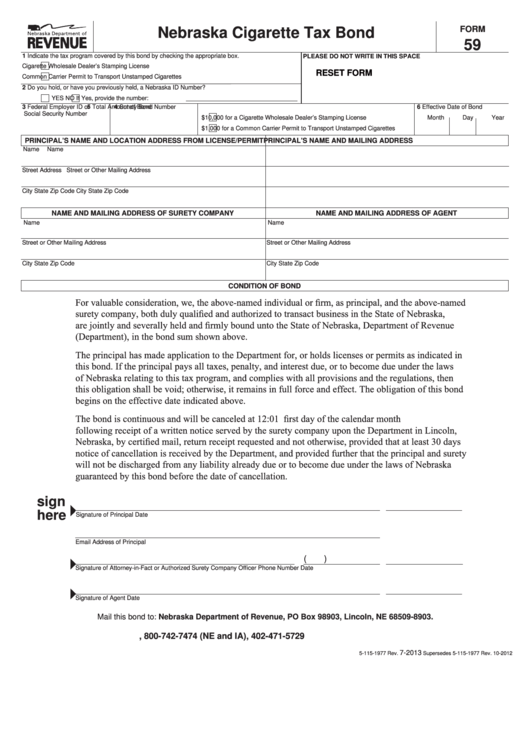

FORM

Nebraska Cigarette Tax Bond

59

1 Indicate the tax program covered by this bond by checking the appropriate box.

PLEASE DO NOT WRITE IN THIS SPACE

Cigarette Wholesale Dealer’s Stamping License

RESET FORM

Common Carrier Permit to Transport Unstamped Cigarettes

2 Do you hold, or have you previously held, a Nebraska ID Number?

YES

NO

If Yes, provide the number:

3 Federal Employer ID or

4 Surety Bond Number

5 Total Amount of Bond

6 Effective Date of Bond

Social Security Number

$10,000 for a Cigarette Wholesale Dealer’s Stamping License

Month

Day

Year

$1,000 for a Common Carrier Permit to Transport Unstamped Cigarettes

PRINCIPAL’S NAME AND LOCATION ADDRESS FROM LICENSE/PERMIT

PRINCIPAL’S NAME AND MAILING ADDRESS

Name

Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

NAME AND MAILING ADDRESS OF SURETY COMPANY

NAME AND MAILING ADDRESS OF AGENT

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

CONDITION OF BOND

For valuable consideration, we, the above-named individual or firm, as principal, and the above-named

surety company, both duly qualified and authorized to transact business in the State of Nebraska,

are jointly and severally held and firmly bound unto the State of Nebraska, Department of Revenue

(Department), in the bond sum shown above.

The principal has made application to the Department for, or holds licenses or permits as indicated in

this bond. If the principal pays all taxes, penalty, and interest due, or to become due under the laws

of Nebraska relating to this tax program, and complies with all provisions and the regulations, then

this obligation shall be void; otherwise, it remains in full force and effect. The obligation of this bond

begins on the effective date indicated above.

The bond is continuous and will be canceled at 12:01 a.m. on the first day of the calendar month

following receipt of a written notice served by the surety company upon the Department in Lincoln,

Nebraska, by certified mail, return receipt requested and not otherwise, provided that at least 30 days

notice of cancellation is received by the Department, and provided further that the principal and surety

will not be discharged from any liability already due or to become due under the laws of Nebraska

guaranteed by this bond before the date of cancellation.

sign

here

Signature of Principal

Date

Email Address of Principal

(

)

Signature of Attorney-in-Fact or Authorized Surety Company Officer

Phone Number

Date

Signature of Agent

Date

Mail this bond to: Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903.

, 800-742-7474 (NE and IA), 402-471-5729

7-2013

5-115-1977 Rev.

Supersedes 5-115-1977 Rev. 10-2012

1

1 2

2