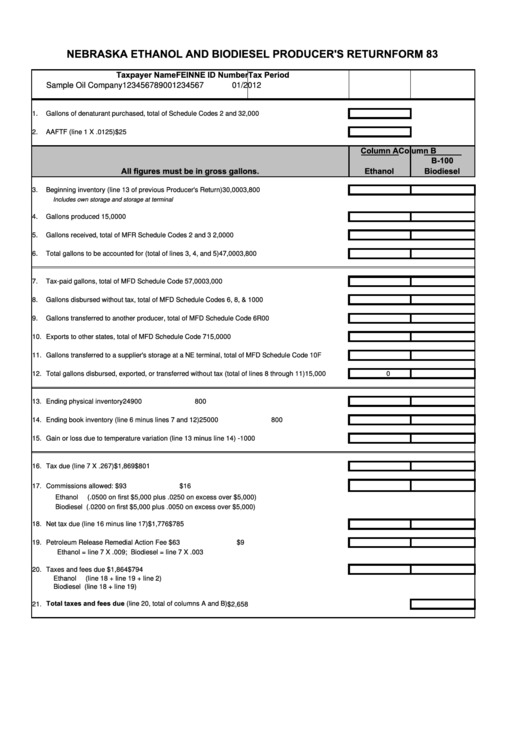

NEBRASKA ETHANOL AND BIODIESEL PRODUCER'S RETURN

FORM 83

Taxpayer Name

FEIN

NE ID Number

Tax Period

Sample Oil Company

123456789

001234567

01/2012

1.

Gallons of denaturant purchased, total of Schedule Codes 2 and 3

2,000

2.

AAFTF (line 1 X .0125)

$25

Column A

Column B

B-100

All figures must be in gross gallons.

Ethanol

Biodiesel

3.

Beginning inventory (line 13 of previous Producer's Return)

30,000

3,800

Includes own storage and storage at terminal

4.

Gallons produced

15,000

0

5.

Gallons received, total of MFR Schedule Codes 2 and 3

2,000

0

6.

Total gallons to be accounted for (total of lines 3, 4, and 5)

47,000

3,800

7.

Tax-paid gallons, total of MFD Schedule Code 5

7,000

3,000

8.

Gallons disbursed without tax, total of MFD Schedule Codes 6, 8, & 10

0

0

9.

Gallons transferred to another producer, total of MFD Schedule Code 6R

0

0

10. Exports to other states, total of MFD Schedule Code 7

15,000

0

11. Gallons transferred to a supplier's storage at a NE terminal, total of MFD Schedule Code 10F

12. Total gallons disbursed, exported, or transferred without tax (total of lines 8 through 11)

15,000

0

13. Ending physical inventory

24900

800

14. Ending book inventory (line 6 minus lines 7 and 12)

25000

800

15. Gain or loss due to temperature variation (line 13 minus line 14)

-100

0

16. Tax due (line 7 X .267)

$1,869

$801

17. Commissions allowed:

$93

$16

Ethanol

(.0500 on first $5,000 plus .0250 on excess over $5,000)

Biodiesel (.0200 on first $5,000 plus .0050 on excess over $5,000)

18. Net tax due (line 16 minus line 17)

$1,776

$785

19. Petroleum Release Remedial Action Fee

$63

$9

Ethanol = line 7 X .009; Biodiesel = line 7 X .003

20. Taxes and fees due

$1,864

$794

Ethanol

(line 18 + line 19 + line 2)

Biodiesel (line 18 + line 19)

21. Total taxes and fees due (line 20, total of columns A and B)

$2,658

1

1 2

2