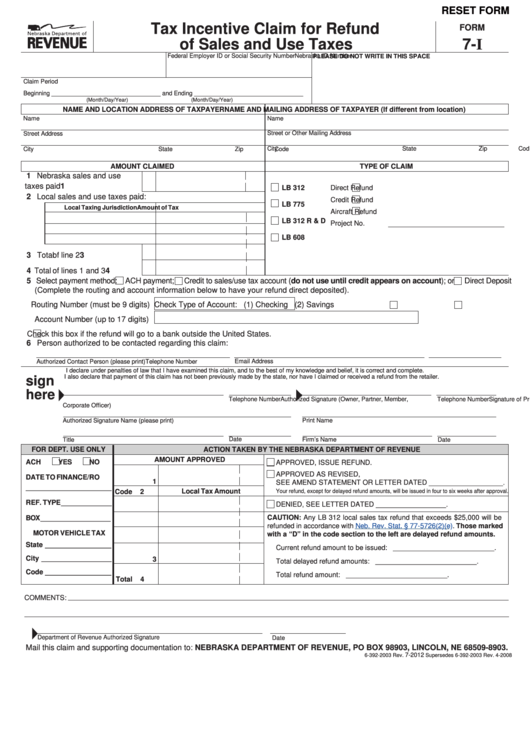

RESET FORM

Tax Incentive Claim for Refund

FORM

of Sales and Use Taxes

7-I

Nebraska ID Number

Federal Employer ID or Social Security Number

PLEASE DO NOT WRITE IN THIS SPACE

Claim Period

Beginning ________________________________ and Ending ________________________________

(Month/Day/Year)

(Month/Day/Year)

NAME AND LOCATION ADDRESS OF TAXPAYER

NAME AND MAILING ADDRESS OF TAXPAYER (If different from location)

Name

Name

Street or Other Mailing Address

Street Address

City

State

Zip Code

City

State

Zip Code

AMOUNT CLAIMED

TYPE OF CLAIM

1 Nebraska sales and use

taxes paid . . . . . . . . . . . . . . .

1

LB 312

Direct Refund

2 Local sales and use taxes paid:

Credit Refund

LB 775

Local Taxing Jurisdiction

Amount of Tax

Aircraft Refund

LB 312 R & D

Project No.

LB 608

3 Total of line 2 . . . . . . . . . . . .

3

4 Total of lines 1 and 3. . . . . . .

4

5 Select payment method:

ACH payment;

Credit to sales/use tax account (do not use until credit appears on account); or

Direct Deposit

(Complete the routing and account information below to have your refund direct deposited).

Routing Number (must be 9 digits)

Check Type of Account:

(1) Checking

(2) Savings

Account Number (up to 17 digits)

Check this box if the refund will go to a bank outside the United States.

6 Person authorized to be contacted regarding this claim:

Authorized Contact Person (please print)

Email Address

Telephone Number

I declare under penalties of law that I have examined this claim, and to the best of my knowledge and belief, it is correct and complete.

I also declare that payment of this claim has not been previously made by the state, nor have I claimed or received a refund from the retailer.

sign

here

Authorized Signature (Owner, Partner, Member,

Telephone Number

Signature of Preparer Other Than Taxpayer

Telephone Number

Corporate Officer)

Print Name

Authorized Signature Name (please print)

Date

Title

Firm’s Name

Date

FOR DEPT. USE ONLY

ACTION TAKEN BY THE NEBRASKA DEPARTMENT OF REVENUE

AMOUNT APPROVED

ACH

YES

NO

APPROVED, ISSUE REFUND.

APPROVED AS REVISED,

DATE TO FINANCE/RO

1

SEE AMEND STATEMENT OR LETTER DATED ___________________.

______________________

Code

2

Local Tax Amount

Your refund, except for delayed refund amounts, will be issued in four to six weeks after approval.

REF. TYPE _____________

DENIED, SEE LETTER DATED __________________.

CAUTION: Any LB 312 local sales tax refund that exceeds $25,000 will be

BOX __________________

refunded in accordance with

Neb. Rev. Stat. §

77-5726(2)(e). Those marked

MOTOR VEHICLE TAX

with a “D” in the code section to the left are delayed refund amounts.

State _________________

Current refund amount to be issued: __________________________.

City __________________

3

Total delayed refund amounts:

__________________________.

Code _________________

Total refund amount:

__________________________.

Total

4

COMMENTS:

Department of Revenue Authorized Signature

Date

Mail this claim and supporting documentation to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98903, LINCOLN, NE 68509-8903.

7-2012

6-392-2003 Rev.

Supersedes 6-392-2003 Rev. 4-2008

1

1 2

2 3

3