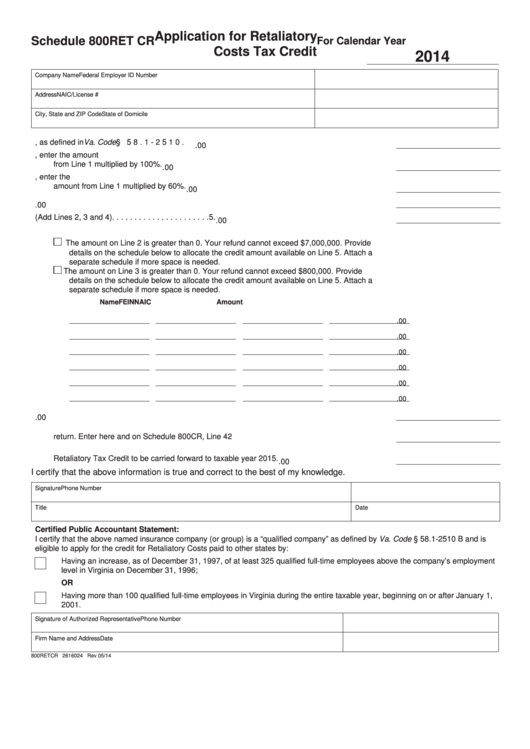

Application for Retaliatory

Schedule 800RET CR

For Calendar Year

Costs Tax Credit

2014

Company Name

Federal Employer ID Number

Address

NAIC/License #

City, State and ZIP Code

State of Domicile

1.

Retaliatory Cost paid, as defined in Va. Code § 58.1-2510. . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

.00

2.

If the Retaliatory Costs Tax Credit was received for taxable year 2000, enter the amount

from Line 1 multiplied by 100%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

.00

3.

If the Retaliatory Costs Tax Credit was not received for taxable year 2000, enter the

amount from Line 1 multiplied by 60%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

.00

4.

Retaliatory Costs Tax Credit carryover. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

.00

5.

Total Retaliatory Costs Tax Credit available (Add Lines 2, 3 and 4). . . . . . . . . . . . . . . . . . . . . .

5.

.00

6.

Check the applicable box to identify your refund.

The amount on Line 2 is greater than 0. Your refund cannot exceed $7,000,000. Provide

details on the schedule below to allocate the credit amount available on Line 5. Attach a

separate schedule if more space is needed.

The amount on Line 3 is greater than 0. Your refund cannot exceed $800,000. Provide

details on the schedule below to allocate the credit amount available on Line 5. Attach a

separate schedule if more space is needed.

Name

FEIN

NAIC

Amount

.00

.00

.00

.00

.00

.00

7.

Total Refundable Retaliatory Costs Tax Credit allocated. Enter the total from Line 6 . . . . . . . .

7.

.00

8.

Enter Refundable Retaliatory Costs Tax Credit amount allocated above and claimed on this

return. Enter here and on Schedule 800CR, Line 42 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9.

Carryover Retaliatory Tax Credit. Subtract Line 7 from Line 5. This is the amount of

Retaliatory Tax Credit to be carried forward to taxable year 2015. . . . . . . . . . . . . . . . . . . . . . .

9.

.00

I certify that the above information is true and correct to the best of my knowledge.

Signature

Phone Number

Title

Date

Certified Public Accountant Statement:

I certify that the above named insurance company (or group) is a “qualified company” as defined by Va. Code § 58.1-2510 B and is

eligible to apply for the credit for Retaliatory Costs paid to other states by:

Having an increase, as of December 31, 1997, of at least 325 qualified full-time employees above the company’s employment

level in Virginia on December 31, 1996;

OR

Having more than 100 qualified full-time employees in Virginia during the entire taxable year, beginning on or after January 1,

2001.

Signature of Authorized Representative

Phone Number

Firm Name and Address

Date

800RETCR 2616024 Rev 05/14

1

1