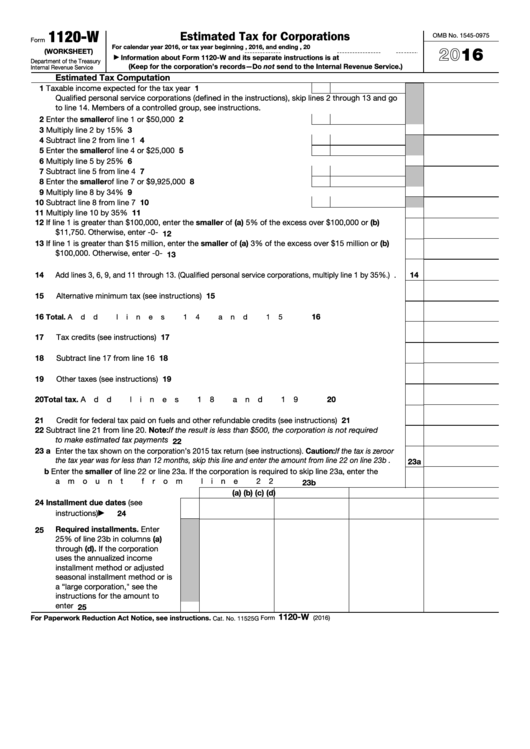

1120-W

Estimated Tax for Corporations

OMB No. 1545-0975

Form

For calendar year 2016, or tax year beginning

, 2016, and ending

, 20

2016

(WORKSHEET)

Information about Form 1120-W and its separate instructions is at

▶

Department of the Treasury

(Keep for the corporation’s records—Do not send to the Internal Revenue Service.)

Internal Revenue Service

Estimated Tax Computation

1

1

Taxable income expected for the tax year .

.

.

.

.

.

.

.

.

.

Qualified personal service corporations (defined in the instructions), skip lines 2 through 13 and go

to line 14. Members of a controlled group, see instructions.

2

Enter the smaller of line 1 or $50,000

2

.

.

.

.

.

.

.

.

.

.

.

3

Multiply line 2 by 15%

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Subtract line 2 from line 1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Enter the smaller of line 4 or $25,000

5

.

.

.

.

.

.

.

.

.

.

.

6

Multiply line 5 by 25%

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Subtract line 5 from line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Enter the smaller of line 7 or $9,925,000

8

.

.

.

.

.

.

.

.

.

.

9

9

Multiply line 8 by 34%

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

Subtract line 8 from line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Multiply line 10 by 35% .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

If line 1 is greater than $100,000, enter the smaller of (a) 5% of the excess over $100,000 or (b)

$11,750. Otherwise, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

If line 1 is greater than $15 million, enter the smaller of (a) 3% of the excess over $15 million or (b)

$100,000. Otherwise, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14

Add lines 3, 6, 9, and 11 through 13. (Qualified personal service corporations, multiply line 1 by 35%.) .

14

15

15

Alternative minimum tax (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

16

Total. Add lines 14 and 15 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

Tax credits (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

18

Subtract line 17 from line 16

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

Other taxes (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

20

Total tax. Add lines 18 and 19 .

20

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

Credit for federal tax paid on fuels and other refundable credits (see instructions) .

.

.

.

.

.

21

22

Subtract line 21 from line 20. Note: If the result is less than $500, the corporation is not required

to make estimated tax payments

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

22

23 a Enter the tax shown on the corporation’s 2015 tax return (see instructions). Caution: If the tax is zero or

the tax year was for less than 12 months, skip this line and enter the amount from line 22 on line 23b

.

23a

b Enter the smaller of line 22 or line 23a. If the corporation is required to skip line 23a, enter the

amount from line 22

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

23b

(a)

(b)

(c)

(d)

24

Installment

due

dates

(see

instructions) .

.

.

.

.

.

24

▶

Required installments. Enter

25

25% of line 23b in columns (a)

through (d). If the corporation

uses the annualized income

installment method or adjusted

seasonal installment method or is

a “large corporation," see the

instructions for the amount to

enter

.

.

.

.

.

.

25

1120-W

For Paperwork Reduction Act Notice, see instructions.

Form

(2016)

Cat. No. 11525G

1

1 2

2 3

3