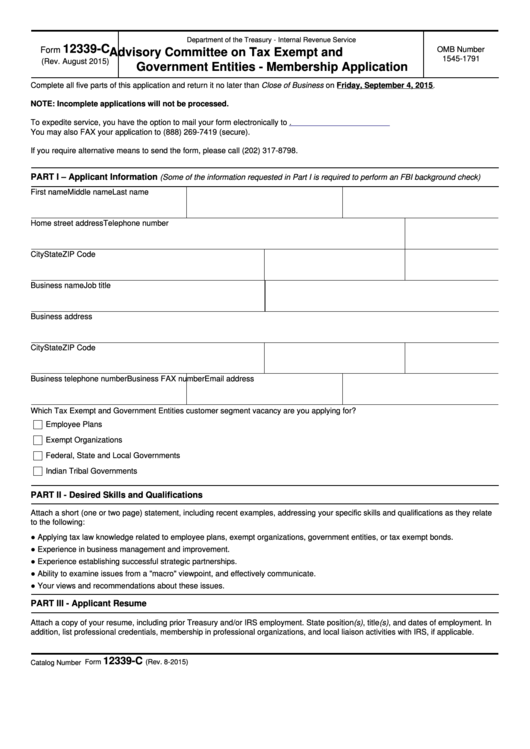

Department of the Treasury - Internal Revenue Service

12339-C

OMB Number

Form

Advisory Committee on Tax Exempt and

1545-1791

(Rev. August 2015)

Government Entities - Membership Application

Complete all five parts of this application and return it no later than Close of Business on Friday, September 4, 2015.

NOTE: Incomplete applications will not be processed.

To expedite service, you have the option to mail your form electronically to tege.advisory.comm@irs.gov.

You may also FAX your application to (888) 269-7419 (secure).

If you require alternative means to send the form, please call (202) 317-8798.

PART I – Applicant Information

(Some of the information requested in Part I is required to perform an FBI background check)

First name

Middle name

Last name

Home street address

Telephone number

City

State

ZIP Code

Business name

Job title

Business address

City

State

ZIP Code

Business telephone number

Business FAX number

Email address

Which Tax Exempt and Government Entities customer segment vacancy are you applying for?

Employee Plans

Exempt Organizations

Federal, State and Local Governments

Indian Tribal Governments

PART II - Desired Skills and Qualifications

Attach a short (one or two page) statement, including recent examples, addressing your specific skills and qualifications as they relate

to the following:

● Applying tax law knowledge related to employee plans, exempt organizations, government entities, or tax exempt bonds.

● Experience in business management and improvement.

● Experience establishing successful strategic partnerships.

● Ability to examine issues from a "macro" viewpoint, and effectively communicate.

● Your views and recommendations about these issues.

PART III - Applicant Resume

Attach a copy of your resume, including prior Treasury and/or IRS employment. State position(s), title(s), and dates of employment. In

addition, list professional credentials, membership in professional organizations, and local liaison activities with IRS, if applicable.

12339-C

Form

(Rev. 8-2015)

Catalog Number 58763Y

1

1 2

2