRESS

WHOLESALER’S NAME AND ADDRESS

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

• A separate Form 68 must be completed to claim a credit for cigarette tax from any credit for Tobacco Products tax.

CIGARETTE TAX CREDIT COMPUTATION

1 Number of packs of 20 cigarettes or less sold to Native American

reservation Indians .....................................................................................

1

2 Credit claimed for exempt sales on packs of 20 cigarettes or less (line 1 multiplied by $.64) ........... 2

3 Number of packs of 25 cigarettes sold to Native American

reservation Indians .....................................................................................

3

4 Credit claimed for exempt sales on packs of 25 cigarettes (line 3 multiplied by $.80)....................... 4

5 Total amount of cigarette tax credit (line 2 plus line 4) ...................................................................... 5

TOBACCO PRODUCTS TAX CREDIT COMPUTATION

6 Credit claimed for tobacco products other than snuff (sold after 10-1-2009) sold to Native American

reservation Indians. Total unit cost of tobacco products sold $______________, multiplied by $.20

6

7 Credit claimed for snuff sold after 10-1-2009, to Native American reservation Indians.

Total ounces of snuff sold __________________, multiplied by $.44 ............................................... 7

8 Total amount of all Other Tobacco Products credits (line 6 plus line 7) ............................................. 8

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it

is correct and complete.

sign

here

Authorized Signature of Retailer

Date

Telephone Number

FOR WHOLESALER’S USE ONLY

• Attach Form 68 to your Cigarette Purchase Order Form if claiming a credit from line 5.

• Attach Form 68 to your Nebraska Tobacco Products Tax Return, Form 56, if claiming a credit from line 8.

Credit has been allowed for the amount shown on line 5 or 8 above on

(Invoice Number or Billing Description)

sign

here

Authorized Signature of Wholesaler

Date

Telephone Number

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE 68509-4818

NEBRASKA DEPARTMENT OF REVENUE — White Copy

WHOLESALER — Canary Copy

RETAILER — Pink Copy

, 800-742-7474 (NE and IA), 402-471-5729

12-2012

Supersedes 5-130-1976 Rev. 11-2009

5-130-1976 Rev.

1

1 2

2