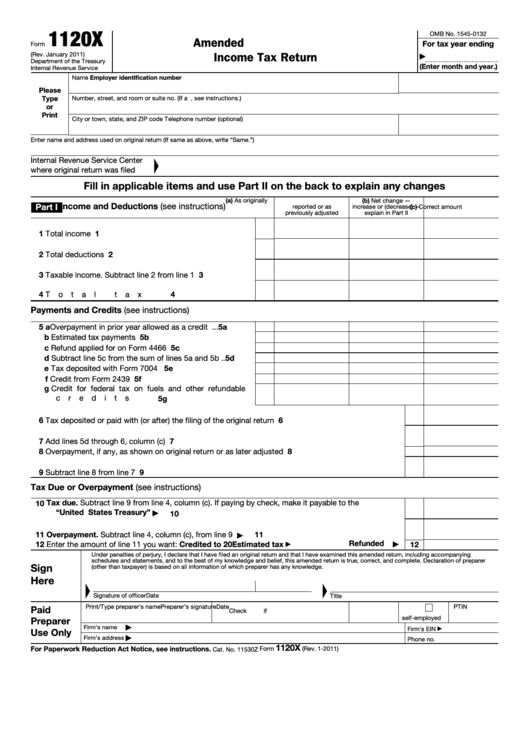

1120X

OMB No. 1545-0132

Amended U.S. Corporation

For tax year ending

Form

Income Tax Return

(Rev. January 2011)

▶

Department of the Treasury

(Enter month and year.)

Internal Revenue Service

Employer identification number

Name

Please

Type

Number, street, and room or suite no. (If a P.O. box, see instructions.)

or

Print

City or town, state, and ZIP code

Telephone number (optional)

Enter name and address used on original return (If same as above, write “Same.”)

Internal Revenue Service Center

where original return was filed

Fill in applicable items and use Part II on the back to explain any changes

(a) As originally

(b) Net change —

Income and Deductions (see instructions)

Part I

(c) Correct amount

reported or as

increase or (decrease) —

previously adjusted

explain in Part II

1

Total income .

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

2

Total deductions

.

.

.

.

.

.

.

.

.

.

.

.

3

Taxable income. Subtract line 2 from line 1 .

.

.

.

3

4

Total tax .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Payments and Credits (see instructions)

5 a Overpayment in prior year allowed as a credit .

5a

.

.

b Estimated tax payments .

.

.

.

.

.

.

.

.

.

5b

c Refund applied for on Form 4466 .

.

.

.

.

.

.

5c

d Subtract line 5c from the sum of lines 5a and 5b .

5d

.

e Tax deposited with Form 7004 .

.

.

.

.

.

.

.

5e

f Credit from Form 2439

.

.

.

.

.

.

.

.

.

.

5f

g Credit for federal tax on fuels and other refundable

credits .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5g

6

Tax deposited or paid with (or after) the filing of the original return .

.

.

.

.

.

.

.

.

.

.

6

7

Add lines 5d through 6, column (c)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Overpayment, if any, as shown on original return or as later adjusted .

.

.

.

.

.

.

.

.

.

8

9

Subtract line 8 from line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Tax Due or Overpayment (see instructions)

Tax due. Subtract line 9 from line 4, column (c). If paying by check, make it payable to the

10

“United States Treasury” .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

▶

11

Overpayment. Subtract line 4, column (c), from line 9 .

11

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Refunded

12

Enter the amount of line 11 you want: Credited to 20

Estimated tax

12

▶

▶

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including accompanying

schedules and statements, and to the best of my knowledge and belief, this amended return is true, correct, and complete. Declaration of preparer

Sign

(other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Signature of officer

Date

Title

Print/Type preparer's name

Preparer’s signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm’s name

▶

Firm's EIN

▶

Use Only

Firm’s address

▶

Phone no.

1120X

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 1-2011)

Cat. No. 11530Z

1

1 2

2 3

3 4

4