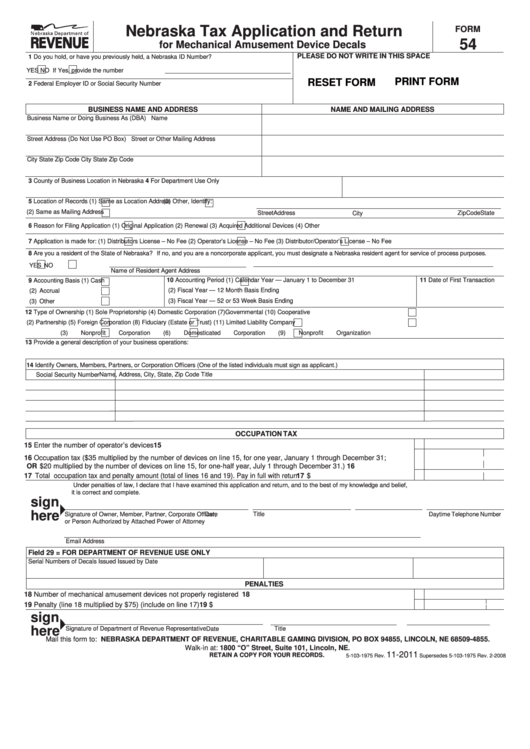

Nebraska Tax Application and Return

FORM

54

for Mechanical Amusement Device Decals

PLEASE DO NOT WRITE IN THIS SPACE

1 Do you hold, or have you previously held, a Nebraska ID Number?

YES

NO

If Yes, provide the number

PRINT FORM

RESET FORM

2 Federal Employer ID or Social Security Number

BUSINESS NAME AND ADDRESS

NAME AND MAILING ADDRESS

Business Name or Doing Business As (DBA)

Name

Street Address (Do Not Use PO Box)

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

3 County of Business Location in Nebraska

4 For Department Use Only

5 Location of Records (1)

Same as Location Address

(3)

Other, Identify:

(2)

Same as Mailing Address

Street Address

City

State

Zip Code

6 Reason for Filing Application (1)

Original Application

(2)

Renewal

(3)

Acquired Additional Devices

(4)

Other

7 Application is made for:

(1)

Distributors License – No Fee

(2)

Operator’s License – No Fee

(3)

Distributor/Operator’s License – No Fee

8 Are you a resident of the State of Nebraska?

If no, and you are a noncorporate applicant, you must designate a Nebraska resident agent for service of process purposes.

YES

NO

Name of Resident Agent

Address

10 Accounting Period (1)

Calendar Year — January 1 to December 31

11 Date of First Transaction

9 Accounting Basis

(1)

Cash

(2)

Fiscal Year — 12 Month Basis Ending

(2)

Accrual

(3)

Fiscal Year — 52 or 53 Week Basis Ending

(3)

Other

12 Type of Ownership

(1)

Sole Proprietorship

(4)

Domestic Corporation

(7)

Governmental

(10)

Cooperative

(2)

Partnership

(5)

Foreign Corporation

(8)

Fiduciary (Estate or Trust)

(11)

Limited Liability Company

(3)

Nonprofit Corporation

(6)

Domesticated Corporation

(9)

Nonprofit Organization

13 Provide a general description of your business operations:

14 Identify Owners, Members, Partners, or Corporation Officers (One of the listed individuals must sign as applicant.)

Social Security Number

Name, Address, City, State, Zip Code

Title

OCCUPATION TAX

15 Enter the number of operator’s devices ..................................................................................................................................... 15

16 Occupation tax ($35 multiplied by the number of devices on line 15, for one year, January 1 through December 31;

OR $20 multiplied by the number of devices on line 15, for one-half year, July 1 through December 31.)................................ 16

17 Total occupation tax and penalty amount (total of lines 16 and 19). Pay in full with return ........................................................... 17 $

Under penalties of law, I declare that I have examined this application and return, and to the best of my knowledge and belief,

it is correct and complete.

sign

here

Signature of Owner, Member, Partner, Corporate Officer,

Title

Date

Daytime Telephone Number

or Person Authorized by Attached Power of Attorney

Email Address

Field 29 =

FOR DEPARTMENT OF REVENUE USE ONLY

Serial Numbers of Decals Issued

Issued by

Date

PENALTIES

18 Number of mechanical amusement devices not properly registered ......................................................................................... 18

19 Penalty (line 18 multiplied by $75) (include on line 17) .............................................................................................................. 19 $

sign

here

Signature of Department of Revenue Representative

Title

Date

Mail this form to: NEBRASKA DEPARTMENT OF REVENUE, CHARITABLE GAMING DIVISION, PO BOX 94855, LINCOLN, NE 68509-4855.

Walk-in at: 1800 “O” Street, Suite 101, Lincoln, NE.

11-2011

RETAIN A COPY FOR YOUR RECORDS.

5-103-1975 Rev.

Supersedes 5-103-1975 Rev. 2-2008

1

1 2

2