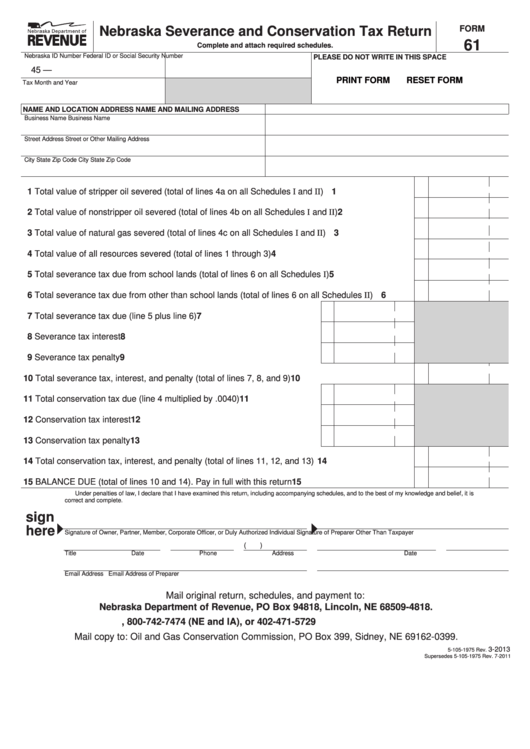

FORM

Nebraska Severance and Conservation Tax Return

61

Complete and attach required schedules.

Nebraska ID Number

Federal ID or Social Security Number

PLEASE DO NOT WRITE IN THIS SPACE

45 —

PRINT FORM

RESET FORM

Tax Month and Year

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Business Name

Business Name

Street Address

Street or Other Mailing Address

City

State

Zip Code City

State

Zip Code

1 Total value of stripper oil severed (total of lines 4a on all Schedules I and II) ...................................

1

2 Total value of nonstripper oil severed (total of lines 4b on all Schedules I and II) .............................

2

3 Total value of natural gas severed (total of lines 4c on all Schedules I and II) ..................................

3

4 Total value of all resources severed (total of lines 1 through 3) .........................................................

4

5 Total severance tax due from school lands (total of lines 6 on all Schedules I) .................................

5

6 Total severance tax due from other than school lands (total of lines 6 on all Schedules II) ..............

6

7 Total severance tax due (line 5 plus line 6) ...............................................

7

8 Severance tax interest ..............................................................................

8

9 Severance tax penalty ..............................................................................

9

10 Total severance tax, interest, and penalty (total of lines 7, 8, and 9) ................................................. 10

11 Total conservation tax due (line 4 multiplied by .0040) .............................

11

12 Conservation tax interest ..........................................................................

12

13 Conservation tax penalty ..........................................................................

13

14 Total conservation tax, interest, and penalty (total of lines 11, 12, and 13) ....................................... 14

15 BALANCE DUE (total of lines 10 and 14). Pay in full with this return ................................................ 15

Under penalties of law, I declare that I have examined this return, including accompanying schedules, and to the best of my knowledge and belief, it is

correct and complete.

sign

here

Signature of Owner, Partner, Member, Corporate Officer, or Duly Authorized Individual

Signature of Preparer Other Than Taxpayer

(

)

Title

Date

Phone

Address

Date

Email Address

Email Address of Preparer

Mail original return, schedules, and payment to:

Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

, 800-742-7474 (NE and IA), or 402-471-5729

Mail copy to: Oil and Gas Conservation Commission, PO Box 399, Sidney, NE 69162-0399.

3-2013

5-105-1975 Rev.

Supersedes 5-105-1975 Rev. 7-2011

1

1 2

2 3

3