Form 12339-A - Tax Check Waiver

Download a blank fillable Form 12339-A - Tax Check Waiver in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 12339-A - Tax Check Waiver with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

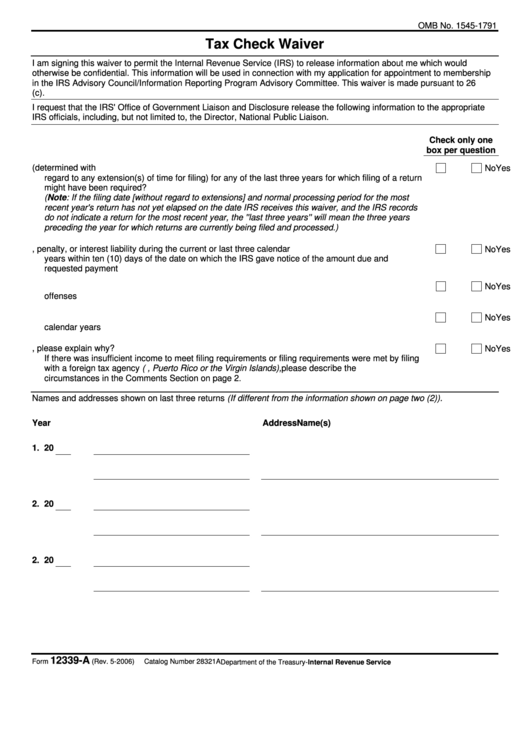

OMB No. 1545-1791

Tax Check Waiver

I am signing this waiver to permit the Internal Revenue Service (IRS) to release information about me which would

otherwise be confidential. This information will be used in connection with my application for appointment to membership

in the IRS Advisory Council/Information Reporting Program Advisory Committee. This waiver is made pursuant to 26

U.S.C. 6103(c).

I request that the IRS' Office of Government Liaison and Disclosure release the following information to the appropriate

IRS officials, including, but not limited to, the Director, National Public Liaison.

Check only one

box per question

1. Have you failed to timely file a Federal income tax return by the required due date (determined with

Yes

No

regard to any extension(s) of time for filing) for any of the last three years for which filing of a return

might have been required?

(Note: If the filing date [without regard to extensions] and normal processing period for the most

recent year's return has not yet elapsed on the date IRS receives this waiver, and the IRS records

do not indicate a return for the most recent year, the ''last three years'' will mean the three years

preceding the year for which returns are currently being filed and processed.)

2. Have you failed to pay any tax, penalty, or interest liability during the current or last three calendar

Yes

No

years within ten (10) days of the date on which the IRS gave notice of the amount due and

requested payment

3. Are you now or have you ever been under investigation for a misdemeanor or possible criminal

Yes

No

offenses

4. Have any civil penalties for fraud been assessed against you during the current or last three

Yes

No

calendar years

5. If a return for any of the last three years was not filed, please explain why?

Yes

No

If there was insufficient income to meet filing requirements or filing requirements were met by filing

with a foreign tax agency (e.g., Puerto Rico or the Virgin Islands), please describe the

circumstances in the Comments Section on page 2.

Names and addresses shown on last three returns (If different from the information shown on page two (2)).

Year

Name(s)

Address

1. 20

2. 20

2. 20

12339-A

Form

(Rev. 5-2006)

Catalog Number 28321A

Department of the Treasury-Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2